MSPs quiz Derek Mackay over Scottish budget plans

- Published

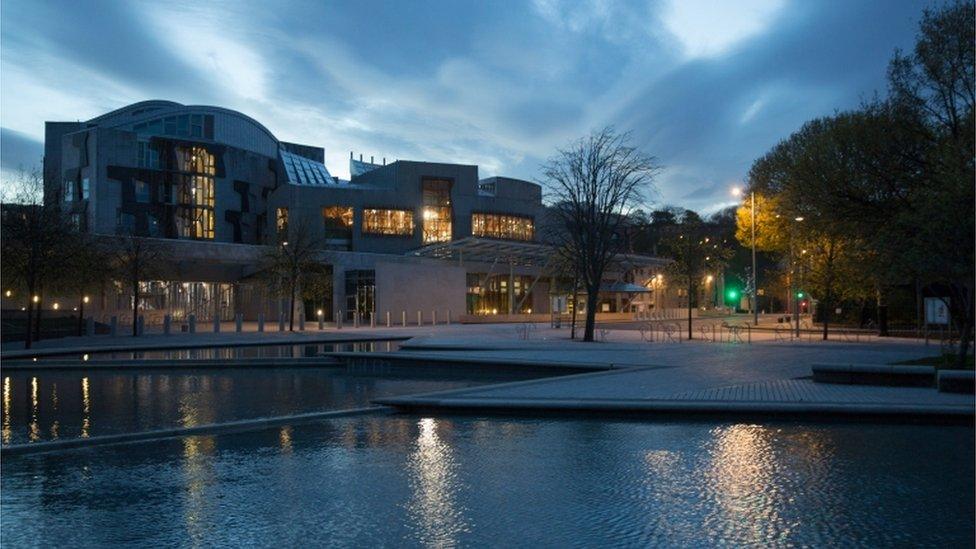

Mr Mackay was quizzed by MSPs on his tax plans

Finance Secretary Derek Mackay has defended his plans for tax as MSPs questioned him over his draft budget.

Holyrood's finance committee quizzed Mr Mackay about the budget, which will see the first use of new tax powers.

The government's plans, which Mr Mackay said would provide "stability and certainty", came in for criticism from opposition members.

There will be a separate vote on the government's tax proposals before the final budget vote in February.

Scotland's parties have failed to reach a consensus over tax, with previous Holyrood votes ending in stalemate.

Members also heard from Robert Chote, chairman of the Office for Budget Responsibility (OBR), who described economic forecasting as like "a spot the ball competition where the judges change their minds repeatedly about where the ball is, occasionally years after the competition".

Holyrood is currently scrutinising Mr Mackay's tax and spending proposals, ahead of a series of votes in February.

The questions at Wednesday's session focused mainly on taxation, with the finance secretary due to return to the committee to discuss his spending proposals.

Among the questions to Mr Mackay in the second meeting will be some sent in by members of the public via social media.

Budget votes

Each of the parliament's other subject committees have taken evidence from relevant ministers. They are now considering draft reports to the finance committee, which will submit its own final report by the end of January.

The first full-chamber debate on the draft budget proposals will be held in the week beginning 30 January, with the budget bill then progressing through the three stages of parliamentary approval through February.

A separate vote on the tax plans will take place prior to the final budget vote, which is expected to be in the week beginning 20 February.

With the SNP a minority government, Mr Mackay will need support from at least one other party in order to see his proposals passed.

Robert Chote from the OBR described the difficulties of economic forecasting to members

Mr Mackay's budget plans would see a distinction drawn between the higher rates of income tax in Scotland and the rest of the UK.

While the UK Treasury aims to up the threshold for the 40p tax rate to £45,000 and eventually £50,000, the SNP has pledged to raise it by no more than the rate of inflation - to £43,430 in 2017/18.

This would leave some Scots paying more tax than those earning the same amount south of the border, which the Conservatives say would make Scotland "the highest taxed part of the UK".

Green co-convener Patrick Harvie questioned whether the plans were progressive enough, saying the difference between Scottish and UK policy would only benefit higher earners.

Mr Mackay said the income tax rate is set year by year, with the SNP elected on the tax proposals currently on the table, but said the policy remains under review.

Mr Harvie said it would be "a huge missed opportunity" if the government were to "dig in their heels and insist on a no-change tax policy now that they have the power, and the political support, for real change".

Contrasting figures

Mr Mackay also clashed with Tory finance spokesman Murdo Fraser over the funding Holyrood receives from Westminster.

The finance secretary accepted there was a real-terms increase in funds for the coming year, but insisted there was an overall decrease over the period the Conservatives have been in government in London.

Mr Fraser pointed to figures on in the budget document on the total budget, from 2010/11 (£34.2bn) to the coming year (£37.9bn), asking Mr Mackay: "Have you got your sums wrong?"

Citing a different set of figures focused on discretionary spending, Mr Mackay insisted real-terms spending would fall by 9.2% over the long term.

The finance secretary was also pressed by Labour's James Kelly on the settlement for local government in the budget. He said councils would have less money for services because the government was not making the best use of its tax powers.

Mr Mackay insisted the settlement for councils was "fair", adding: "If it was such a bad deal for local government then I'm sure Cosla would have rejected it."

Patrick Harvie did not look entirely convinced by Mr Mackay's arguments on tax

Analysis by BBC Scotland political editor Brian Taylor

Perhaps the sharpest and most prolonged exchange came when Patrick Harvie of the Greens intervened.

Mr Mackay knows that there is very, very little chance of either Labour or the Conservatives striking a deal with him to enable the budget to proceed.

Which leaves the Greens and the Liberal Democrats. The Lib Dems don't have a presence on the committee so it was up to Mr Harvie.

Intriguingly, the Green co-convener pursued the topic of tax very vigorously indeed. Mr Mackay has indicated that he is less than minded to give ground on his tax package which he regards as carefully calibrated, balancing concerns and interests.

From first principles, Mr Harvie seems unwilling to concede that. He wants to rebalance the tax proposals to make the relatively wealthy pay more. In short, he wants elements of his own manifesto project to be adopted.

Mr Harvie knows that there will be a separate vote on tax at Holyrood - before the stage three final vote on the budget. That is why he is pushing so hard now for concessions on tax and not just spending.

The budget calculations include the end of the council tax freeze, with councils able to raise rates by up to 3%, and extra increases to bands E, F, G and H, which were agreed earlier in the parliamentary term.

However, the government has abandoned proposals to use council tax funds for national education targets - a plan which had proved controversial with opposition parties, with all backing a Tory amendment saying it would undermine local accountability.

The parties also failed to come to any consensus over tax in a vote the week before the draft budget was published, with a series of votes ending in stalemate after opposition members united against an amendment put forward by Mr Mackay.

While the Conservatives oppose the SNP's tax plans as going too far, Labour, the Greens and the Lib Dems say they are not radical enough.

Other proposals in the draft budget include:

Extra funding for local services via the education and health budgets

An extra £300m for NHS resource budgets

£47m to mitigate the "bedroom tax" and a pledge to "abolish" it as soon as possible

More than £470m of direct capital investment to begin delivery of 50,000 affordable homes

£140m for energy efficiency programmes

£100m investment in digital and mobile infrastructure

The committee appealed for members of the public to submit budget questions for the next meeting with Mr Mackay via social media, using the Twitter hashtag #askthecabsec.

They said a selection of the queries submitted would be put directly to the finance secretary, with the Scottish government invited to provide written responses to them all.

- Published23 December 2016

- Published19 December 2016

- Published15 December 2016

- Published14 December 2016