Tax choices: Holyrood comes of age

- Published

The income tax debate feels like a fork in the road for the Scottish Parliamenr

This might be the week the Scottish Parliament came of age. Eighteen years old, able to drink, drive and fight for its Queen and, er, country, it's spent those years as the recipient of an allowance, with freedom to choose how to spend it.

Now, it has to make its own way in the world, finding its own source of income.

That's compromised by most tax-raising remaining with Westminster. The ties still bind. But with 30% of Holyrood's moola coming from income tax, and another 7% from other sources including Air Passenger Duty and business rates, that's a big wedge.

And it should, by now, have sunk in that the income tax takings are directly related to the rate of growth. At less than half of the UK's growth rate over the past two to three years, Holyrood is going to have less budget than it would if income tax had remained controlled from Westminster.

So with something innocuously titled a discussion document, the Scottish government has started an educational process. It's a dry subject, but how tax is raised, and where the tax burden falls, is now going to be as important as where money is spent.

Fork in the road

And how money is spent is going to loop back to whether it is possible to spend it in smarter ways, to avoid having to levy higher revenues. In other words, to justify higher tax, ministers have to justify not only the need for more spending, but that current spending is efficient.

In general, when you ask people if they're willing to pay higher taxes, they will answer yes if they think a) it's necessary and b) the money will be spent wisely and efficiently, and that no other option is to hand, such as re-allocating funds.

So, here begins a new chapter in Scotland's political life. The decisions made this winter, about next year's budget mix, will set the direction of taxation and spending and will likely resonate through Scottish politics and government for many years to come. This feels like a defining moment - a fork in the road.

Among a generally uneasy, sceptical response from business lobbies, one piece of advice seems particularly important and uncontroversial. The Scottish Council Development and Industry (SCDI) says to think long-term: don't set tax policy solely and simply to muddle through this year's budget wrangles.

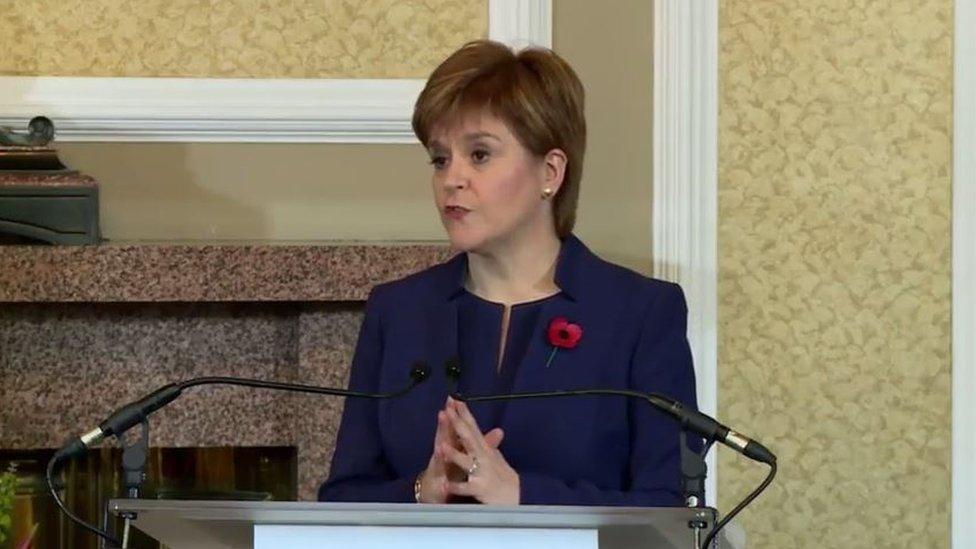

Nicola Sturgeon unveiled her government's income tax options paper at an event in Edinburgh on Thursday

Celtic Tiger

If you read The Role of Income Tax in Scotland's budget (and I'd recommend it, it makes a dry subject admirably accessible) one option that is barely mentioned is the possibility of cutting tax.

As my esteemed colleague Brian Taylor points out, this contrasts with the recent support by the SNP government for freezing council tax, cutting corporation tax, and they still talk of cutting Air Passenger Duty (sorry, that should now read Air Departure Tax).

Tax cutting was a key part of Alex Salmond's economic armoury, intended to stimulate economic growth and to portray a potentially independent Scotland as a business-friendly Celtic Tiger.

Under Nicola Sturgeon, and with a parliament that leans to the left of centre, the question is not whether taxes should go up or down, but by how much the tax take should rise, and how that extra tax burden should be distributed.

It does so with minor adaptations to the guiding principles of Adam Smith; does the tax system provide certainty and transparency about what will be owed? Is the tax proportionate to the ability to pay? Is it efficient to collect and convenient to pay?

Behavioural effects

It then sets four further guiding principles for the current Scottish Parliament:

The revenue test: does a proposed change actually raise more money? If not, think again.

The progressivity test: does the change fall more on those who are best able to pay?

The lower income test: does a shift in tax rates protect poorer households? Some options, mainly the ones proposed by Scottish Greens, are for rebalancing the tax burden so that tax bills would fall for below-average earners.

The economic growth test: what does the tax change do to economic activity and output?

The last one is the trickiest. If the choices on tax stunt growth even further, then revenue will be reduced and public services harmed.

How can we know if they'll constrain growth? We can't know.

Economic theory tells us that it usually will. There is a significant footnote in the Scottish government's discussion document, where it cites research by the International Monetary Fund, published this autumn, concluding there is no evidence to suggest that a move to a more progressive taxation system is harmful to growth.

Note that's a move to a more progressive taxation system. It's not research into a move to a higher tax burden. The effect of sucking money out of household and business budgets has an aggregate effect on the money available to spend.

Government can use that revenue to boost demand, and it can try to channel that to domestic economic activity. But the long-running debate in the mixed economies of the western world is about whether government is best placed to allocate that money efficiently, or as efficiently as numerous private decisions can do.

Changes to tax rates, particularly those loaded on to high earners, can also backfire by reducing revenue. Much of the discussion paper is concerned with the unknowable impact of 'behavioural effects'. They are the inevitable re-arrangement of finances - from reduced working hours to shifting income beyond the reach of the Scottish taxperson, for instance to dividends or to England.

These could make a big difference. It is reckoned that a rise in the additional rate of tax from 45% to 50% could bring in an extra £53m, from the 20,000 or so Scots earning more than £150,000. But it could have strong, adverse behavioural effects, resulting in more than £24m less revenue.

Cliff edge

For much of the detail and choices, you should read the discussion paper. But I offer one further observation about comparisons.

The benchmark almost always used for Holyrood is Westminster. But it doesn't have to be. It is pointed out that international comparisons put the current Scottish tax burden at a lower share of national output than most other developed nations. (Note that claim includes oil and gas revenue in 2014. It has since turned negative.)

Other countries also demonstrate that a wider range of tax bands can be more progressive. They have the appeal of removing that cliff edge just north of £42,000, when the UK marginal income tax take doubles.

There are five bands in Belgium and Norway, and seven in US federal tax, unless Republican reforms simplify them. Yet a lot of bands does not equate to more fairness: Sweden and Denmark have two, but they have designed them progressively. Britain currently has three, and one of them is only for very high earners.

It's also pointed out that the level of services and amount of free stuff has to be taken into the reckoning. Taxpayers in Scotland get free university tuition, a bigger contribution to long-term care costs, pensioner bus passes and they had their council tax frozen for nine years.

A health service free at the point of need will surely load lots more onto the government bill, but removes the need for a lot of private insurance. Ask any American.

In other words, the choices on offer in the debate about taxation and spending force a choice about what kind of country Scotland wishes to be.

Big public services and relatively low tax is not the option any more. It is relatively well-funded public services and welfare with higher tax to fund them, or it is weaker public services and social provision with lower tax. Scandinavia or the USA?

They can be tweaked annually, but some time soon, the direction of travel will have to be set. It will affect decisions on investment, and and we'll have to live with the consequences.

Both sets of choices are to be found where there are strong economies.

The tax system chosen is not the only factor determining the strength of the economy. Many other factors have an important role. But tax and spending matters, a lot.