Scottish Budget: Economists issue income tax gap warning

- Published

People earning £50,000 elsewhere in the UK will pay £1,500 less income tax than those in Scotland

The income tax gap with the rest of the UK could put some people off coming to work in Scotland, economists have said.

Scotland's finance secretary confirmed on Wednesday he will not pass on a tax break for higher earners that was announced by the chancellor in October.

It means people earning £50,000 in Scotland will pay £1,500 more income tax than elsewhere in the UK.

The Scottish Fiscal Commission said it could make people "think twice" about working in Scotland.

And they predicted it would also make others consider leaving Scotland or changing their residency status, and would have an impact on whether people go for a promotion or work more hours.

Overall, they forecast that this "behavioural change" will reduce income tax revenues in Scotland by about £6m a year.

The Scottish government argues that the country has a fairer tax regime than the rest of the UK, and that people living in Scotland get perks such as free university tuition and personal care that other parts of the UK do not offer.

The Scottish Fiscal Commission was established by the Scottish Parliament to provide independent economic forecasts, with its members being appointed by Finance Secretary Derek Mackay.

When he outlined his draft Scottish budget for next year on Wednesday, Mr Mackay said he would freeze the threshold for the higher rate of income tax at £43,430, which is estimated to raise an additional £68m.

However, the threshold will increase to £50,000 across the rest of the UK from next April.

This will widen the gap for higher rate taxpayers, who are taxed at 41p in Scotland but at 40p elsewhere.

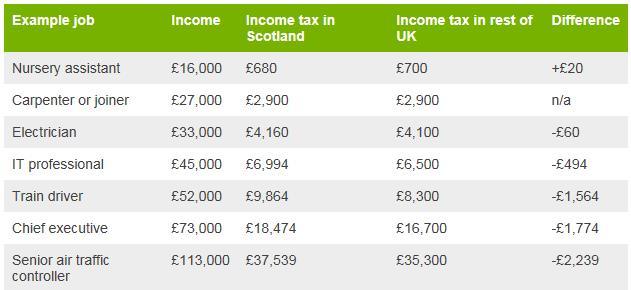

Source: Fraser of Allander Institute

The changes mean that someone earning £45,000 will pay £494 more a year in Scotland than they would in the rest of the UK, with someone on £50,000 paying £1,544 more and anyone earning £100,000 will pay £2,044 more.

Everyone earning under £27,000 in Scotland - about 55% of all taxpayers - will pay less tax than they would elsewhere, but only by about £20 a year.

Scottish Fiscal Commission chief executive John Ireland said the increasing gap for higher rate taxpayers "will affect where people choose to locate over time, both people thinking of coming to Scotland and people living in Scotland who can either leave Scotland or change their residency.

"We think it will knock off about £6m from income tax revenues."

Nicola Sturgeon and Derek Mackay say Scotland is the fairest taxed part of the UK

The commission's chairwoman, Dame Susan Rice warned of the tight labour market in Scotland and said people might "think twice about coming to Scotland for a job".

And its head of economy, income tax and VAT, David Stone, said: "If you are currently sat at £45,000 and facing a 53% marginal tax rate, you put student loan repayments and pension contributions on that as well, you could be taking home as little as 30p in the pound.

"So the incentive to go for a promotion, work more hours it is going to have an effect in the income range and we've tried to capture that in our behavioural costing."

The income tax gap was raised at first minister's questions on Thursday, with Scottish Conservative deputy leader Jackson Carlaw saying it could make it harder for Scottish hospitals to attract consultants.

Mr Carlaw told First Minister Nicola Sturgeon that: "You can't tax people who aren't coming to Scotland".

'Better deal'

But Ms Sturgeon insisted her government's budget was "fairer and gives a better deal to people who are hardworking as she pointed to more generous public sector pay settlements in Scotland.

She said that a porter in the NHS could therefore be as much as £800 a year better off working in Scotland compared to England, with a police constable at the top of their scale benefiting by £1,200.

A paramedic will get £400 more a year working in Scotland, she added, while police officers just starting work would be £4,500 better off.

The first minister said: "Of course all of that doesn't take account of the fact that if you live and work in Scotland your children don't have to pay £9,000 a year to go to university , your elderly relative doesn't have to pay for personal care.

"Taxpayers in Scotland, whatever amount they earn, get a far better deal under this government and long may it continue."

Meanwhile, the Scottish Fiscal Commission also forecasts that the Scottish government could have to pay back £472m to the UK government due to differences in the forecast between the block grant and devolved tax take.

But it stressed that the number is volatile and could become positive in future years, leading to the UK government having to pay more to Scotland to reconcile the difference.

Overall, the commission has improved its economic growth forecast for 2018 to a 1.4% rise in GDP from its 0.7% prediction in May.

Recent strong economic performance is credited for the increase, which in 2019 is predicted to be 1.2% rather than the May forecast of 0.8%.

Post-2020 this becomes more subdued, said to reflect forecast low productivity growth.