No changes to tax rates in Scottish budget

- Published

Public Finance Minister Kate Forbes stepped in to deliver the budget

There will be no changes to income tax rates in Scotland in the coming year, the government has announced.

Public Finance Minister Kate Forbes set out the budget in the place of Derek Mackay, who resigned as finance secretary on Thursday morning.

She announced that tax rates will not increase, although the threshold where the upper rates kick in will be frozen.

And she committed extra funding to health, education and investment aimed at tackling the "climate emergency".

The SNP need votes from opposition parties to pass the budget, and Ms Forbes urged them not to be "partisan".

The build-up to the budget was disrupted when Mr Mackay was forced to quit the government over reports he had sent hundreds of social media messages to a 16-year-old boy, external.

Junior minister Ms Forbes - a first-term MSP who is aged just 29 - stepped in at the last minute to deliver the speech, and is set to take the lead in talks with opposition parties.

She said the package included "significant investment in our response to the global climate emergency, to strengthen our economy and improve our public services".

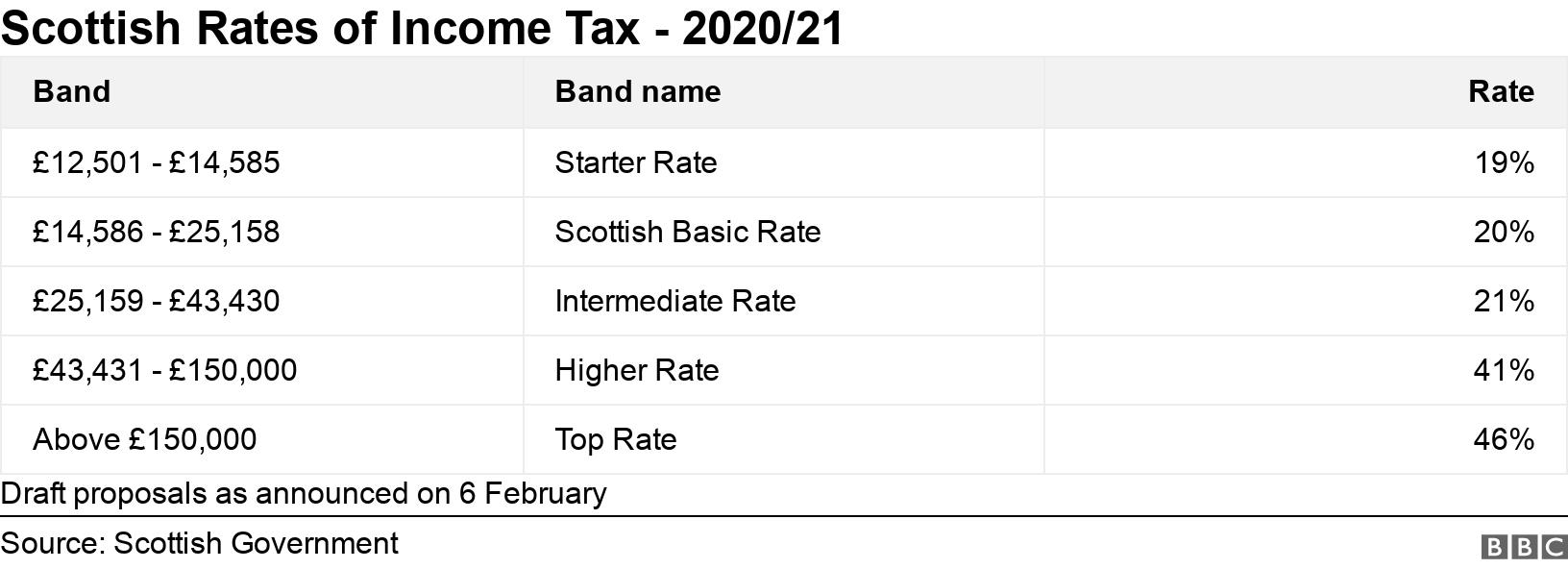

Under the plans, Scotland's current tax rates will not increase, and the threshold at which people start paying the basic and intermediate rates will increase by the rate of inflation.

The thresholds for the higher and upper rates will be frozen, with Ms Forbes calling this the "fairest and most progressive income tax system in the UK".

Funding proposals in the budget include:

more than £15bn for health and care services

£117m of investment in mental health support

a real-terms increase in revenue funding for councils

£180m for closing the attainment gap in schools

£270m for rail services

a 60% boost in funding to reduce harm from alcohol and drugs

The budget had a particular focus on environmental issues, with Ms Forbes saying it would "step up the delivery of our ambition to tackle climate change".

This includes £1.8bn of capital investment in projects to reduce emissions, and funding for active travel, electric vehicles, agriculture and peatland restoration.

A budget bill will now be introduced at parliament, and is due to be voted on by MSPs in three weeks' time - which is how long Ms Forbes now has to secure a deal.

New forecasts from the Scottish Fiscal Commission, external were published alongside the budget, warning that "Brexit remains a risk to continued economic growth".

Ms Forbes stepped in after Derek Mackay tendered his resignation with immediate effect

Opposition MSPs praised Ms Forbes for stepping in to deliver the budget, but were critical of some of the content.

Murdo Fraser said the Conservatives could not support the budget because it "falls well short of where we need it to be".

He said freezing the upper rate tax thresholds could widen the gap between what higher earners pay in Scotland and the rest of the UK, and said "not enough money is being handed to police".

For Labour, Rhoda Grant said essential services were "worse off" under the SNP, and that the government was using "smoke and mirrors" to obscure this.

She said the budget was a "disappointment", calling for a "step change" in local government funding and extra money to make Scottish education "world-leading" again.

Scottish Green co-leader Patrick Harvie said the budget was "timid" and was not an "emergency response" to climate change.

And Lib Dem leader Willie Rennie said councils "have only been given half of what they need", saying the government should focus on services rather than independence.

- Published13 January 2020

- Published7 January 2020