SNP to oppose new health and social care tax

- Published

The UK government say the tax is needed to help health and care services recover from the pandemic

The SNP is to oppose a new UK-wide health and social care tax that is expected to raise £1.1bn a year for the Scottish NHS.

The prime minister says the increase to National Insurance will raise money to help health and care services recover from the impact of the Covid pandemic.

But SNP MP Kirsten Oswald said the move would adversely impact on those who could least afford it.

MPs are due to vote on the proposals on Wednesday evening.

The tax will be introduced across the UK to pay for reforms to the care sector and NHS funding in England - but a proportion of the money raised will be ring-fenced and given to the devolved administrations, including the Scottish government.

The UK government's health secretary, Sajid Javid, said an estimated £1.1bn of the £12bn that is expected to be raised across the UK would be given to the Scottish government, which he said was more than would actually be raised in Scotland.

It would also be almost double the estimated £660m a year that the Scottish government says its plans for a new National Care Service would cost.

How will the new tax work?

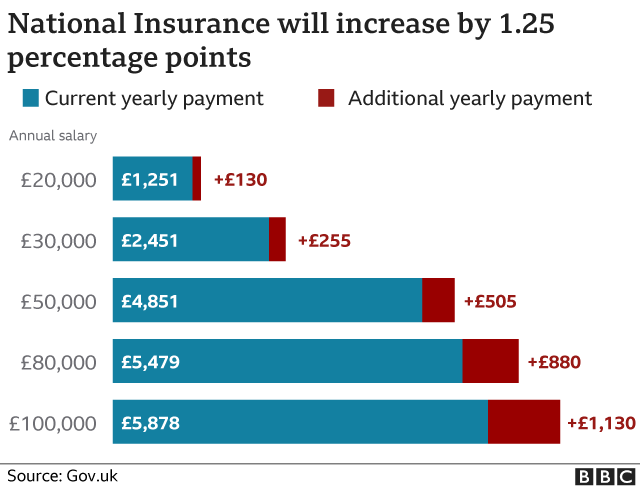

The tax will begin as a 1.25 percentage point rise in National Insurance from April 2022, and will be paid by both employers and workers.

It will then become a separate tax on earned income from 2023, which will be calculated in the same way as National Insurance and will appear on an employee's payslip.

This will be paid by all working adults, including older workers, and the UK government says it will be "legally ring-fenced" to go only towards health and social care costs.

Speaking to the BBC's Good Morning Scotland programme, Mr Javid said it would be for the Scottish government to decide how this additional money was spent.

But he said the "obvious place" would be for it to go towards health and social care, given the huge impact of the pandemic on things such as hospital waiting times.

Mr Javid also dismissed as "nonsense" claims from SNP politicians that the scheme would be similar to the so-called Poll Tax that was introduced by Margaret Thatcher in Scotland in 1989.

He said basing the tax on National Insurance was "the fairest way as it would mean that "those who earn more pay more".

Mr Javid added: "Some 50% of the revenues raised will come from the highest earning 14%, and that principle of those that earn more pay more applies throughout the UK".

However, Ms Oswald said there was a "significant lack of detail" over what the changes would mean for Scotland, adding: "It certainly isn't a proposal that we support".

Ms Oswald, the SNP's deputy leader at Westminster, said any additional money for public services was welcome - but insisted that raising National Insurance contributions was not the right way to do it.

She said: "This money will be coming from people who can least afford to pay it, so from young people, from people who have more limited incomes.

"That is the same group of people who are looking at a £1,000-plus cut in their income as Universal Credit is taken away from them by the UK government, who are removing the uplift there".

She described the proposals as "regressive" and said the UK government could have instead looked at measures such as increasing capital gains tax - which Mr Javid said would not have raised nearly as much money.

Deputy First Minister John Swinney said his expectation was that the Scottish government would spend funds from the new tax on health and social care services in Scotland.

And he said he would be looking "forensically" at the full details of the proposal - which the prime minister has said will be set out in a spending review later this year - to ensure there were "no negative Barnett consequentials in other areas of the budget" as a result of the changes.

The GMB union said the "significant" funding additional coming to Scotland should be used to "tackle years of exploitative working conditions and an understaffing crisis" in the country's health and social care services.

It said this should include a £15 an hour minimum wage in social care, and "continuing to restore the value of pay for NHS staff after a decade of cuts".

Labour leader Sir Keir Starmer has said that the new tax would merely be a "sticking plaster" for health and social care services.

And he said the announcement broke the Conservatives' pledge at the last election not to raise National Insurance, income tax or VAT - and targeted young people, supermarket workers and nurses, rather than those with the "broadest shoulders".