Council tax rises: Cashing in on Welsh seaside hotspots?

- Published

Welsh councils have been discussing whether to force the owners of empty properties and second homes to pay more council tax.

New rules mean local authorities can impose a premium on the council tax bill of up to 100%.

On Thursday, councillors on Anglesey agreed to an extra 25% rise - while Pembrokeshire council were also meeting to discuss possible changes.

On Anglesey, the move has been splitting opinion.

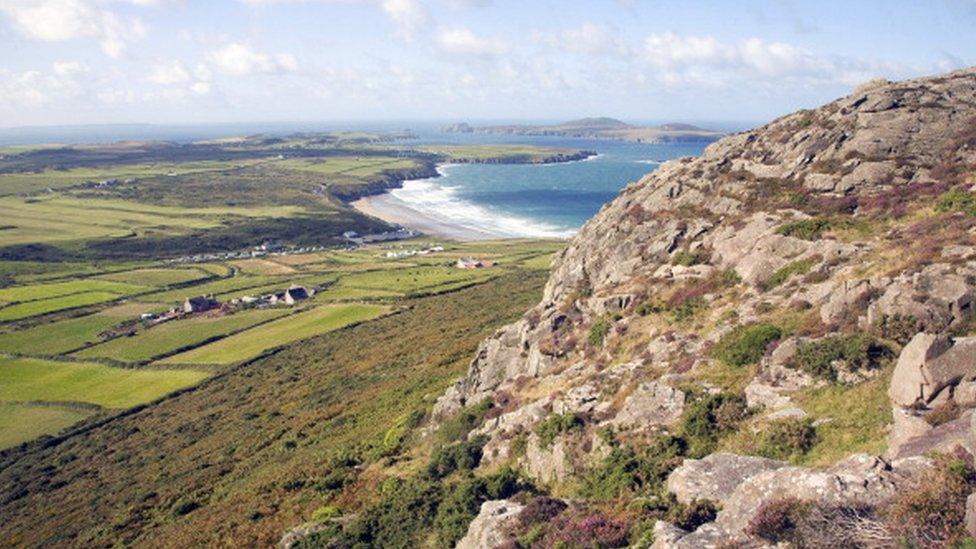

Rhosneigr. It is picture postcard perfect. Golden sands sweep along a rugged coastline, as waves whip in from the Irish Sea, calling-out to windsurfers.

It is one of the most sought after holiday destinations on the island, along with Trearddur Bay some 20 minutes away.

And there lies the problem.

On some streets in Rhosneigr, almost every other house is empty or a holiday home - 42.7% of the properties fall into this category.

Trearddur Bay does little better - there, 34% of dwellings are either long-term empty or second homes, with the owners living elsewhere most of the year.

It also means the average semi-detached house in the area is on the market for about £247,000 - compared with the port town of Holyhead just 15 miles away where a similar home costs just £125,000.

"I think it's terrible really. We've just had a walk round, and you can see that there are quite a lot of holiday homes here, so it must be hard for the people to get houses here," remarked one visitor making his way around Rhosneigr on a chilly and overcast March morning.

"It is a bit like the Lakes really - isn't it - especially for first-time buyers."

The reference to 'the Lakes' is well-made by the tourist - because across Cumbria, councils have acted in a bid to get more empty homes back into the housing market.

In some parts of the Lakes, second homeownership hit 70% in places around Grasmere, like Langdale.

In response, councils in the Lake District mirrored action already taken by authorities in Wales, and scrapped discounts on tax bills for second homes.

They then took it a step further - and since 2013, owners with a property that has been empty for more than two years face a 50% premium on their council tax bill.

But the route being taken in Wales could be viewed as being even more draconian.

Last year, changes to the law meant all councils in Wales could impose a 100% premium on not just empty properties - but on second homes too.

So far, eight authorities have declared an interest - with Flintshire and Powys agreeing to a 50% levy for those falling foul of the new rules, and Ceredigion and Carmarthenshire set to decide later in the month.

Gwynedd has deferred is decision for a year, concerned that setting a premium tax might see second home owners try to exploit loopholes.

Neighbouring Conwy has agreed on paper to bring in the full 100% extra charge. However, it will now spend the next year consulting, and examining just what other councils are doing.

Back on Anglesey, the recommendation on the table was for a 25% increase.

Council leaders argued that it would strike a balance between encouraging those with empty properties to put them back into the housing market, without harsh penalties for tourist operators and the second home sector.

"The purpose of the premium is to try to get long-term empty properties back into use in the county, not for creating additional income for the council," insisted a senior official.

"It's important that we take the tourism industry into account when coming to a final decision, but I do not believe that introducing a 25% premium will be pricing people out of the local market," added the council leader, Ieuan Williams.

Unsurprisingly, not everyone backed that view.

Judith Matthews runs Menai Holiday Cottages, with a portfolio of properties - some of them second homes - across the island and parts of Gwynedd.

Her language was forceful.

"It leaves a bad taste with all of us who live on the island, work hard and invest on the island year round to bring people to the island, to make it a thriving prosperous place to live," she stated.

"The timing is bad to have started to talk about raising money from second homes, which is tourism related, when tourism is probably the key earner on the island."

She also questioned why it is "bricks and mortar" that is the target for taxation - when the island is home to literally thousands of long-term let mobile homes and chalets.

"Our houses are not empty," she stressed.

"Those houses have got people in them, and the people in them create jobs on the island, which helps keep young people here on the island."

The other main industry with a vested interest is, of course, the housing sector.

Anglesey estate agent Melfyn Williams could best be described as ambivalent on the new tax charge.

"I think the people who are choosing, certainly the £500,000-plus houses, that's a lifestyle decision," he said, from his Holyhead office.

"If they were having to pay 25% more on their council tax, it's something they won't be happy about, but I think it's a decision they will factor in when they are purchasing and how much they offer.

"They'll accept the extra payment - because they'll have to."

Where he has been a little less happy has been when it comes to the local investor, rather than the holidaymaker.

"People who are living the dream of owning the second property as an investment - some of them are stretching to do that, to create a pension fund for themselves for the future, to employ people locally," he said.

"It's not very nice for those people who have been encouraged to do this and find out there is a sting in the tail."

Despite the outcome of Thursday's council vote on Anglesey, and those already taken and to come for other council, there will be period for reflection. The new council tax bills with or without those increases will not be dropping through the letterbox until next spring.

Certainly time for the second homeowners back in Rhosneigr to enjoy at least one more summer relaxing by the sea.

- Published22 February 2016

- Published26 January 2016

- Published3 April 2014