Budget 2016: Impact on Wales from the Chancellor's announcements

- Published

We'd already had the announcement of the £1.2bn Cardiff Capital Region deal - but what else would Chancellor George Osborne reveal in his Budget which would have an impact in Wales?

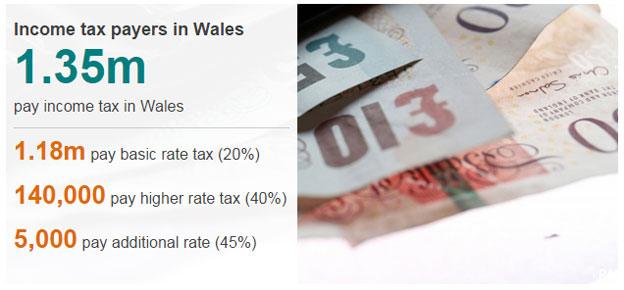

Taxation

When it comes to the money we have to spend, those of us who pay income tax will be a bit better off after the Budget.

About 1.3 million people in Wales pay income tax - and they start paying when they earn more than £10,600 pounds a year.

Nine out of ten only pay the 20% basic rate but from next April all income tax payers will be able to earn £11,500 before they start paying tax - a saving of about £180 a year.

That's about £3.50 a week.

Also from next April the 40% rate of income tax will not come in until people earn £45,000; at the moment in Wales only 140,000 people pay that 40% rate.

Meanwhile, the cut in corporation tax to 17% in 2020 would affect 25,000 Welsh businesses.

Tolls

The headline grabbing announcement was the halving of tolls on the Severn Crossing from 2018.

About 13 million vehicles pay Severn bridge tolls every year and the Institute of Directors (IoD) said it would make a "real difference to Welsh businesses trading across the bridge".

The level of tolls has been a particular issue for the haulage industry, which supports more than 60,000 jobs in Wales. Larger companies face bills into six figures each year.

In addition to the freeze on fuel duty, the Road Haulage Association (RHA) called the toll reduction a step in the right direction, although it said it wanted "in a perfect world" no tolls at all.

"We're extremely happy," said Kate Gibbs of the RHA. "Every added cost to a haulier has to be passed onto the customer - so you or I see higher costs in shops."

Public services

Welsh council leaders are already anticipating a "tough picture" for public services over the next four years and Finance Minister Jane Hutt also admitted her concern at what lies ahead after Mr Osborne signalled an extra £3.5bn in spending cuts.

"Councils up and down Wales will continue to be forced to make difficult choices about local services in the future, on top of the swingeing reductions that have been visited on them already," said Anthony Hunt, deputy finance spokesman for the Welsh Local Government Association.

Steel industry

There was no easing of the burden of business rates for steel producers, which the Community union called "sorely disappointing".

"Steel producers will continue to be penalised with high business rates for the investments they have made, adding uncompetitive costs in a difficult global market," said general secretary Roy Rickhuss.

Meanwhile, the Treasury has agreed to the Welsh Government's request to create an enterprise zone for Port Talbot, which includes the Tata site.

Growth and city deals

The commuting patterns in the north of England and north Wales

Following on from the signing of the deal for south east Wales, the Chancellor promised he would "open discussions" with the Welsh Government and local partners about the proposed city deal for the Swansea Bay City Region - welcomed by Sir Terry Mathews, who is leading the vision of an "internet coast".

It also said it would also open the door to a "growth deal" for north Wales , external- which would provide funding for partnerships between councils and business - to make the most of its connection to the Northern Powerhouse. This development was welcomed by the IoD, which called it "overdue".

Chairman of the Deeside Business Forum Askar Sheibani said infrastructure investment was "desperately needed" in the next Budget.

In conclusion

While some opportunities for the Welsh economy were unveiled by the Chancellor, his official forecasts for the UK economy show there are tough times ahead.

The economy here is slowing down and the Chancellor warned of potential risks from the global economy.

His argument is that to ride more difficult times those £3.5bn public sector cuts are necessary.

But they are bound to take more money out of the Welsh economy and could cost jobs.

- Published16 March 2016

- Published16 March 2016

- Published16 March 2016

- Published15 March 2016

- Published16 March 2016

- Published16 March 2016