Who might save Tata Steel in Port Talbot?

- Published

Sanjeev Gupta already has an interest in south Wales in Newport

As emergency talks take place in London and Welsh AMs reconvene to discuss the steel crisis in Cardiff Bay, economics correspondent Sarah Dickins looks at who might take over the threatened Tata steelworks in Port Talbot.

Liberty House - Sanjeev Gupta

Indian-born Sanjeev Gupta, the founder of steel, commodities and property group, Liberty House, already knows south Wales well and is the hottest bet.

His company bought the mothballed former Alphasteel works in Newport - with workers on half pay for 18 months until it was ready to reopen late last year - plus a 10% stake in the firm behind the proposed Swansea Bay tidal lagoon. He also owns Uskmouth power station near Newport.

Mr Gupta also helped save hundreds of jobs at steel firm Caparo - which included a plant in Tredegar, Blaenau Gwent.

Liberty has also struck a deal already to buy two Scottish steel mills from Tata.

But these are very different from Port Talbot. Between them the two Scottish plants Clydebridge and Dalzell employ 270 people; in contrast Port Talbot employs 4,000.

So why would Liberty want to spend even more cash and in the steelworks at Port Talbot which it is claimed is losing £1m a day?

Mr Gupta has suggested he would not be interested in the whole of the Tata operation at Port Talbot but sees a longer term future if there are changes.

He told Bloomberg News on Monday, external: "There is a model which says that we transition over time from blast furnaces to arc furnaces.

"It will sustain all the jobs, it will mean a lot of retraining, but it will sustain all the jobs. It will sustain the hot end of the business, but it's a much bigger undertaking."

We have already seen from the way in which Liberty bought the Newport steelworks and Uskmouth power station is that it is a company that plans for the long term.

At the moment, Uskmouth generates electricity from Russian coal but the plan is to change it to biomass and provide renewable energy, perfectly placed alongside its steelworks.

At the moment, Liberty in Newport rolls imported steel slab and turns it into finished steel. However, it plans in future to use an electric arc furnace to produce molten steel.

Although not making steel from iron ore, the process still uses vast amounts of electricity and energy costs are one of the main problems for the steel sector at the moment.

When Liberty has its own biomass plant making renewable energy, an electric arc furnace makes more sense financially.

Liberty may not be interested in running blast furnaces to make steel in the short term.

But it may be persuaded to take it on and in the medium term change to an electric arc system if the cost of electricity became cheaper.

That could be done either through the building of a power plant - plans have already been unveiled for one by Tata in Port Talbot - or by changes to the way heavy industry pays for electricity in the UK .

The steel employers' body - UK Steel - says steel companies in France and Germany get help from government to reduce the transmission and distribution elements of their electricity bills. That lowers production costs.

A ThyssenKrupp steel slabs plant in Duisburg, Germany

ThyssenKrupp

German group thyssenkrupp Steel Europe, external has 27,000 workers and is one of the world's leading suppliers of high-grade flat steel, producing 12.4 million tonnes last year.

However, it appears to be ruling itself out early on as the BBC understands it is not interested in buying Tata Steel's UK businesses.

Greybull Capital has been talks over Tata in Scunthorpe

Greybull Capital

The London-based business turnaround specialist is headed by two families - brothers Marc and Nathaniel Meyohas and Richard Perlhagen.

It rescued Monarch Airlines and has been in talks with Tata , externalabout a £400m deal for taking over its long products business, mainly in Scunthorpe in north Lincolnshire.

Scunthorpe makes wire rods, steel beams and rail track - a very different business to Port Talbot - although it employs similar numbers of workers.

The company said it was not interested in taking over Port Talbot and has not had any discussions.

"Greybull is solely focused at this time on discussions about the acquisition of the long products steel business in Scunthorpe," said a spokesman.

Greybull has been working on that deal for a year and is still not finalised, such is the complexity of buying a steelworks.

There has already been discussions about what would happen to the pension fund if Port Talbot was sold.

In Scunthorpe, it is not expected that Greybull will takeover the British Steel pension liabilities, instead it is thought they would stay with Tata.

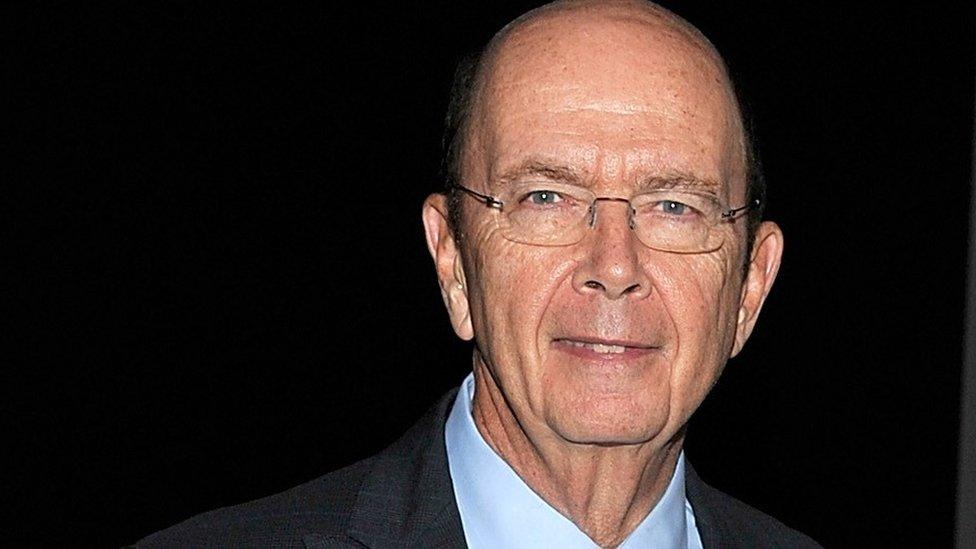

Wilbur Ross has been called 'the King of Bankruptcy'

Wilbur Ross

Wilbur Ross is a US billionaire Wall Street investor and chairman of WL Ross & Co merchant bankers. He has been called a "vulture investor" and a "shark" although he prefers the comparisons to a phoenix or a porpoise. He was behind the sale of Northern Rock in 2011 and also took a share in the Bank of Ireland.

Back in the United States, Ross formed International Steel Group, taking on struggling plants, and later sold it to Mittal Steel to become the biggest steelmaker in the world. He is still a director of ArcelorMittal.

"We like to go into buildings that aren't totally burned down and where you can put the fire out and have something very valuable, survive," he told the BBC in 2012.

It is possibly not a metaphor useful to Port Talbot, which wants its fires to carry on burning but Ross, 78, has made a reputation of looking at "everything that's in trouble" so is probably expecting a call.

- Published4 April 2016

- Published31 March 2016

- Published3 April 2016

- Published18 February 2016

- Published3 April 2016

- Published16 October 2015