Help to Buy extension call for second hand homebuyers

- Published

- comments

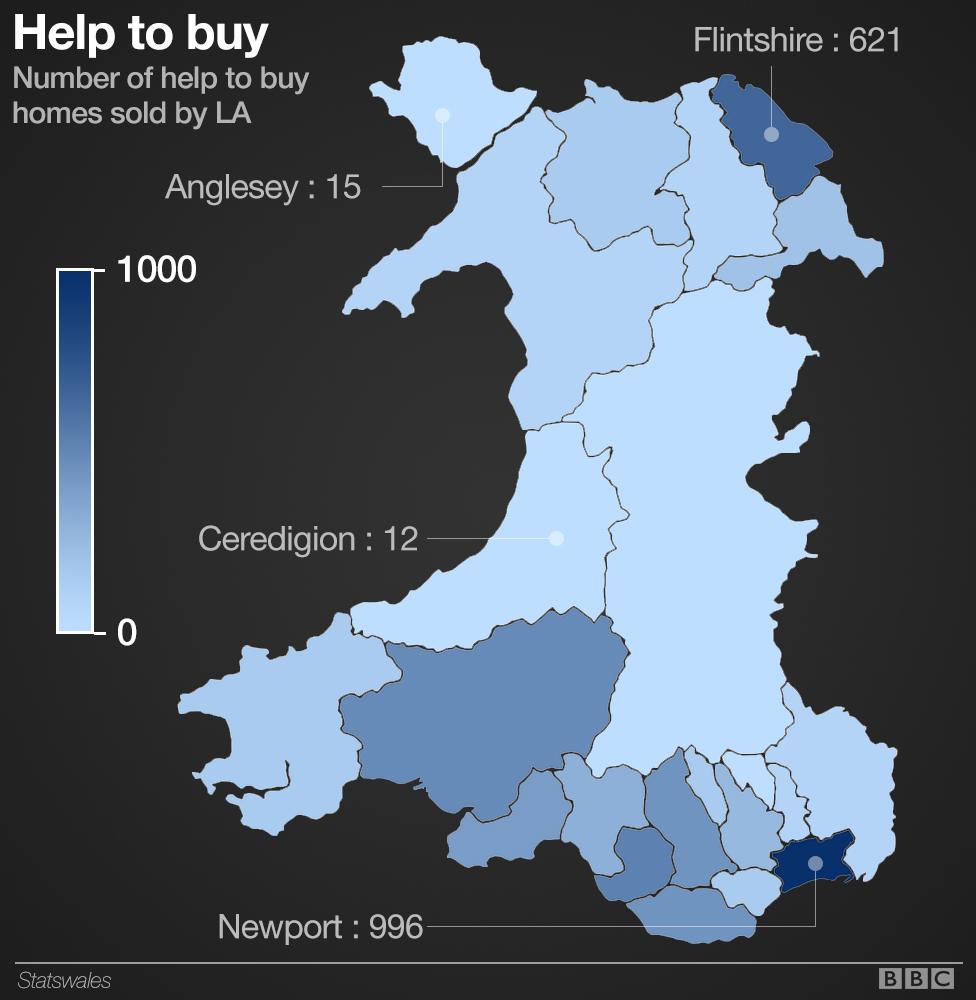

Newport has the biggest Help to Buy take-up with 996 buyers since the scheme started in 2014

Buyers of all types of homes should be able to access a Welsh Government-backed deposit contribution scheme, according to property experts.

More than a quarter of newly-built Welsh homes sold last year used the Help to Buy shared equity scheme.

But critics have said the scheme does not stimulate the housing market as it only applies to new builds and should be widened.

The Welsh Government said Help to Buy had "benefitted" the housing industry.

Sally Fletcher says she could not have afforded to buy a new home without using Help to Buy

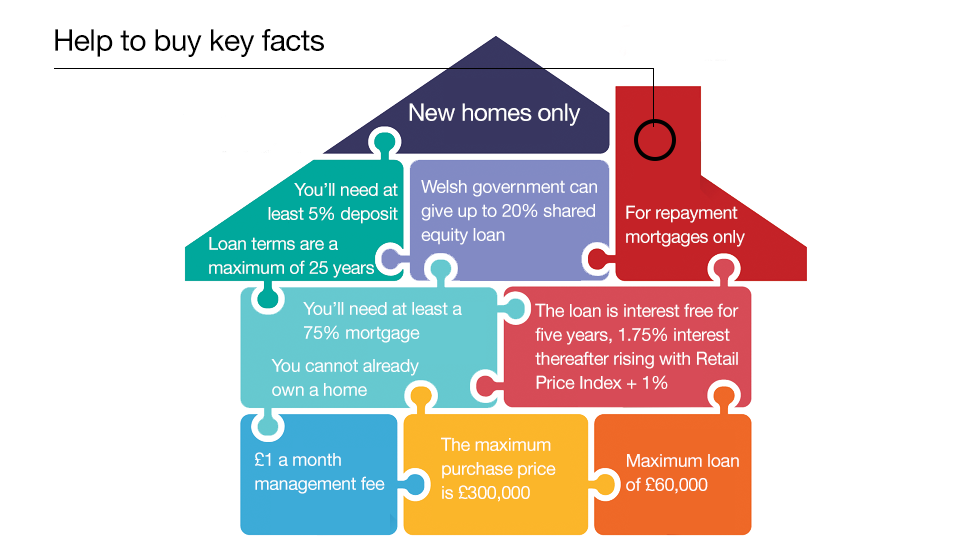

The programme - where the buyer funds 5% of the deposit and the Welsh Government loans up to a further 20% of the purchase price - is nearing 5,500 completions since its inception in 2014.

So far, almost £200m has been handed out for more than £1bn worth of new homes in Wales and developers including St Modwen, called the scheme "essential".

When the owner eventually sells, they repay the same percentage they borrowed - a 20% borrowing on a £200,000 house is £40,000 and if it was sold for for £250,000, they would repay £50,000.

The Welsh Government said all loans would be "reinvested in Wales".

The UK government did offer a Help-to-Buy Mortgage Guarantee scheme, external for second-hand homes but this ended in December 2016.

Newport has seen the biggest take-up with 996 buyers using the scheme and this has been attributed to the building of five new housing developments.

Aberystwyth estate agent Layla Mangan explains low take-up in Ceredigion

Alan Darlow, co-owner of Newport-based Roberts estate agents, said: "If it [Help to Buy] included the whole market you'd see the more established properties selling."

"By them selling, the people in those houses would be able to upsize and established areas would regenerate naturally.

"That would stimulate the market far better and help those who maybe still in negative equity following the housing market crash in 2008, external."

Analysis - Martin Roberts, presenter of BBC's Homes Under The Hammer

Martin Roberts has presented the BBC's Homes Under The Hammer since it began in 2003

The hardest thing for anybody looking to get on the housing ladder is saving for a deposit and any scheme to help people get on to the housing ladder has to be a good thing.

But Help to Buy is only for new builds and I encourage anyone starting out on the property ladder to buy something you can add value to.

If you buy a new build there is not much scope to add value, so someone who is struggling can buy cheaper, do it up then move up the property ladder.

If you can not afford the centre of Cardiff, there are some potential goldmines in the valleys - which has good transport links in established communities - you can buy a half decent house at an auction for £40,000.

The less you spend on the property, the less you have find for a deposit. So if you are buying a £200,000 new home, your 5% deposit is £10,000.

But if you buy a £40,000 house, £10,000 would be a 25% deposit.

Help to Buy statistics

Total equity loans spent: £199.9m

Total worth of Help to Buy properties purchased: £1,008m

Average property purchase: £183,973

Average equity loan value: £36,000

Between January 2014 and 30 June 2017. Source: Welsh Government

Property expert Henry Pryor called for Help to Buy to be scrapped.

"Unfortunately it's now turned into something of a curse for most people because ironically we're now seeing house prices pushed up," he told BBC Radio Wales.

"House builders have done extremely well as a result of the initiative but I'm afraid the time has come to turn off the tap."

The Welsh Government said the Help to Buy Wales scheme had given many first time buyers the help they needed to get on to the property ladder.

"It has also helped to stimulate additional building activity, benefitting the Welsh housing industry and wider economy," a spokeswoman added.

"We are investing up to £290m in a second phase of the scheme to support the construction of more than 6,000 homes - part of our target to build an additional 20,000 affordable homes over the course of this government."

- Published13 July 2017

- Published7 June 2017

- Published1 April 2017

- Published10 December 2015

- Published15 March 2015

- Published29 May 2014

- Published25 November 2013