Technology firms in south Wales face skilled staff battle

- Published

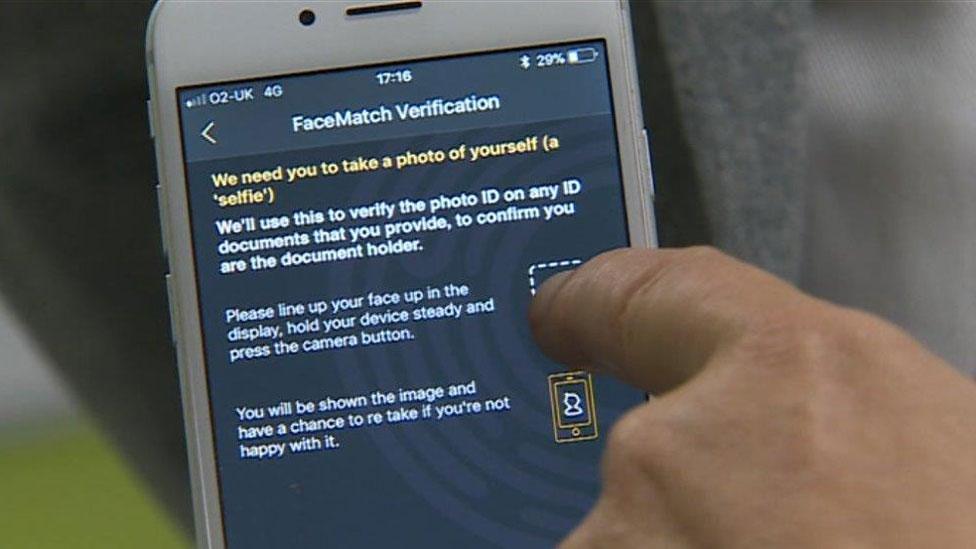

Penarth financial technology firm Credas shows Sarah Dickins how facial recognition software can be used when hiring for a job

Some of the fastest growing financial technology firms in Wales are at risk of being held back by skills shortages, a leading specialist lawyer has warned.

Cerian Jones said so-called fintech companies have told her they are "chasing fish in the same small pool".

She said those firms not actually trying to fill a recruitment gap "are trying to retain staff so they don't go elsewhere".

Cardiff is facing competition from London and Bristol among other cities.

Ms Jones, a patents attorney and partner at UDL in Cardiff, said: "When I talk to software companies about what their biggest challenge is, nine times out of 10 it's recruitment.

"These are very skilled positions, needing skilled graduates with the right coding and development skills."

She said there was a lure of working in London and firms in south Wales were having to be creative in trying to entice people "in a candidates' market".

Some were finding it difficult, even when offering £60,000 salaries.

The Chancellor of the Exchequer has said fintech is the fastest growing sector in the UK, external.

It covers a wide range of technology companies, from those involved in price comparison sites, to new ways of transferring, borrowing or managing money.

Credas develops face-recognition software

Emma Williams, head of marketing at Credas in Penarth Marina, said: "If you buy a financial product there's some sort of fintech involved. If you go for a mortgage or buy a house, you'll get exposed to some sort of technology that's up and coming."

Cedas has been in business for about a year and has developed an app that uses facial recognition to check the validity of a person and their documents, for buying a house or getting work.

Financial technology companies are often relatively small dynamic companies and, by their very nature, tend to be below the radar.

For example, Active Quote employs 130 people in Cardiff and has helped 100,000 customers with products like health insurance.

But most people have not heard of it because the firm works behind the scenes providing technology for well-known comparison sites.

The team also started the online investment management venture Wealthify two years ago. Only 15 people work for it at the moment but a large investment from Aviva means it is planning rapid expansion.

Chief executive Richard Theo said fintech was a "real revolution taking off and we have a real hotspot of that in Wales".

While the technology means companies can employ fewer people, Mr Theo said the Welsh economy gains from people doing better jobs.

"It's the software guys, the marketing guys and the investment guys, it's not the menial work or the traditional call centre stuff, it's quality jobs," he added.

'Keen support'

A report in 2015 from consultants EY described the UK as a global leader in fintech, employing 61,000 and generating more than £6.5bn.

The latest FinTech 50 , externalcompiled by industry experts of innovative firms across Europe has 29 of them based in London, with Berlin another strongly performing city.

As yet, there are no official figures for numbers working in fintech in Wales.

But Economy Secretary Ken Skates is examining the sector in his first task and finish group and said the Welsh Government was "keen" to support and develop it.

Mr Theo said Cardiff's challenges were probably no different from other cities but it could still do more.

"We've got a great academic infrastructure but we've got to do a bit of work to get them turning out the skills we need - more people with digital marketing expertise, more software engineers, the kind of dot-net skills that financial services like us actually need."

- Published29 August 2017

- Published13 April 2017

- Published12 April 2017

- Published19 August 2017

- Published19 August 2017

- Published27 January 2014

- Published6 December 2012