Barclays closure spells end of Llandovery's banking history

- Published

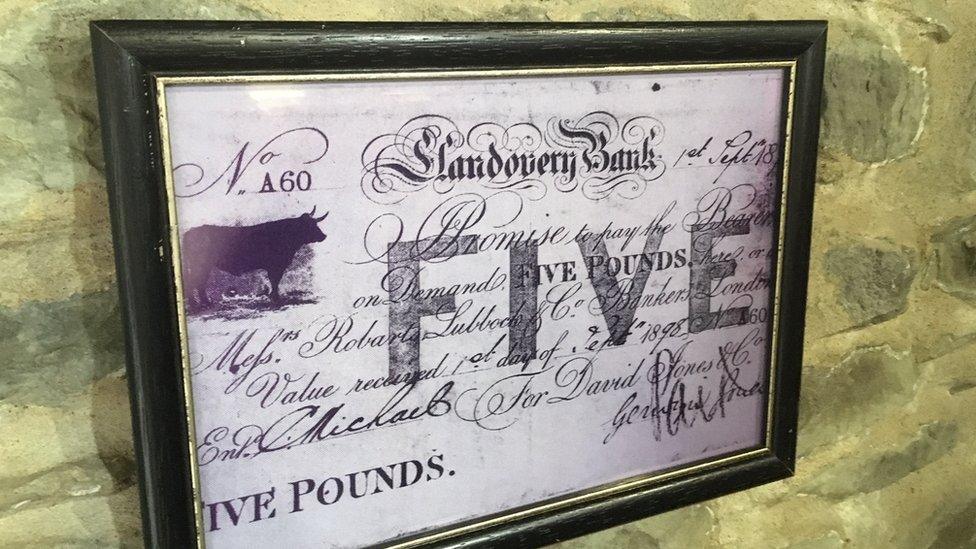

David Jones and Co became known for the black ox printed on its bank notes

When Barclays closed its doors on Friday evening, Llandovery in Carmarthenshire lost its last bank.

Yet two centuries ago the town was the banking hub of south west Wales.

David Jones and Co was founded in 1799 to serve the Carmarthenshire drovers who led thousands of cattle at a time to market in London.

The journeys were months-long, along ancient routes across Wales and southern England.

The bank became locally known as the Black Ox Bank, or Banc yr Eidion Du, owing to the emblem of an ox on the left side of their bank notes.

It was bought out by Lloyds Bank in 1909 - marking the end of independent banking in Wales.

Local historian Handel Jones explained the scale of the droving operation.

"To this day you can find inns and pubs in Wiltshire and Oxfordshire which have signs in Welsh offering board and lodging to drovers," he said.

"It was a mammoth task, taking between three and six months, and requiring cows to be iron-shod like horses, and geese to have their feet protected with a coating of tar and sand."

The Kings Head Inn is where the Black Ox Bank was established centuries ago

However, Mr Jones added that by the 18th Century the task had become even more difficult due to the risk of highwaymen, meaning they carried as little cash as possible - depositing it in drovers' banks along the route.

"These banks would have reciprocal arrangements with each other, allowing credit to be passed up and down the chain," Mr Jones explained.

He said this not only protected the drovers from robbery, but also allowed them to finance their journeys and send cash home sooner than if they carried it themselves.

It depended not only on the liquidity of each bank, but perhaps more importantly on the trust drovers placed in them.

David Jones himself started out as a drover aged 15.

Already a wealthy businessman in his own right, he was able to establish the Black Ox Bank after marrying Anne, the daughter of Rhys Jones of Cilrhedin, who brought with her a fortune of £10,000.

Llandovery's Barclays branch closed its doors for the last time on Friday

It was a highly competitive industry, with over 100 other independent banks in Wales at the time.

Nevertheless, when Mr Jones died in 1839 he had increased his worth to £140,000.

His three grandsons continued to grow the bank, opening two new branches in Llandeilo and Lampeter.

The decline of droving during the 19th Century, combined with several banking crises, hit the Welsh companies hard.

Banking panics

However Karen Sampson, head of archives and museum at Lloyds Banking Group, said this only seems to have enhanced the Black Ox's reputation.

"Whereas other independent banks were bought up by major chains because they were going under, when David Jones and Co decided to sell to Lloyds in 1909 they did so from a position of strength," she said.

"As with many country banks in England and Wales, the Black Ox had a licence to print its own banknotes.

"During the panic of 1825 and 1826, one drover wished to withdraw his savings, but when the teller issued him Bank of England notes he refused them, stating that he felt Black Ox notes were far more dependable."

She added that during another banking crisis, David Jones was said to have showered a crowd with sovereigns to prove the bank's liquidity.

"A measure of how David Jones and Co's reputation thrived as others' waned is that Lloyds continued to use the Black Ox logo in Carmarthenshire for another twenty years after the takeover," Ms Sampson said.

Nowadays the Black Ox is largely forgotten in Llandovery, something which local councillor Handel Davies is hoping to change by erecting a blue plaque to honour the bank.

"We can't do much now about the banks which have left the town, but we can at least remember our heritage," he said.

- Published9 January 2019

- Published18 December 2018

- Published5 December 2017