Coronavirus: Second-home owners 'use loophole' to claim grants

- Published

- comments

Abersoch in Gwynedd is well known as the "second home capital" of north Wales

Some second-home owners are using a "loophole" to claim grants which are intended to help small businesses survive coronavirus, it is claimed.

Firms employing fewer than nine people can apply for £10,000 grants as part of a £1.1bn Welsh Government package.

Five councils are calling on Welsh ministers to change advice so second-home owners who pay business rates rather than council tax cannot claim.

The Welsh Government said councils can ask for more evidence from claimants.

Properties that are used as full-time holiday accommodation are often registered as businesses.

But a rising number of second-home owners have moved from paying council tax - which includes a second-home premium - to paying business rates.

In Wales, a second-home owner can register to pay business rates if the property is available to be let for at least 140 days a year and is actually let for a minimum of 70 days.

And after making the transition, they may be eligible for a discount from the Welsh Government, including a 100% discount if the rateable value is less than £6,000.

One councillor has claimed owners of "around 250" second homes in Powys have moved to paying business rates in this way, and that Powys council is in the process of issuing grant payments.

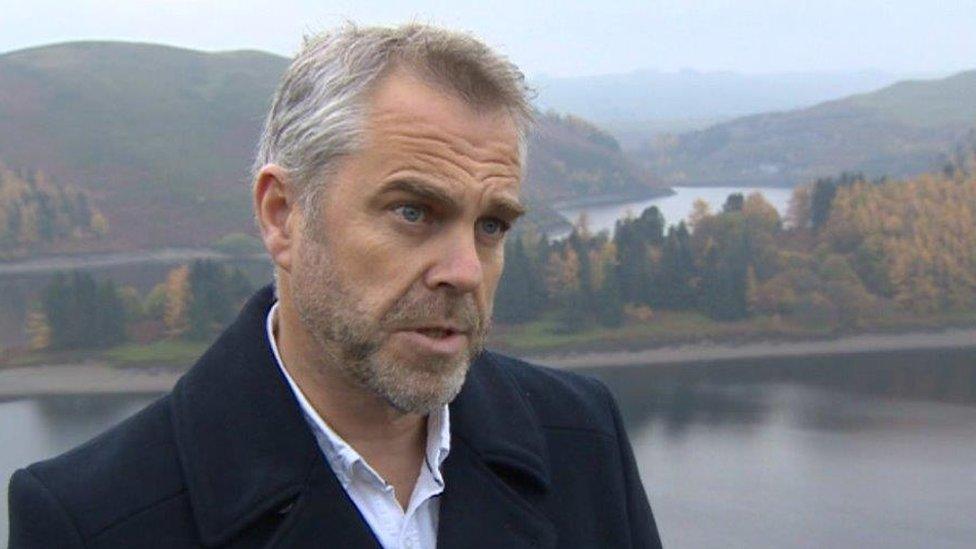

Elwyn Vaughan says Powys council is in the process of issuing the payments to second home-owners

"They don't pay any business rates in Powys and yet they are able to benefit from the £10,000 grant," said councillor Elwyn Vaughan, who represents a ward in the Dyfi Valley.

"It could mean around £2.5m paid out to these holiday homes which is a stark raving bonkers situation.

"The money should be there for genuine, small businesses of which Powys has a wide range of companies like that which should be benefiting from these grants."

Local authorities are responsible for assessing claims for the small business grants and distributing the money.

Powys council said it was applying Welsh Government guidance for assessing grant eligibility, and it was for ministers to determine how any loopholes should be closed.

Deputy council leader Aled Davies said there were about 650 holiday lets in the area which had been assessed as small businesses and were eligible for small business relief.

"These businesses, which include farm diversification projects, holiday chalets and second homes when let, make a valuable contribution to our tourism offer and our local economy," he said.

"If any grants are found to have been paid in error or fraudulently, we can claim it back and will seek to do so."

Ceredigion, which is home to Newquay, is among the councils who have spoken out

But five councils - Gwynedd, Ynys Mon, Conwy, Ceredigion and Pembrokeshire - say millions could be paid to people who have designated a second home a business in order to avoid paying council tax.

Gwynedd has about 5,000 second homes - more than any other county in Wales - and the council estimates the owners of between 1,500 and 1,800 of them may be registered as businesses.

If all were to receive the grant it would mean a total of more than £15m being paid out from Gwynedd alone.

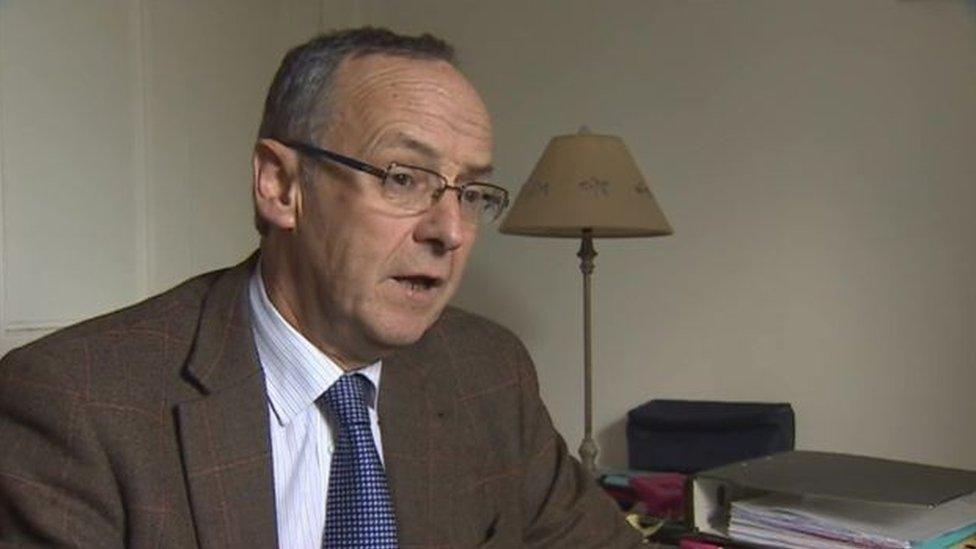

Gwynedd council leader Dyfrig Siencyn said he had made a plea to Wales' Housing Minister Julie James, who "has sympathised with our case".

Gwynedd council leader Dyfrig Siencyn says Housing Minister Julie James is "sympathetic" to his concerns

A Welsh Government spokesman said: "Business support grants are available to self-catering businesses as they fall within one of the sectors most immediately affected by the pandemic and they make an important contribution to our tourism economy.

"However, local authorities have discretion about awarding the grant and can also require business owners to provide additional evidence to support their claim.

"Second homes are liable for council tax and may be subject to additional premiums of up to 100%. The premiums are set by individual local authorities."

A SIMPLE GUIDE: How do I protect myself?

AVOIDING CONTACT: The rules on self-isolation and exercise

WHAT WE DON'T KNOW How to understand the death toll

TESTING: Can I get tested for coronavirus?

LOOK-UP TOOL: Check cases in your area

- Published11 April 2020

- Published10 April 2020

- Published21 March 2020

- Published26 November 2020

- Published16 April 2020