Brexit: Can Welsh firms cash in on trading rules?

- Published

Could businesses turn to UK-based manufacturers to avoid potential border checks and taxes on goods?

Is Brexit an opportunity for Wales' manufacturers?

The UK left the European Union on 31 December, but it was only on Boxing Day that a trade deal was reached.

It means companies that trade with the EU face more barriers and red tape.

A report, external on the future of Europe's retail supply chains found manufacturing of £4.8bn of goods could move to the UK due to Covid and Brexit. So is Brexit yet another hassle or are Wales' manufacturers cashing in?

'Big uplift'

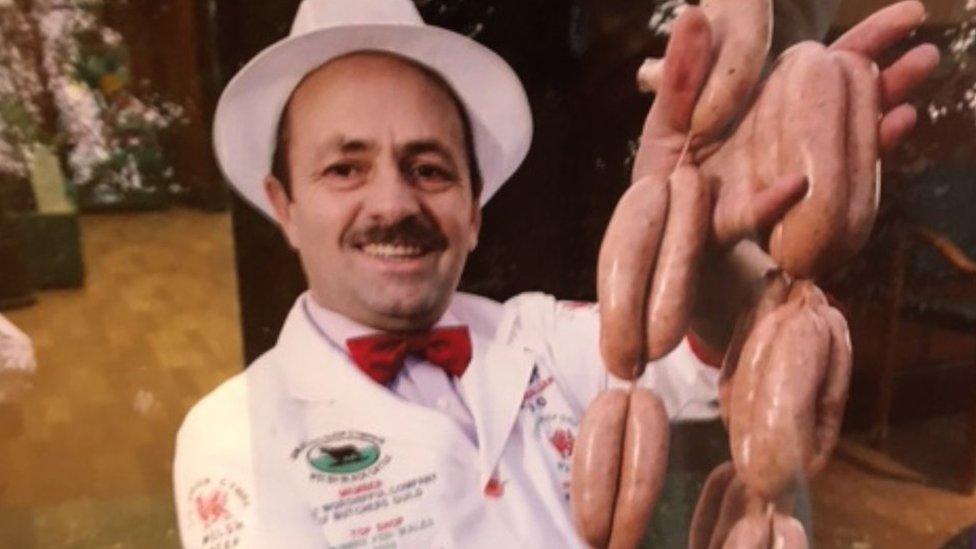

Sausage producer John Langford has seen a rise in sales

John Langford, owner of The Welsh Sausage Company in Welshpool, Powys, said he was already benefiting before the new trade deal was announced.

Ten years ago Mr Langford, who owned butcher shops at the time, was approached by McDonald's to provide sausages for its restaurants.

The deal led to him opening a factory and his company now produces 500,000 sausages a day and also supplies supermarkets, the prison service and a number of pub chains.

"We've seen a big uplift in people buying from us rather than from Europe," he said.

"They're worried about the stock coming in. If it's fresh stock, they can't get it in fast enough from Europe with a week in the docks."

While the coronavirus pandemic had "stuck the fork in" many further deals, he remains confident they will happen in the future.

'Immediate problem'

The director of Filco Supermarkets says Brexit could be a big opportunity for Welsh manufacturers

Matthew Hunt is the director of Filco Supermarkets Limited, which has nine stores across south Wales.

He said the business had been expecting no deal and resulting supply issues, so had purchased "substantial" stocks of dry and longer life items to mitigate shortfalls.

"The announcement of the deal immediately allayed those fears but did have an implication for us - the problem of space and money tied up in stock that was not required or necessary," he said.

"So clearly as a business we have an immediate problem of how to deal with this and effectively liquidate the stock. That would inevitably result in lost profits as to clear the stock we have been forced to make reductions."

But he said the deal had created "stability" which meant the business could continue to focus on the impact of Covid, "soaring staff absence being the primary point of concern, currently".

'Too early to tell'

Hiut Denim's manufacturers are based in Turkey and Italy and it has customers all over Europe

Clare Hieatt founded Hiut Denim Co with her husband David in Cardigan, Ceredigion, in 2011.

The company, which sells direct to customers, was one of the early beneficiaries of the "Meghan effect" when the Duchess of Sussex was photographed wearing its jeans in 2018.

But with its denim manufactures based in Turkey and Italy, and customers all over Europe, Mr Hieatt said it was unclear how things would change.

"It is still too early for us to assess the impact on our fabric deliveries - our first batch of fabric is due to arrive at the end of the month and will get a better picture then."

The company would like to use UK-based suppliers, but Ms Hieatt said it was not possible: "We've just done a small launch with [a small UK denim manufacturer] but they're very niche and would never be able to supply - there are no suppliers in the UK."

She said the trade deal meant shipping orders to customers in Europe involved a lot of extra paperwork: "It is currently adding about five minutes more admin time to each individual pair of jeans we ship - we are hoping that the carriers we use will develop better software to make this process a lot easier."

She fears the changes could hit the business: "We haven't felt it yet, but we are concerned that we might lose some European customers because of uncertainty over duty charges."

'Wake-up call'

Robert Jones had feared a no-deal Brexit and a hike in the cost of importing footwear

Robert Jones's family business Rowberry was founded by his parents 1971 and the firm has shops in Swansea city centre, Mumbles in Swansea county and Llanelli in Carmarthenshire.

The business imports about 70% of its stock from Europe and before the deal was reached, Mr Jones had feared a no-deal Brexit, which he thought may have increased the price of importing shoes by between £10 to £20 a pair.

"Like all British importers I'm happy that there's a deal," he said.

"I always look forward to going to buy from Italian factories - I've had an order on hold in Italy for sandals this coming spring and have asked this company to proceed with the order.

"But it was a wake-up call, so I will still be going to Vietnam and China to view alternatives."

He said he would like to be buying more stock from UK manufacturers, but said there were "so few left".

'Zero hassle'

Michael Grimwood says Peter's Food is looking for alternative suppliers to replace their European contracts

Michael Grimwood is managing director of Peter's Food in Bedwas, Caerphilly, which supplies pies and pasties to supermarkets and hospitality outlets across the UK.

He said the company had "hung on by our fingernails" during the pandemic while its staff also faced mass Covid testing following positive cases.

He said before the trade deal was reached, Brexit felt like "just another headache" but now he is more optimistic.

"As a chilled food supplier of a particularly British product, we see little upside opportunity as an exporter.

"On the supply side, however, we are delighted that the market disruption we may have seen in both supply logistics and marketplace pricing - either from tariffs or markets moving up to match tariffed pricing - is now much diminished."

He said dealing with import documentation had led to some "very low-level cost".

Preparing customs work in advance meant the announcement of a deal was "zero hassle", he added.

Before the trade deal was announced, Peter's Food had started sourcing alternative suppliers for produce bought from Europe amid concerns over supply.

This has included replacing their European hotdog providers with a company in the UK.

"Certainty has been the big upside," he said.

"If I dare to describe anything as certain in our very uncertain Covid world."

- Published7 January 2021

- Published17 December 2020

- Published14 December 2020

- Published28 December 2020