Land transaction tax: 'Chaos' over changes for second homes

- Published

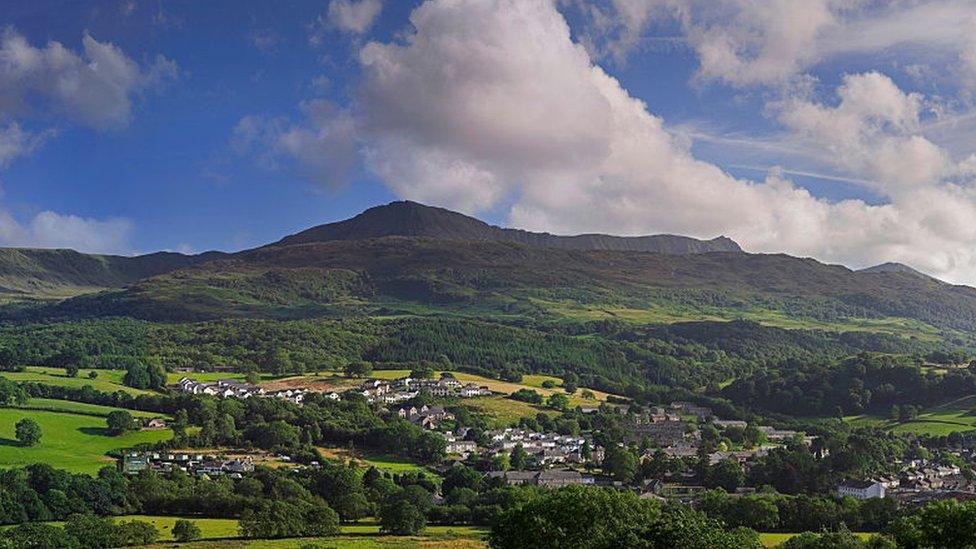

The changes apply to people buying second homes in Wales

An increase in land transaction tax for second homes in Wales has begun with just a few hours' notice, causing "chaos" according to a solicitor.

Second home-owners must now pay an additional 4% levy when they buy properties up to £180,000, external, rising to 16% for homes worth at least £1.6m.

But solicitors said they were "dismayed" at being given just hours' notice of the changes.

The Welsh Government says they could help raise £13m for social housing.

A spokeswoman added: "As with any budget announcements, these changes were not shared in advance."

The Law Society says the changes only applying in Wales but not England may mean solicitors over the border handling purchases in Wales may not be aware until they do a final calculation upon completion.

David Greene, president of the Law Society of England and Wales, said solicitors were dismayed when the changes were announced on Monday to come into effect on Tuesday, adding: "These last-minute changes come at a time when solicitors are under enormous pressure."

In the village of Abersoch, Gwynedd, a beach hut can cost as much as an affordable home

Property solicitors were already dealing with Wales adopting stricter lockdown measures and people seeking to move before the 31 March tax holiday deadline, Mr Greene said.

They are dealing with "record numbers of transactions, which are being hit by delays in searches", he added.

"They now have clients who face paying thousands of pounds more if they are unable to proceed with their transaction within the very short notice period given."

Edward Friend, director of Carreg Law in Carmarthenshire, said five of his clients due to complete on Monday or Tuesday were affected - with some managing to do so before the tax hike came in and others now having to pay extra money they had not anticipated.

"It amounted to four working hours' notice, so yes it has been chaotic.

"If you own a property and you buy another, it could be for your son or daughter or you're working somewhere, a holiday home or because you're separating - it catches you and you have to pay an increase.

"Yesterday we had transactions that were going to be completed yesterday and today, mirroring each other, and clients completing today are paying a significant amount more.

"A client completing yesterday saved about £2,500."

Mr Friend said his firm was now having to go through every file it has open, and inform clients they will have to pay more land tax than in the quote originally given.

"You tend to report how much it costs at the beginning so they're budgeting from the moment they put the offer in, the finances for a transaction take place a week before so they have to pay that difference on the spot.

"The reason it's chaotic is we have to go through the files we've opened and inform all the clients, and that's had to be done at the busiest time of the year."

'Unfair and unjust'

Mr Friend added he had been contacted by firms in England asking for clarity.

"Every solicitor is unlikely to be aware, one English firm last night at 5:25 emailed me asking if their transactions are affected. It shows the pressure they are under.

"In my experience they've never been this last minute, they normally give you notice of the change."

Mr Friend added people who have exchanged but not yet completed are exempt from paying the extra tax - which he said was "unfair and unjust" as the exchange date is often beyond the client's control.

The changes to land transaction tax are part of the Welsh Government budget

The move comes as part of the Welsh Government's budget for 2021-22.

Finance Minister Rebecca Evans said the budget would mean "difficult choices" as extra Covid-19 funding dries up.

Opposition parties have said Wales needs a Covid-19 recovery plan.

While Wales received an extra £5bn in funding from the UK government this year to deal with the pandemic, this will fall to £766m in 2021-2022.

- Published21 December 2020

- Published3 November 2020

- Published27 October 2019

- Published19 October 2020