House buying: Property sale tax holiday ending in Wales

- Published

Christine Bryan has managed to buy her new home within the tax holiday window

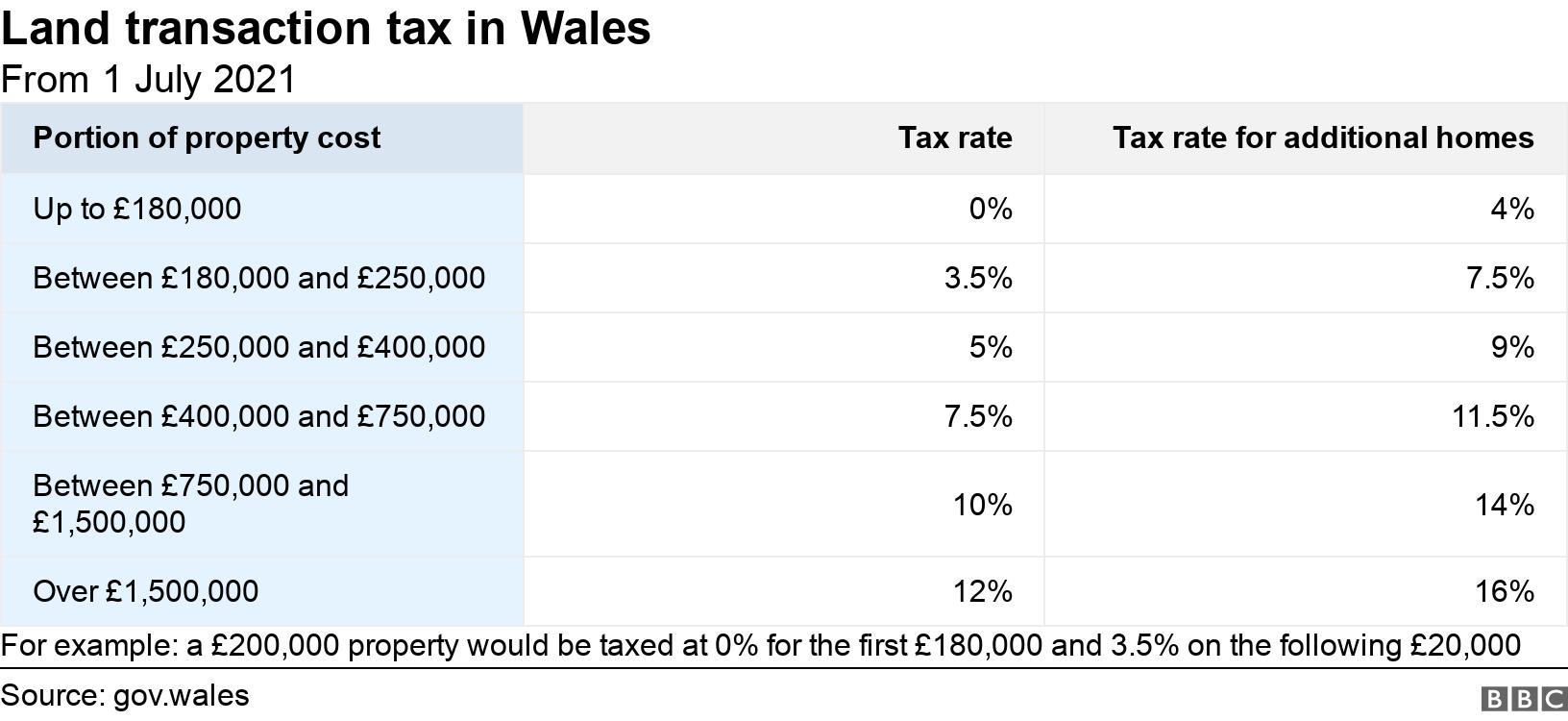

An exemption for homebuyers paying tax on properties which cost £250,000 or less is coming to an end.

Wales temporarily raised its threshold for land transaction tax (LTT) during the pandemic from £180,000 to £250,000, in line with other UK governments.

The exemption, originally for sales until March 2021, was extended to 30 June.

Some homebuyers have saved thousands by completing sales within the deadline, but others are set to miss out.

Nathan Reeks, director of Nathan James estate agents in Caldicot, Monmouthshire, said: "Because we're so near to the border with England, it's made a massive difference to the purchases we've seen."

People moving within Wales could save up to £2,500 on a purchase, but people moving to England stood to save up to £15,000 because of the differing rates of stamp duty there.

"It's been massive pressure for the girls in the office, for estate agents and solicitor in general, for anyone involved in the trade," Mr Reeks said.

"Most solicitors have said 'if you're not completing before 30 June, don't ring me because I'm too busy'.

"There's a lot of pent-up demand. No-one knew the pandemic was going to do what it's done to the housing market.

"We have got all the people who wanted to move last year moving this year as well.

"It's like layers of a cake. The first two layers are last year's and this year's movers. Then we've got the people who are thinking you can save £2,500, or £15,000.

"Then we've got people who need to move because of lifestyle changes because they're working from home now and need more space."

Mr Reeks said more people moved with his firm in May than in the whole of 2020 because of pandemic restrictions last year.

"We'd normally sell about 10-14 a month - it's been 22-30 the last three months.

"The pressure has been extreme. I feel sorry for people who have tried to move at the moment."

But, he added: "It did make a difference. It's helped a lot of people, which is good."

'It's out of your hands'

Christine moved partly to help look after her grandchildren, including grandson Seb

One of those who has benefited from the tax holiday is Christine Bryan, who managed to beat the deadline for her property sale and purchase.

She and her husband John are moving from Baglan, Port Talbot, to be nearer to family in Llantwit Major in Vale of Glamorgan, and completed on the purchase on Tuesday.

As their new property cost £280,000, according to the Welsh government's LTT calculator they would have been liable for a bill of £3,950 if they had exchanged after Wednesday, but because they were able to complete the sale during the exemption period, they only had to pay £1,500.

"We felt a bit pressured [because of the deadline] but it's out of your hands," she said.

"There wasn't a problem with our end but the people that we were buying off, it looked as if it wasn't going to go through at one stage."

Mrs Bryan said the sale had taken about seven weeks and the couple even moved in with her mother in order to facilitate the sale of their own home.

"We moved out of our property a few weeks ago because we didn't want to hold our buyers up," she explained.

She said the extra money saved would be useful for putting towards purchasing furniture for the new house.

But Penarth-based Duncan Millward has not been so lucky.

Delays from their purchaser's side means they have missed the deadline and, as they are moving to their "dream home" near Hereford in England, he estimates they are facing a stamp duty bill of about £11,000 on the £725,000 house.

"The process has taken a long time," he said.

"There have been a few hurdles along the way with our buyers getting a mortgage.

"My wife and I will be in tears if we don't manage this purchase and, as of last week, the house went back on the market."

He is still hopeful they will be able to overcome the hitches and proceed, but they have another deadline looming - because of the differences in stamp duty levels and payment holiday timeframes in England, if they do not compete the purchase before the end of September they could face a bill of up to £50,000.

- Published2 June 2021

- Published29 May 2021

- Published22 May 2021

- Published14 July 2020

- Published14 July 2020

- Published2 April