Second homes in Wales: Are owners selling up ahead of tax hikes?

- Published

Pembrokeshire, along with Gwynedd, already has a 100% council tax premium on second homes

Are tax hikes and rule changes in Wales already seeing more second home owners sell their properties?

Some estate agents say there are signs of that, but others say not enough is being done to ensure local people can afford homes.

All councils in Wales will be able to set council tax premiums of up to 300% on second homes from April 2023.

The Welsh government said it was committed to using "immediate and radical" action to tackle injustices.

The changes, included in a Labour-Plaid Cymru co-operation agreement, are part of an effort to make it easier for people to afford homes where they grew up.

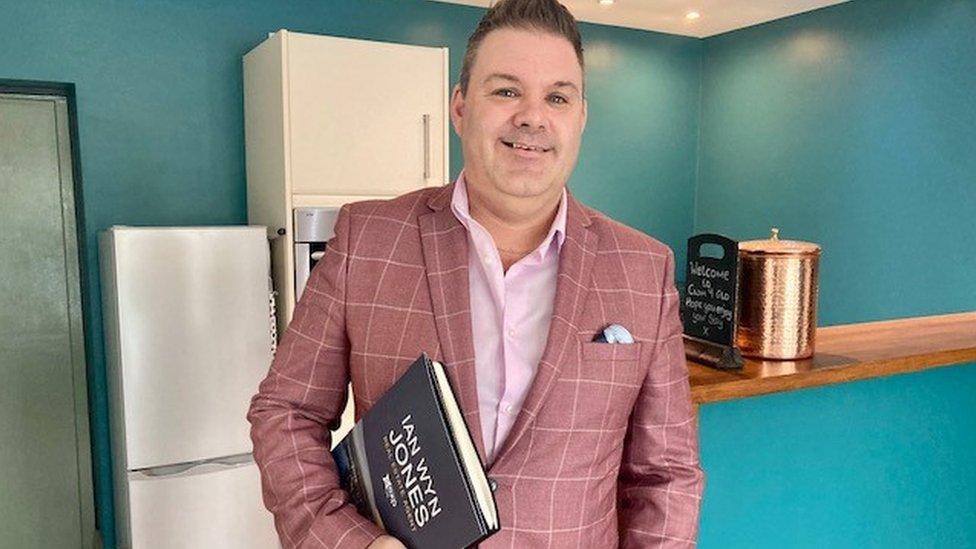

Ian Wyn-Jones, an estate agent based in north Wales, said that over the last couple of months it was clear "changes have come, and they're working".

Estate agent Ian Wyn-Jones says the changes are already making a noticeable difference

'Ticking all the boxes'

"We're here in Cwm y Glo near Llanberis today, where the vendor is selling the property clearly because of the new regulation," he said.

"The people who are buying it are local first-time buyers, so in a way it's ticking all the boxes."

But he does not see the changes having an impact in the so-called second home "honey pots".

"Places like Abersoch, Trearddur Bay, Rhosneigr and Harlech - were not going to see any changes there," he said.

"The people there, they're not going to be fussed because the prices there are ranging from £1m up to £4m for a four or five-bedroom house."

This second home in Cwm y Glo, near Llanberis, was being sold to a local first-time buyer

But Mr Wyn-Jones said he believed any changes should help manage the holiday let market, not push it away, as it was an important part of the local economy.

"Every single house that's let as a holiday home, there's a little community around each one. You've got your cleaners, your marketing team, you've got everything."

What is changing?

According to government body Stats Wales, there were a total of 23,974 second homes in Wales subject to council tax in 2022, as well as 22,140 empty homes.

Under new rules, councils will be allowed to decide which level of council tax premium is appropriate for their local circumstances, up to 300%. The current maximum is 100%.

This does not necessarily mean all councils will make an increase, or that they will increase the premium to the maximum permissible.

Some councils are already charging higher levies, including 100% in Gwynedd and Pembrokeshire, which have the largest number of second homes - 3,746 and 3,794 respectively this year.

The criteria for self-catering accommodation being liable for business rates instead of council tax will also change.

At the moment properties available to let for a minimum of 140 days in any 12-month period, and actually let for at least 70 days, pay rates not council tax.

Under the changes properties must be available to let for at least 252 days, and actually let for at least 182 days to qualify.

Owain Llywelyn, spokesperson for the Royal Institute of Chartered Surveyors in Wales, said the council tax increase was just "one small step" to address the second homes issue, and that more action was needed.

"There are many other potential measures that that could be enacted," he said.

"One of which is perhaps a change in the land tax transaction level from 4% to 8%."

He also suggested a council tax multiplier of up to 10 times for some properties, in addition to implementing rules ensuring only people living within about 35 miles of a property can purchase it.

Rhys Tudur, of the Hawl i fyw Adra (right to live at home) campaign, also believes further steps are needed.

Rhys Tudur says stricter measures are needed

He said: "I hope the changes will make a degree of difference but I don't foresee they'll make as much of a difference as we'd hope.

"They must put in more strict measures, such as a second home tax which is implemented when a home is purchased, and in addition there should be a cap on the number of second homes in each given community.

"The government has consulted upon these measures but they've yet to act upon them, and they should do so soon."

Welsh ministers are encouraging councils to put any extra money raised from higher taxes into increasing the amount of affordable housing.

The Welsh Local Government Association (WLGA) said the "intended impact is to reduce the demand for second homes" and is "not intended as a money raising exercise by councils".

"The council tax premiums can form part of a package that also includes planning measures and steps to reduce the number of self-catering properties being switched to business rates instead of council tax," a spokesperson added.

The Welsh government said: "We are committed to taking immediate and radical action using the planning, property and taxation systems to tackle the injustices in the current housing market, including the negative impact that second homes and unaffordable housing can have, and will soon have a package of proposals to tackle the various problems this presents."

EXPLORE ANGLESEY'S RICH WILDLIFE: Iolo explore Wales’ biggest island by land and sea

ICONIC WELSH PEOPLE, PLACES AND THINGS: Kiri unearths the best clips from the BBC Wales archive

- Published22 May 2022

- Published23 November 2021

- Published2 March 2022