Wales house prices: Family feel forced out amid record figures

- Published

Charlotte Moult fears she will be forced to move her family out of Cardiff

"We almost feel like we are being forced out of the city," said Charlotte Moult.

She longs to be a first-time buyer, but house prices have left her family feeling trapped in a rented Cardiff property.

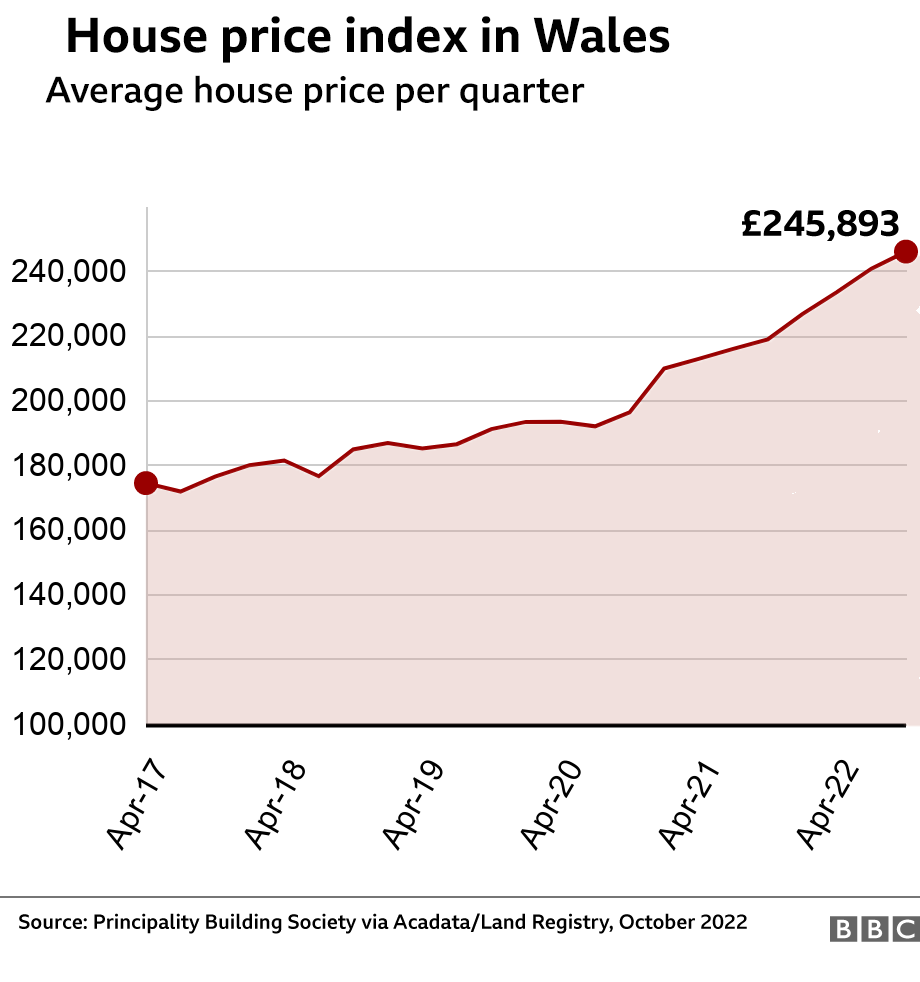

Average house prices in Wales hit a new record high of £245,893 in the third quarter of this year, according to the Principality Building Society.

Charlotte said it was "proving impossible" to find an affordable home.

Data for the three months from July to September 2022 showed the average price of a house in Wales crept above £245,000 for the first time.

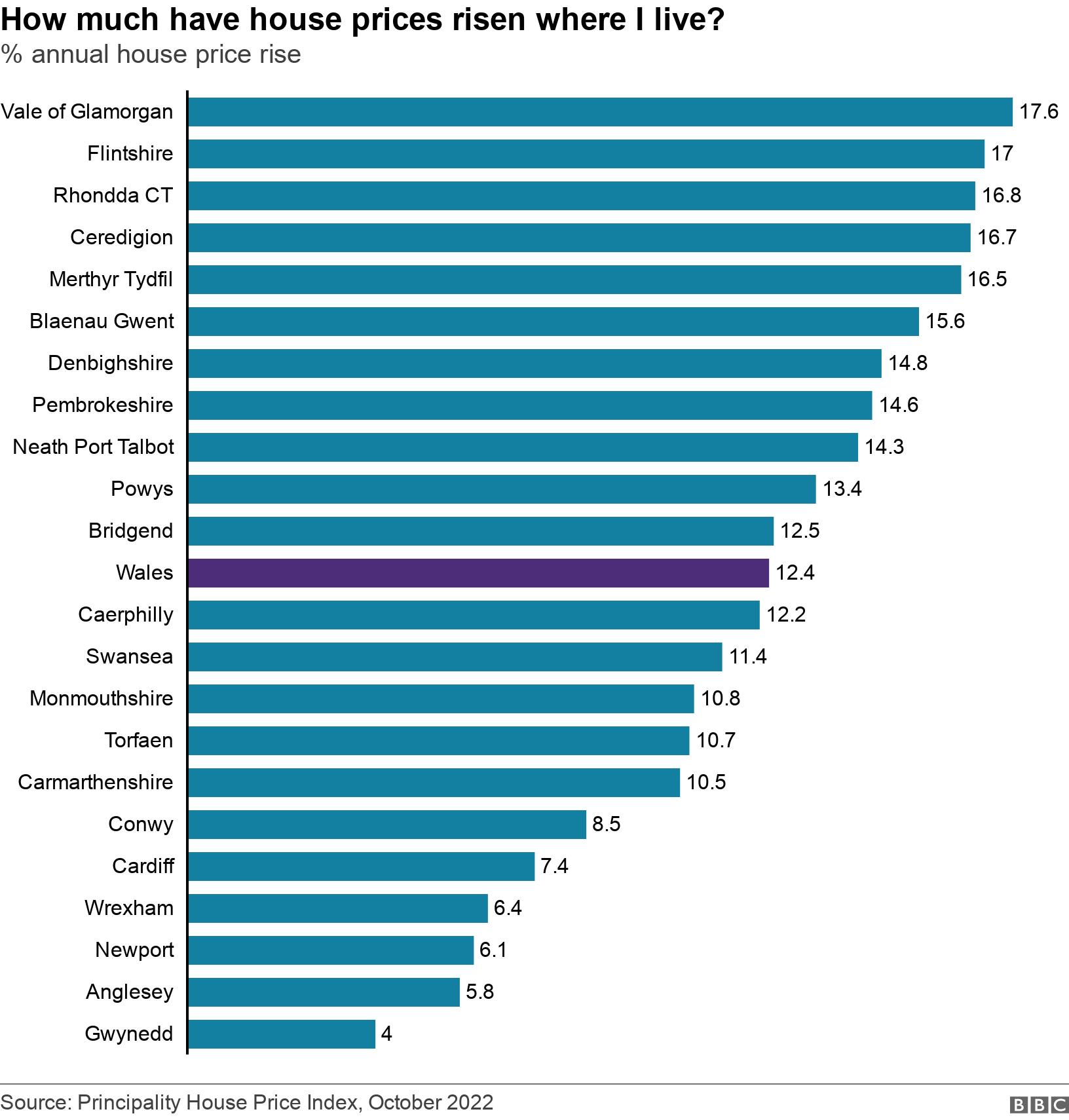

It is an increase of 12.4% on the same time last year, and an increase of 2.2% compared to the previous three months. Nine local authorities reported record highs for the second quarter in a row.

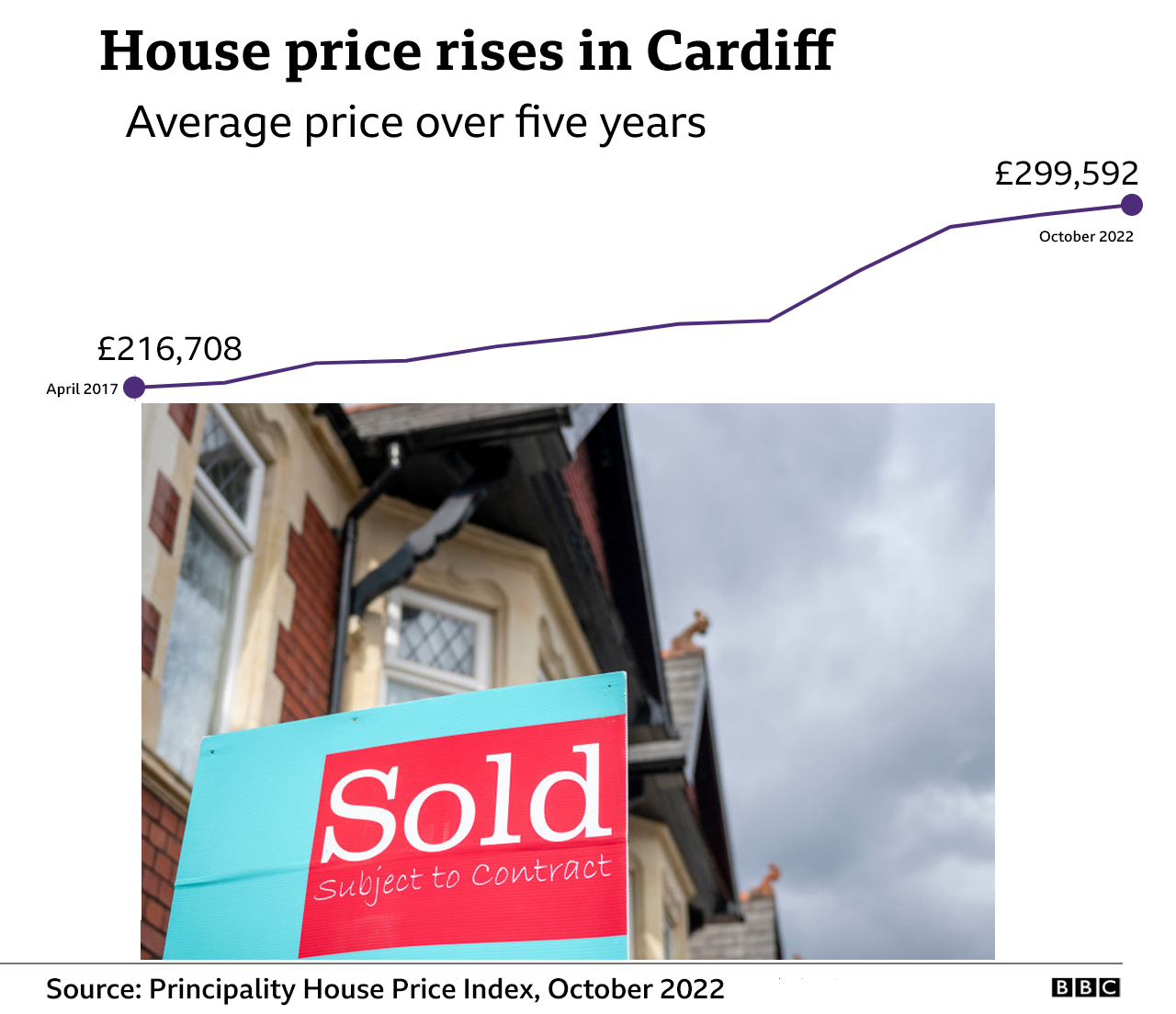

In Cardiff the average cost of a home is now almost £300,000.

Ivan and Charlotte Moult are expecting their third child

Charlotte, 31, and her husband Ivan, 33, are expecting their third child next year. They have been privately renting in Pontcanna for five years, but now face leaving Cardiff to buy a first home that's big enough for their family.

She wants more help for first-time buyers who already have a family and need a larger house.

'It is really disheartening'

She said: "There are no properties that we can buy here for less than £300,000 for the size of house that we need.

"So without that support from the government we are having to look outside of Cardiff, which would mean moving our children out of school, which is not what we wanted to do. It is really disheartening."

Despite being happy in their rented home, Charlotte said she would like the security of owning her own place.

"I feel we'd have much more stability if we were to purchase our own property. We wouldn't be worrying whether our landlady will sell the house, due to the current market, which has been on our minds for the past year or two," she said.

The Principality Building Society recorded annual increases in house prices in every local authority in Wales. The highest increase was in the Vale of Glamorgan, where they climbed 17.6% to an average £355,590.

'There are many unknowns at this stage,' said Shaun Middleton of the Principality Building Society

But Shaun Middleton from the building society said market conditions since September may mean that house prices will stabilise.

"The message is that there's ever increasing headwinds there and it's going to take a quarter or two to absolutely see what the impacts of the last few weeks had," he said.

'A lot more expensive'

He added that the recent rise in interest rates will mean mortgages are more expensive.

"There's a couple of different consequences and the first thing people may literally think: well, I've got a significant cost of living squeeze in my pocket, the mortgage is going to be a lot more expensive, so they choose not to move.

"But the second thing and probably the most important thing is when we assess the affordability of a mortgage, we have to consider rising cost of gas, utility bills, petrol.

"And what that means is when we do the affordability assessment, we'll probably be able to offer you less for that mortgage as we would have been able to do a few months ago, which means that even if someone wants to move they might not be able to."

'Financial support'

The Welsh government said: "We want everyone to have access to a good quality, safe and affordable home.

"We understand the difficulties first-time buyers face, particularly given the current cost of living crisis and because of recent actions by the UK government which have driven up the cost of mortgages.

"We are making changes to land transaction tax so the majority of people buying their main residences, including first-time buyers, will pay no tax on their transaction.

"Our home ownership schemes, such as Help to Buy Wales, provide financial support to people who want to buy a home but need help. Since its introduction, more than 13,000 homes have been delivered through Help to Buy Wales. Three-quarters of sales through the scheme have been to first-time buyers."

FIGHT FOR YOUR RIGHTS: The Welsh consumer show fighting for YOUR rights

Related topics

- Published30 December 2021

- Published18 July 2022