Travel insurance warning after Thailand motorbike crash

- Published

'He was in a terrible state and very lucky to be alive'

The sister of a man who is facing a large medical bill after a motorbike crash in Thailand has urged others to check their travel insurance policies.

The Boxing Day crash left 28-year-old Adam Davies with serious injuries, including a fractured skull.

Adam, from Dinas Cross, Pembrokeshire, now faces large medical costs which are not covered by his travel insurance.

His provider, Lloyds Bank encouraged customers to check the terms and conditions of their insurance.

Adam's family have raised £20,000 to pay for treatment, but have warned others to check their policy's fine print.

Adam's sister Jess Davies, 30, said while her brother had worldwide travel insurance, the policy would not pay out for medical expenses as he had been away from the UK for more than 31 days.

Following the crash on the island of Ko Tao, he remains in a hospital in Koh Samui, with his parents at his bedside.

In addition to fractures to his skull, he has bleeding on the brain, a punctured lung, broken ribs, a broken clavicle, a broken scapula and a fractured ankle.

Jess Davies said her brother had no idea of the clause in his travel insurance policy which meant his medical bills would not be covered

"He was on a little island and he was driving a scooter and he just, I think he came round a bend and just went straight in to an electric pole," said Jess.

"We didn't find out until it was 24 hours after. He had to be shipped to another island because there was no hospital there and he had multiple injuries, some major injuries and his insurance wouldn't cover him."

Jess has managed to raise £20,000 for her brother through an online fundraising page, but she is urging other travellers to be more cautious.

Adam's parents, Alison and Graham, are hoping to stay with him in Thailand until he is well enough to travel home to Wales

"It was something in the small print. He took out an insurance policy which enabled him to travel worldwide, that's how it was sold. But it would only insure him for one country for 31 consecutive days."

She's urged others to study the "small print" of policies before travelling.

"I know it's annoying to look through… nobody really reads the small print, but I urge everybody to do it. Even if it takes half an hour, it's worth it.

Family friend, Lucie Macleod, 23, said no one expected the policy to have such a clause, which is why it is important to read the whole thing.

Lucie Macleod said it felt like a "no-brainer" to get travel insurance with your existing bank, but it's important to read the policy

"Nobody would have ever thought that one of the caveats would be that every 30 days you would have to land back in the UK," said Lucie.

"It was worldwide insurance, and for a year. It seemed convenient to have the same bank and same insurance. Everybody should definitely read the small print."

'Overwhelmed' by support

Jess has thanked the hundreds of people that have raised the more than £20,000 for her brother's medical care.

"People worldwide have helped out and we're just amazed and overwhelmed by all the help we've had really and the support," she added.

"It reached the target within 24 hours, which was £15,000, and it's up to £20,000 now and keeps on climbing. We are just so grateful and so blessed to have all this help and support."

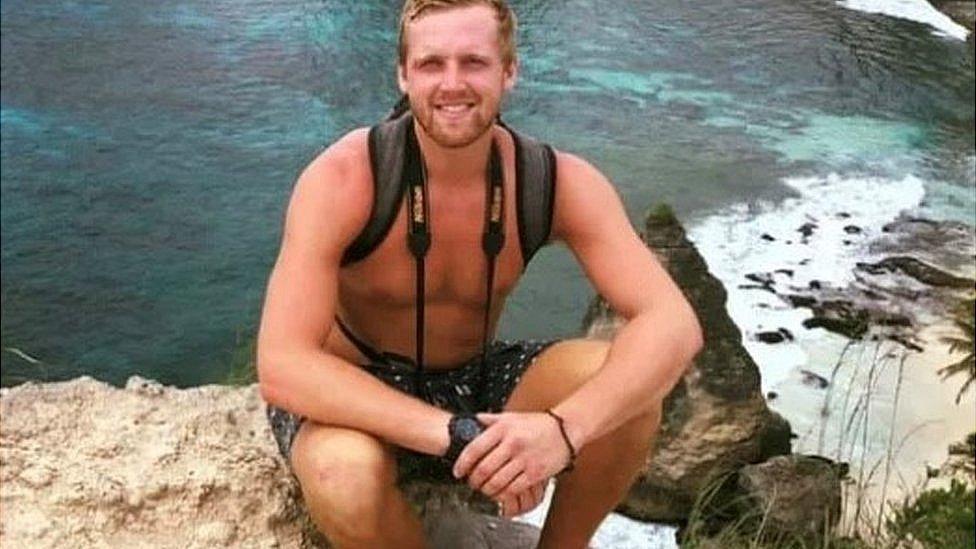

Adam Davies bought worldwide travel insurance for a trip to Thailand, but was caught out by a clause after he was injured

Adam's parents, Alison and Graham, are hoping to stay in Thailand until he is well enough to travel home to Wales.

A spokesperson for Lloyds Bank, Adam's insurer, said: "We would always encourage customers looking to travel abroad for an extended period of time to check the terms and conditions of their insurance, whether that's been provided through their bank account or purchased separately.

"Most providers, including Lloyds Bank, will make it clear what is covered under your policy when you first take it out, and send annual reminders to make sure it remains suitable for you."

- Published10 April 2020

- Published5 July 2022

- Published11 January 2021