Cost of living: How much is my council tax going up?

- Published

Council tax, which helps to fund services such as local playgrounds, will be increased across the board in order to keep up with rising costs

Thousands of households in Wales face a rise of more than £100 in council tax as local authorities announce plans to help with the cost of living.

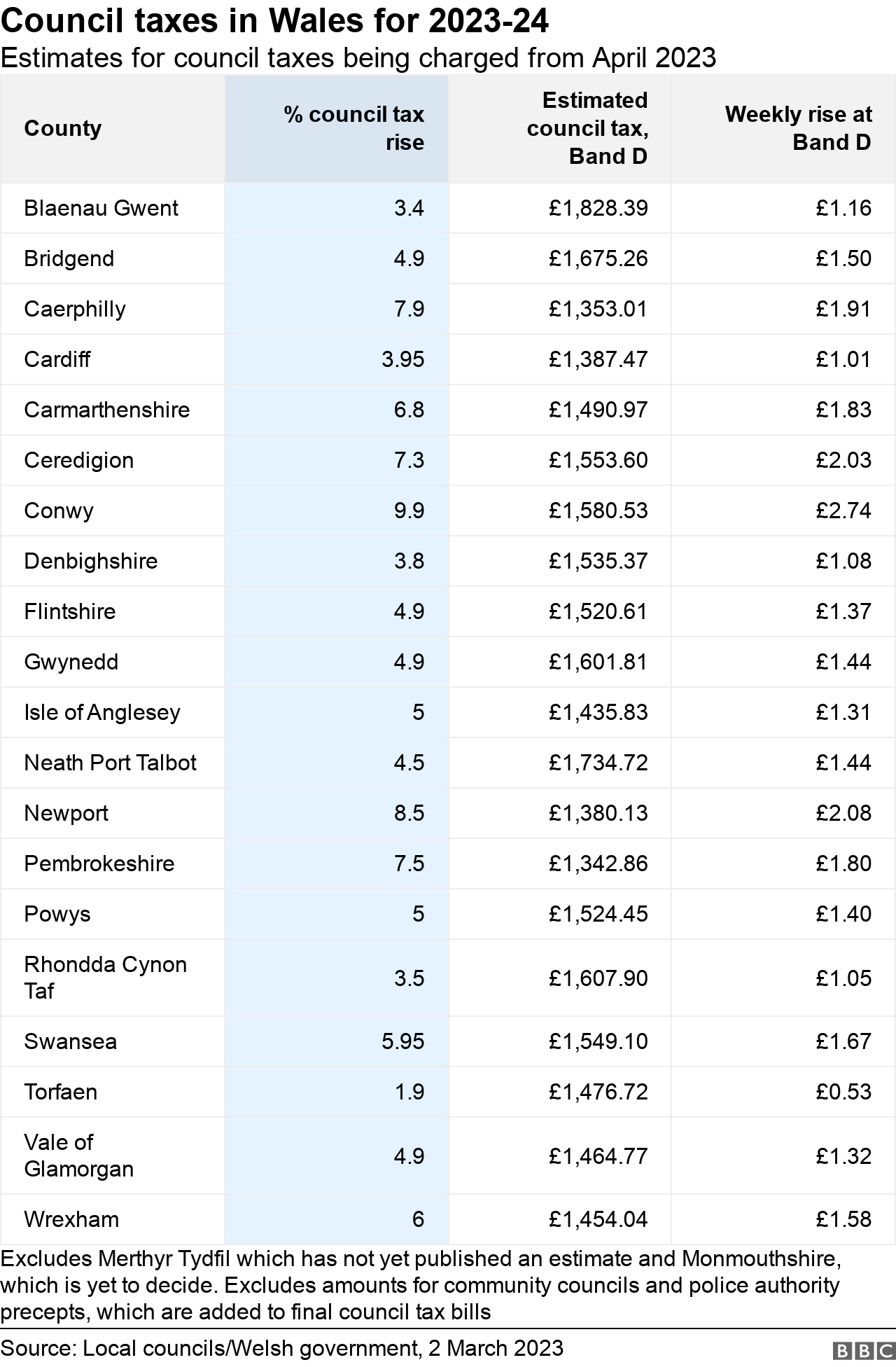

The average hike is set to be 5.5%, with Conwy seeing the highest annual rise of almost 10%. Torfaen and Blaenau Gwent are among the lowest.

Merthyr Tydfil and Monmouthshire councils are yet to agree final plans.

The body representing Welsh councils said that to rely on service cuts alone could have been "dangerous".

What is council tax?

Council tax is a compulsory charge on properties in England, Scotland and Wales set by local authorities to raise money to spend on providing services in their area.

Homes are graded into different bands according to how much they were worth at a certain point in time.

People with more expensive properties are in a higher category.

In Scotland, councils also have complete freedom to set rates.

In Wales councils set rates, but the government can cap council tax rises that are deemed "excessive", external.

Northern Ireland is not covered by the council tax system, and operates a separate domestic rating system, external.

Currently an average band D council tax for Wales, external for 2022-23 is £1,777.

This includes £1,433 for county councils, £304 for police and £40 for community councils.

How much more will I have to pay?

Councils are legally required to balance their budgets and have proposed how much they plan to increase council tax to help keep up with rising costs.

Wales' 22 local authorities operate schools, collect bins and run social care and libraries among other services.

Councils get funding from the Welsh government, with other sums coming from fees and council tax.

So far, Welsh councils look to be setting an average increase of about 5.5%.

That percentage rise affects the county council element only, although when the final bill comes people may see a rise in the amount they pay for police services and community councils.

Last year, on average the cost of police added an extra £304 to final bills. Community councils can add a typical amount of around £50, depending on where you live.

The council areas with the highest increases include Conwy (9.9%), Newport (8.5%), Caerphilly (7.9%) and Pembrokeshire (7.5%).

Conwy could see a rise of almost £3 a week compared to a weekly rise of 53p in Torfaen, which is only 1.9%.

Council tax increase "is going to make people worry even more"

Blaenau Gwent (3.45%) and Denbighshire (3.8%) are also on the lower end of the scale.

You can check your council tax band on the UK government website, external, with the changes coming into effect in April.

How much funding do councils get from the Welsh government?

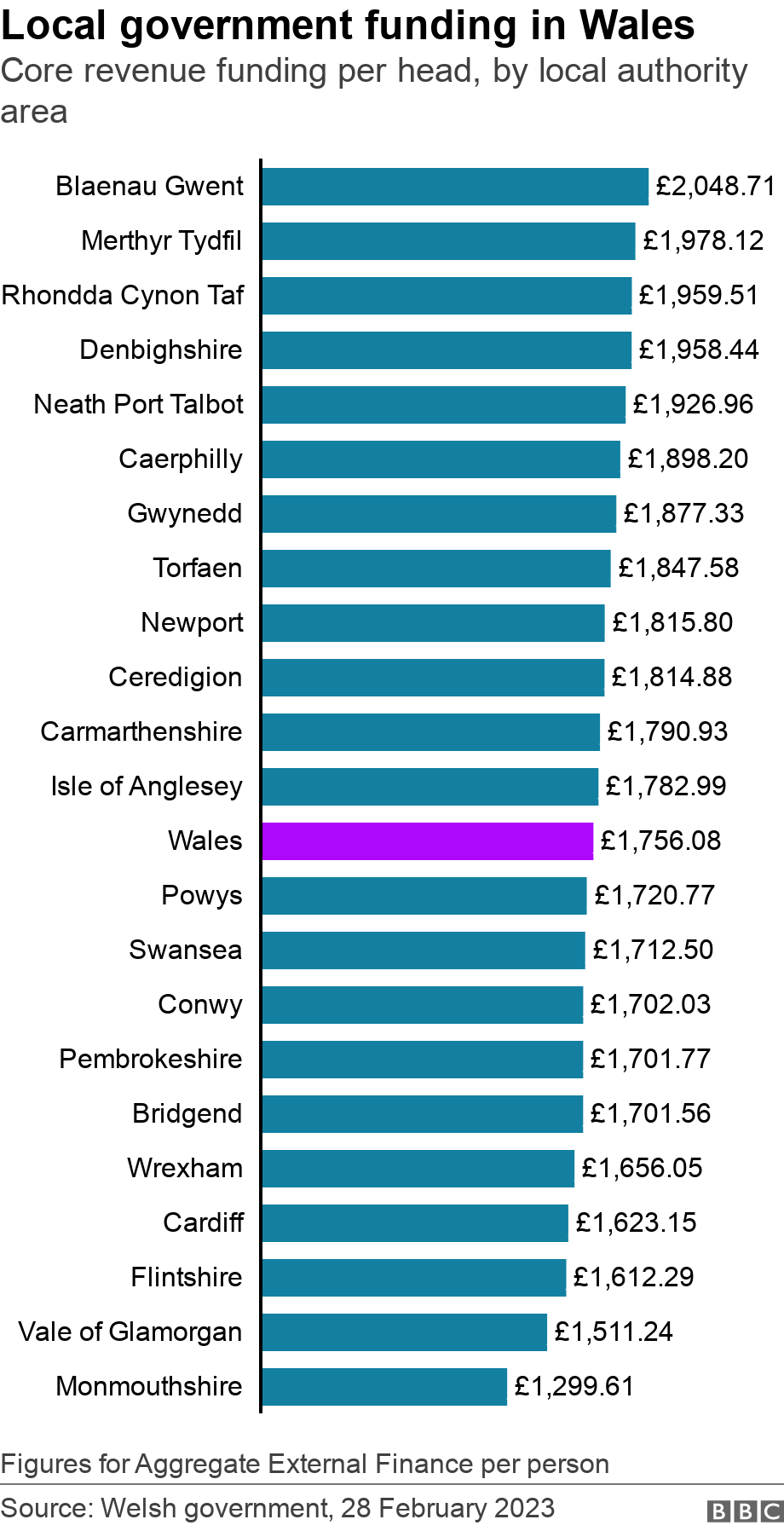

Councils get most of their funding from the Welsh government, sharing a pot of £5.5bn, announced earlier this week, external, and which the finance minister remarked was a "significant increase" on the previous year.

She recognised that councils still faced tough decisions in setting budgets and council tax.

Conwy council leader Charlie McCoubrey said its proposed 9.9% increase, the biggest in Wales, was because the authority had kept council tax low over the past decade using the council's reserves.

"We really understand that people find it difficult, and we do our best to keep the percentage as low as possible," he said.

Mr McCoubrey said: "Traditionally we have had a low tax level compared to our neighbours, and as a result our funds have decreased."

He said because of this the council was unable to use its funds to help with the budget for the coming year.

"It's a balance - I know people find it difficult," he added.

He criticised the way the formula was worked out but said he had a commitment from the Welsh Local Government Association (WLGA), which represents councils in Wales, that it would be reviewed.

A spokesman for the WLGA said budget setting had been "extremely difficult", with authorities facing an estimated £784m pressure in 2023-24.

"While the settlement from the Welsh government was better than expected, it still leaves an enormous gap of around £300m to be bridged," he said.

"Budgets and council taxes are in the process of being approved across Wales, and this process will be complete next week."

The Welsh government with formally publish the increases at the end of March.

Who pays council tax?

Student only households are one of the few exceptions for paying full council tax

As a general rule, anyone who is over 18 and owns or rents a home has to pay council tax.

It is the responsibility of the tenant, not the landlord, to pay council tax.

Some exceptions and discounts apply and include:

If you are in a property solely occupied by students

If you work away from home and your property is empty, you can get a 50% discount

If you live alone, you get a 25% discount

The Council Tax Reduction Scheme is also available for households who are entitled to Job Seekers Allowance, Employment Support Allowance, Pension Credit, Income Support. You can read more on this here, external.

What do people think?

Bob Barry, pictured left, and Robert Hutchings are part of a group of friends who meet for coffee but think the cost of living might restrict them soon

In Caerphilly, Bob Barry, 71, and Robert Hutchings, 64, are part of a group of friends who meet for coffee every day, but said bills going up could put an end to that.

"We come here and have coffee regular - well maybe we won't be able to come here as regular because the money is not there," said former British Steel worker Mr Hutchings.

Mr Barry, a retired charity worker, added: "It's a big chunk of money, 7.9%, for a lot of people who are on poor wages.

"Wales has been a poor wage economy my whole life, with certain exceptions and many of those jobs have been lost now which paid well.

"Because everything has gone up, you have to ask is it legitimate for the council to raise council tax by that much when they have so much money in reserves."

Tracey James worries about what increased council tax will mean for her family and the most vulnerable

Tracey James loves spending time treating her granddaughters but said she believed any rise in council tax would put people under more financial pressure.

"It's another thing that adds on to what's already happening - the heating costs, the food costs," she said.

"People are going to really struggle now and for some families, it's going to break them.

"I am lucky, we are just about managing but the likes of my mother and other OAPs - what more can they do?"

Refuse collection is one of the services covered by council tax

Dr Marlene Davies, an expert in local government finance at the University of South Wales, said councils were struggling with the cost of living, with their wage bills being their biggest problem.

"Fuel, heating, even buying food, we've been told food inflation is hitting 17%, well where do school meals come from? Council budgets," she said.

"The cost of living is going up for everyone and it has impacted on local authorities in exactly the same way.

"Different councils have taken out different loans, interest rates have gone up, that doesn't just affect mortgages, it affects all kinds of loans authorities have taken out in the past, which has to be taken out of their revenue budget."

'More cuts would be dangerous'

WLGA spokesperson and Gwynedd council leader Dyfrig Siencyn says it has been difficult to find the balance for residents

Speaking on behalf of the WLGA, Gwynedd council leader Dyfrig Siencyn said: "I think we are in a better place than we thought we were in some months ago.

"The first figures that we calculated were quite frightening actually and would have meant serious deep cuts to frontline services.

"Each council has their own different situation and some have faced extremely difficult situations."

He added: "It is a very difficult balance in rising council tax or cutting services. It can mean lives can be danger if we didn't protect those services and that's the balance we have to take into account."

Related topics

- Merthyr Tydfil County Borough Council

- Wales

- Conwy

- Pembrokeshire County Council

- Wrexham County Borough Council

- Merthyr Tydfil

- Newport City Council

- Department for Levelling Up, Housing and Communities

- Bridgend

- Caerphilly

- Cardiff

- Torfaen County Borough Council

- Vale of Glamorgan Council

- Council tax

- Wrexham

- Conwy County Borough Council

- Welsh government

- Cost of Living

- Newport

- Ceredigion

- Vale of Glamorgan

- food

- Caerphilly County Borough Council

- Powys Council

- Rhondda Cynon Taf County Borough Council

- Isle of Anglesey County Council

- Local government

- Torfaen

- Gwynedd Council

- Published1 December 2022

- Published28 February 2023

- Published14 December 2022