Principality Building Society boss fears more rate rises

- Published

Rising interest rates are having an effect on first time buyers, with fewer "across the whole of the UK market", says Julie-Ann Haines

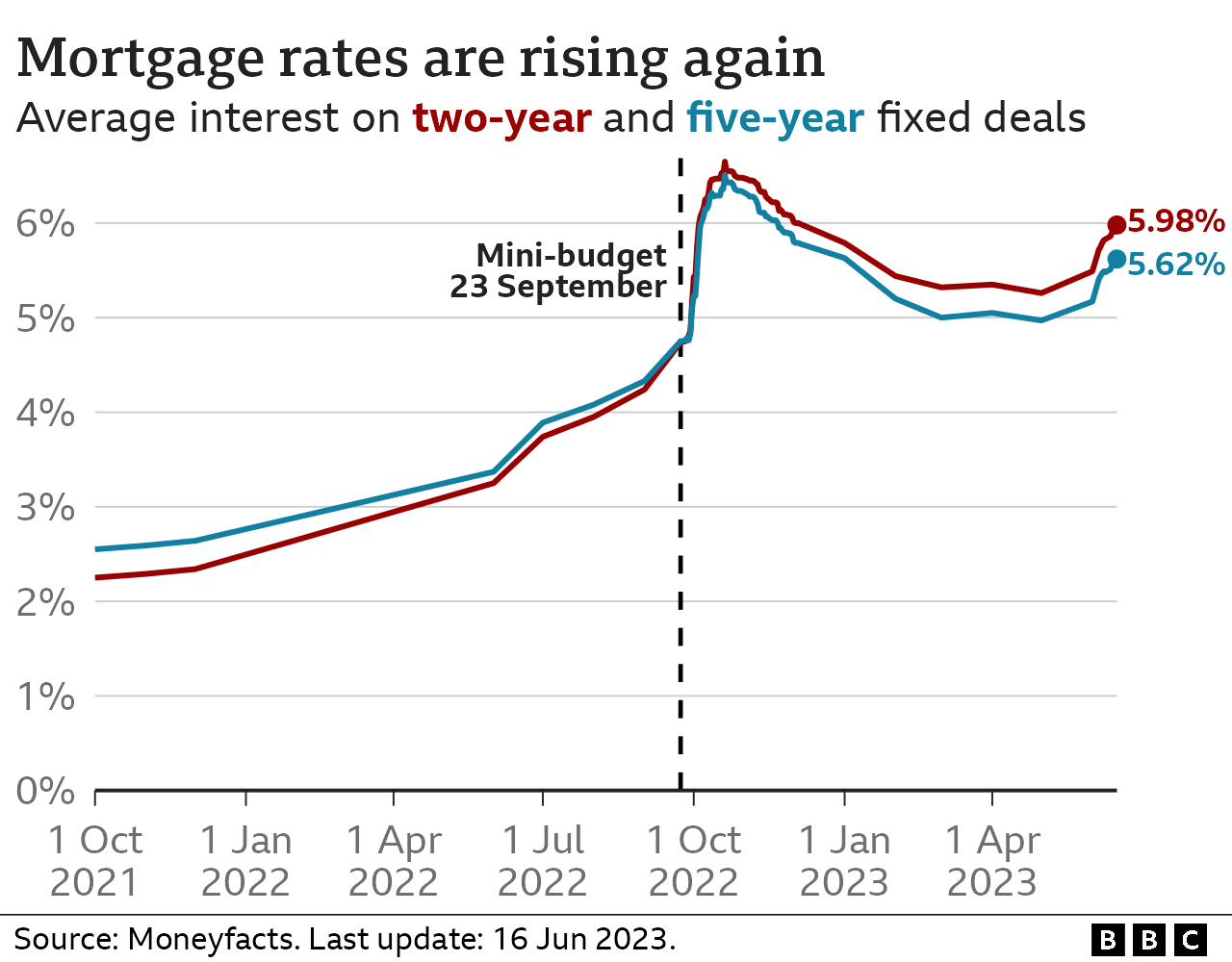

Home owners are paying £3,000 more for £150,000 mortgages than a year ago after rate rises, according to the boss of Wales' biggest building society.

And the "inflation crisis" could lead to more people feeling the pinch, said Julie-Ann Haines from the Principality.

An estimated 800,000 people in the UK come off fixed rate deals this year.

Ms Haines said a £150,000 mortgage now costs £3,000 more each year than a previous two-year 2.57% fixed rate deal - the current rate is at just under 6%.

Cabinet minister Michael Gove said help for people struggling with mortgages was being kept "under review".

Ms Haines said: "I feel really sorry for those customers who are coming up to the end of a fixed rate mortgage over the next six months.

"Our expectation is that, unfortunately, we would expect the Bank of England base rate to be increased at the next three meetings of the monetary policy committee," she told BBC Radio Wales' Sunday Supplement.

It increased the rate to 4.5% from 4.25% at its last meeting.

Ms Haines said "the majority of banks and building societies aren't seeing significant increases in the number of customers in difficulty".

"But that is because there's so many customers who've been on fixed rate mortgages," she added.

"And it's the fact that we've got about 800,000 people across the UK that are going to come off a fixed rate mortgage over the rest of this year."

And she said a further 1.6 million people were estimated to see their fixed rates deals end in 2024.

The rising rates were starting to have an effect on first time buyers, with fewer "across the whole of the UK market", she added.

Ms Haines said: "If these market rate predictions of where the Bank of England base rate might go... then I would expect that confidence and the ability for first time buyers to pass all of the stress testing and affordability tests, that really starts to come under pressure.

"It is back to the Bank of England and the government to do as much as they can to ensure that this inflation crisis doesn't get embedded into the economy."

- Published1 June 2023

- Published17 June 2023