British Steel pensions: Port Talbot worker lost £50,000

- Published

Malcolm Sibthorpe lost thousands of pounds due to bad pension advice

A steelworker was left in tears after losing £50,000 from his pension due to an adviser who pocketed £1m in illegal commissions.

Darren Reynolds was fined £2.2m, external for dishonestly advising 670 customers, including 150 steelworkers like Malcolm Sibthorpe of Ebbw Vale, Blaenau Gwent.

The Financial Conduct Authority (FCA) said it was one of its "worst cases".

Reynolds called the FCA's findings "rubbish" and said his side of the story would come out at a tribunal.

About 8,000 steelworkers, many from Wales, moved £2.8bn from their pension plan when it was restructured in 2017.

"[Darren Reynolds] knew what he was doing," Mr Sibthorpe, 63, said.

"He just ripped everyone off.... he knew he was stealing money from us, but he wasn't the only one. "

The closure of the British Steel Pension Scheme (BSPS) in a deal with Tata Steel resulted in what one Welsh MP called a "feeding frenzy" of unscrupulous advisers.

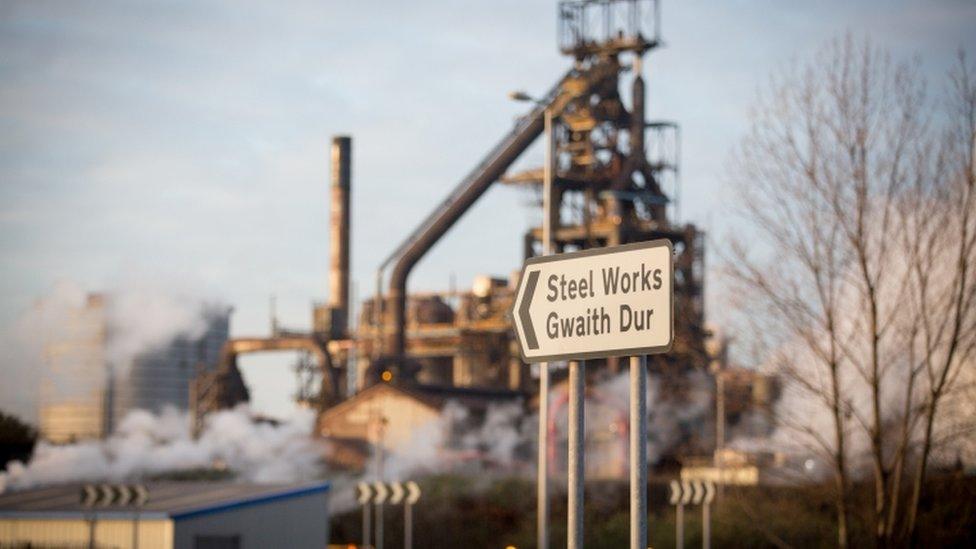

Mr Sibthorpe was at the steel works in Port Talbot where he said staff were being approached about moving their pension pots into private schemes.

"A guy in work told me he was given £50 cash to get me interested," he recalled.

Mr Sibthorpe remembered Reynolds as having the "gift of the gab" when he came to meet him and his wife at their home in August 2017.

"I think we were gullible... [Reynolds] told us we would lose 10% if we went with the government scheme and we wouldn't be able to get our money out. That's how he sold it to us.

"He told he us he did pensions for the police and Post Office. When we saw his name on the FCA website we thought it was legitimate."

Malcolm Sibthorpe (top row, middle) was a steelworker for 29 years

By the October, Mr Sibthorpe said word had started to get out among his fellow workers that something was not right about the pension scheme Reynolds was recommending.

"I phoned [Reynolds] and he said he would get my money out, but I never heard from him again. We were crying. We didn't know what was going to happen with our money."

He said he spent that Christmas worrying 40 years of his working life had "gone down the drain".

Mr Sibthorpe did get his pension pot back at the end of December, but it was £50,000 smaller due to transfer fees and, for the rest of his life, the payments will fluctuate with the market.

He said his pension pot had been further hit by the Covid pandemic and the war in Ukraine.

Financial adviser, Alistair Rush (right) has helped hundreds of steelworkers who were given bad pension advice, including Malcolm Sibthorpe (left)

He got back £38,000 as part of £71.2m in payments from the Financial Services Compensation Scheme (FSCS).

On top of the £2.2m fine, Reynolds is now banned from giving financial advice and an advisor at his now-dissolved firm based in Willenhall, West Midlands, Active Wealth UK, was also banned from working in the sector.

Andrew Deeney was fined £397,000 for taking £200,000 in illegal commission payments.

The FCA investigation found Reynolds tried to hide his commissions by filtering them through shell companies.

The 53-year-old from Willenhall, West Midlands, called the FCA's findings rubbish.

His fine and suspension will now go to the Upper Tribunal, external where Reynolds said "his side of the story" would come out.

Steelworkers in south Wales were "duped" into moving their pensions into high-risk investments, the FCA says

The FCA's Therese Chambers called it "one the worst cases we have seen".

She said the pair - who cost their clients an estimated £42.3m - not only "duped" workers into leaving safe pension schemes for "unsuitable, high-risk investments", they then tried to "hide their misconduct from us".

Under FSCS, £19.8m was paid to 511 of Active Wealth's former customers, less than half what they had lost, the FCA said, due to a £50,000 cap on payments from the scheme.

The FCA also banned Simon Hughes, ordering him to pay £159,000 in redress for bad pension advice to hundreds of BSPS members through S&M Hughes Ltd, which is now in liquidation.

"These financial advisors and the system was set up to rob us of our money," Mr Sibthorpe said.

"To me it is a criminal thing, [Reynolds] should go to jail, I think."

A criminal investigation by South Wales Police ended with no further action being taken.

"It seems like the rich people get away with it and us poor workers are left with the bill," he added.

- Published31 March 2022

- Published26 October 2019

- Published19 January 2018

- Published13 June 2018