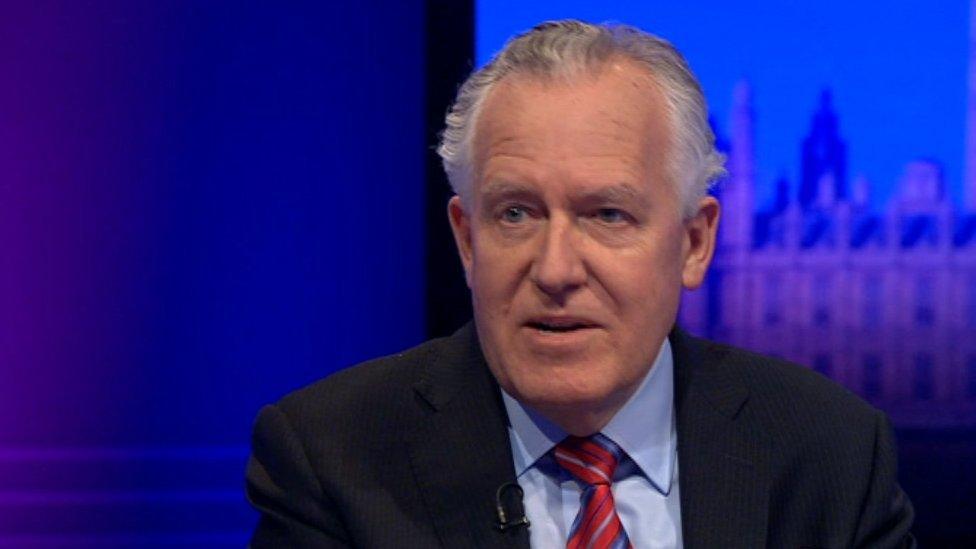

Lord Kinnock attacks plan to devolve income tax powers without poll

- Published

Former Labour leader Lord Kinnock and former Welsh Secretary Lord Murphy have hit out at plans to hand the Welsh Assembly income tax raising powers without the need for a referendum.

The Wales Bill proposes scrapping the current requirement for a poll.

But Lord Kinnock said the power was being offered in the "cynical knowledge" it will not be used.

The two opposed the move during the bill's committee stage in the House of Lords on Monday.

Under the Wales Act 2014 AMs were given the chance to have income tax powers if a referendum was fought and won - but the Wales Bill would devolve the powers without a vote.

Lord Kinnock told the Lords there was "a straightforward justification for a referendum on such a fundamental constitutional and economic decision".

"In a parliamentary democracy, referendums are justifiable when there is a proposal to change the way in which we are governed," he said.

Lord Kinnock said giving the assembly the power to levy income tax would "very profoundly change the way in which Wales is governed".

He added the additional power was being offered in the "certain and cynical knowledge" that it would not be exercised, adding: "Accountability must relate to exercisable powers, not abstract ones."

'Burden'

Lord Murphy questioned why the UK government had changed its mind on the need for a referendum.

"There is a good, sound economic and financial reason why the people of Wales should not be burdened by an extra income tax," he said.

He warned that Wales was not a wealthy country compared to England, so the "burden would be high" were an income tax to be raised in Wales alone.

However, Liberal Democrat Baroness Humphreys welcomed the government's move, insisting power and accountability were the basis for democracy.

Plaid Cymru's Lord Wigley also backed the move, insisting a referendum was "not an appropriate tool for deciding" taxation policy.

Responding for the UK government, Wales minister Lord Bourne of Aberystwyth said: "This is a limited power. It's not transferring all income tax powers to Wales.

"I think we would be doing Wales a massive disservice by having a referendum I don't believe is necessary in the changed circumstances of devolution in 2016."

- Published10 October 2016

- Published14 June 2016

- Published25 November 2015

- Published24 September 2016

- Published12 September 2016