Wales offered income tax powers without referendum

- Published

Chancellor George Osborne says he will deliver a minimum "funding floor" for Wales

Control of some of the income tax levied in Wales can be devolved to the Welsh government without a referendum, Chancellor George Osborne has said.

It means Welsh ministers could control £3bn of taxes a year by 2020.

Mr Osborne also promised that spending per head on devolved services in Wales would not fall below 115 percent of spending per head in England.

Welsh ministers said their budget would fall in real terms and they needed more details on the minimum funding pledge.

Key points of the Spending Review

Announcing plans for £20bn worth of cuts in the Commons on Wednesday, Mr Osborne told MPs Britain had to tackle its national debt but put its economic and national security first, saying they provided "the foundations for everything we want to support".

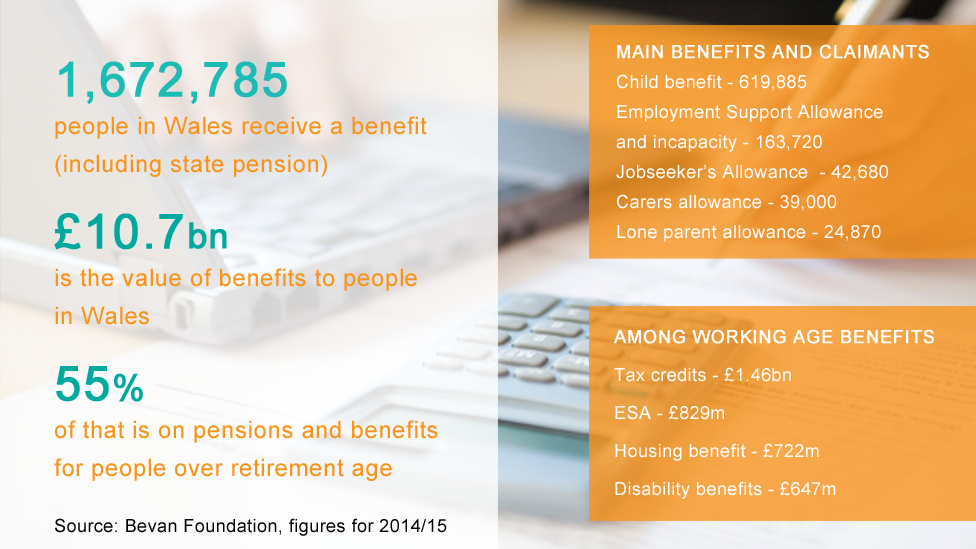

However, the chancellor said he had dropped plans to cut tax credits, paid to 238,000 families in Wales, after the House of Lords effectively blocked them.

He also ruled out any reductions to police funding in England and Wales, after the Home Office had previously urged forces to prepare for cuts of 25% or 40%.

Dyfed-Powys police and crime commissioner Christopher Salmon said it was "encouraging news".

How changes to benefits could affect people in Swansea

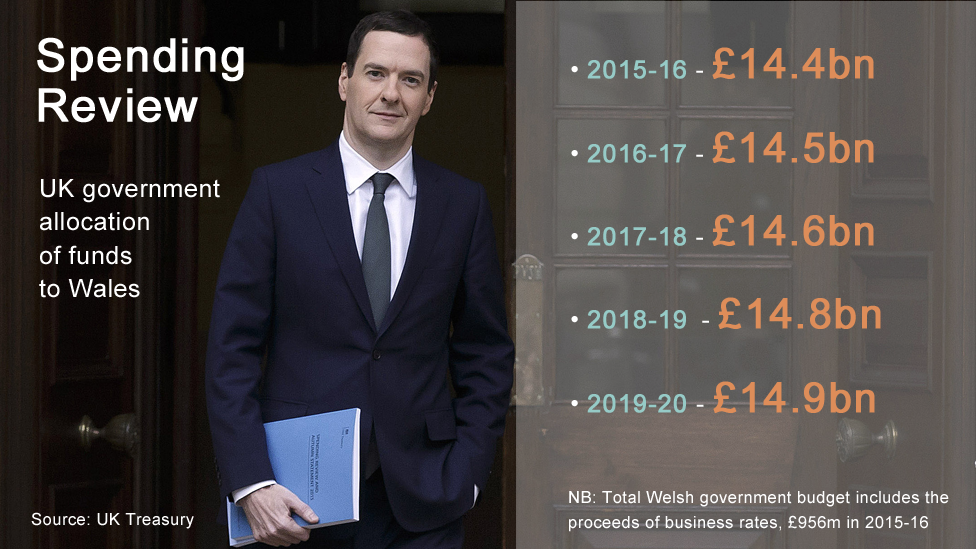

Mr Osborne confirmed that block grants to the Welsh government would rise to just under £15bn by 2019/20.

The Welsh government's total budget for 2015/16 is £15.3bn, including £14.4bn of block grants, plus around £950m from the proceeds of business rates.

The chancellor said he would also help fund a "city deal" backing infrastructure projects for Cardiff and the surrounding areas, to which the Welsh government and local authorities have already pledged £580m.

S4C is set to see the money it receives from the Department for Culture, Media and Sport cut from £6.7m to £5m by 2019.

While this represents 10% of its funding, - the rest comes through the licence fee - chairman of the S4C Authority Huw Jones called the reduction "disappointing".

Labour Welsh Finance Minister Jane Hutt described it as "another smoke and mirrors" Spending Review.

"The reality looks like an overall real terms cut to our budget," she said, predicting it would fall by 3.6% between 2015/16 and 2019/20.

Ms Hutt added that there was "nothing to relieve the ongoing and significant pressures on public services in Wales"'.

Welsh Secretary Stephen Crabb hailed it as a "landmark" settlement for Wales.

"By removing the need for a referendum on income tax, the Welsh Assembly will finally take its place alongside other mature legislatures by being accountable to the people it serves," he said.

Although First Minister Carwyn Jones told BBC Wales he was in favour of devolving some income tax powers "in principle", the Welsh government needed more details on the plans and timescale involved, he said.

Mr Jones said Mr Osborne's minimum funding pledge for Wales, the so called "funding floor", offered no long term guarantees.

"One of the problems we have, of course, is that the UK government has said we will put a funding floor in place, to keep Welsh funding at a constant level, but only for the length of this Parliament," he said.

"That's not a permanent solution - we need to have full reform of the Barnett formula to see that."

Plaid Cymru MP Jonathan Edwards welcomed the tax changes, saying: "A referendum would have been a complete waste of time and resources, and we are pleased that the UK government has finally seen sense on this matter."

Welsh Lib Dem leader Kirsty Williams also welcomed the dropping of the referendum requirement, saying: "Tax varying powers will bring much-needed accountability to Wales' political system.

"For too long, successive Welsh Governments have been able to spend money without having the responsibility for raising it."

However, UKIP Wales leader Nathan Gill said: "It's frankly outrageous that Osborne has opened the door to devolve tax raising powers to Wales without a referendum for the people."

Rachel Banner from True Wales, the group which campaigned against further devolution in the 2011 referendum, claimed that introducing income tax powers for Wales without a referendum was "illegitimate and brings the devolution settlement into disrepute".

'A clown'

Meanwhile, shadow chancellor John McDonnell was branded "a clown" by a Welsh party colleague.

Alun Davies, the AM for Blaenau Gwent, said John McDonnell was "out of his depth" on Twitter.

He made the claim after Mr McDonnell produced Mao Zedong's Little Red Book in the House of Commons while saying Mr Osborne was selling off £5b worth of UK assets, in particular to China.

Mr Davies tweeted, external: "McDonnell is a clown. Way out of his depth.

"We needed leadership, strength and substance today. We got Mao".

Mr McDonnell said the reference was "a bit of a joke".

Analysis by Sarah Dickins, BBC Wales economics correspondent

For the 238,000 families in Wales on tax credits, there may be relief that the chancellor has walked away from bringing in the tax credits he proposed in the Summer Budget but it is in effect just a delay. The savings will still be made and will be factored into Universal Credit when it is fully rolled out across the UK. At the moment it is in all but three local authorities in Wales, not Cardiff, RCT nor the Vale of Glamorgan, but not all areas within those authorities.

The decision by the chancellor that Wales will have the powers to raise and vary income tax are part of his policies of bringing decision making about economic development closer to home. For example, in England local authorities will be financed by council tax and business rates rather than grants.

But Scotland has had powers to raise or lower income tax by 1p in the pound for many years and not used them. In Wales there are very few people, only 4,000 in 2014/15, paying higher rate tax of 45%. The vast majority pay basic rate tax and a 1p increase or decrease is estimated to only raise an extra £180m on 2012 estimates. A Welsh government that raised income tax by 1p would have to decide whether that was worth the potential political pain.

The ten local authorities behind the Cardiff City Deal, a request for around £500m from the Treasury as part of a £1.2 billion project, will be pleased that the chancellor confirmed support in principle. The team behind the City Deal now have to develop detailed plans for projects, involving the public and private sectors, that will make the economy of south-east Wales stronger. That may not be as straight forward as it seems.

- Published25 November 2015

- Published25 November 2015

- Published12 November 2015

- Published4 November 2015

- Published24 November 2015

- Published22 November 2015

- Published21 July 2015

- Published8 July 2015

- Published10 April 2015