Council elections 2017: What is your council tax rate?

- Published

Voters will go to the polls on Thursday to determine who will represent them on local councils.

But once the votes are counted, what can residents expect to pay in council tax?

Below are the figures for a Band D property for every council area in Wales for the current financial year of 2017/18, how much that has gone up by for the current year, and what the average property in the area actually pays.

They are grouped here by police force region - council tax includes the police precept which is added to the overall bill paid by homes.

Gwent

Dyfed-Powys

North Wales

South Wales

How are councils funded?

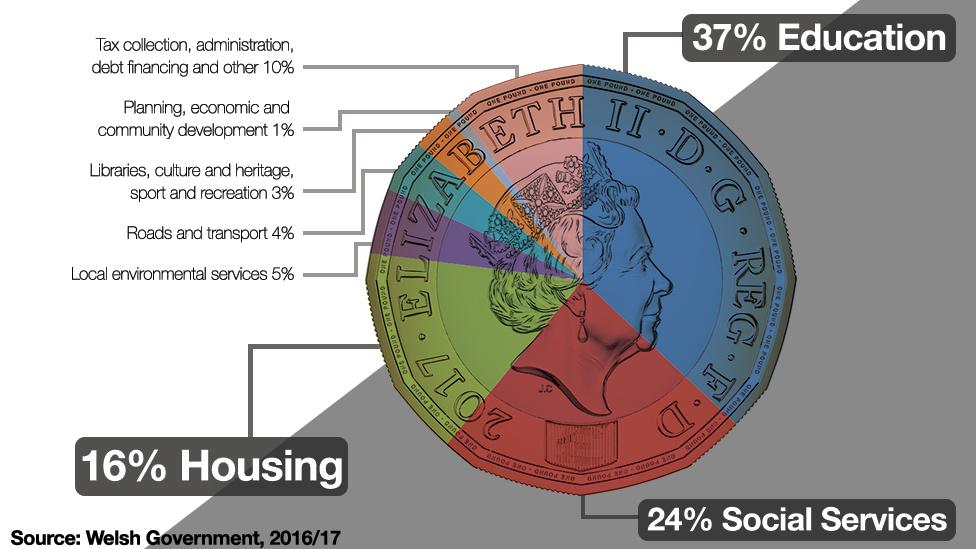

How £1 in council spending breaks down

Local government is not fully funded by council tax.

Much of the funding for councils comes in the form of grants from the Welsh Government, which in turn gets its funding from the UK government in London.

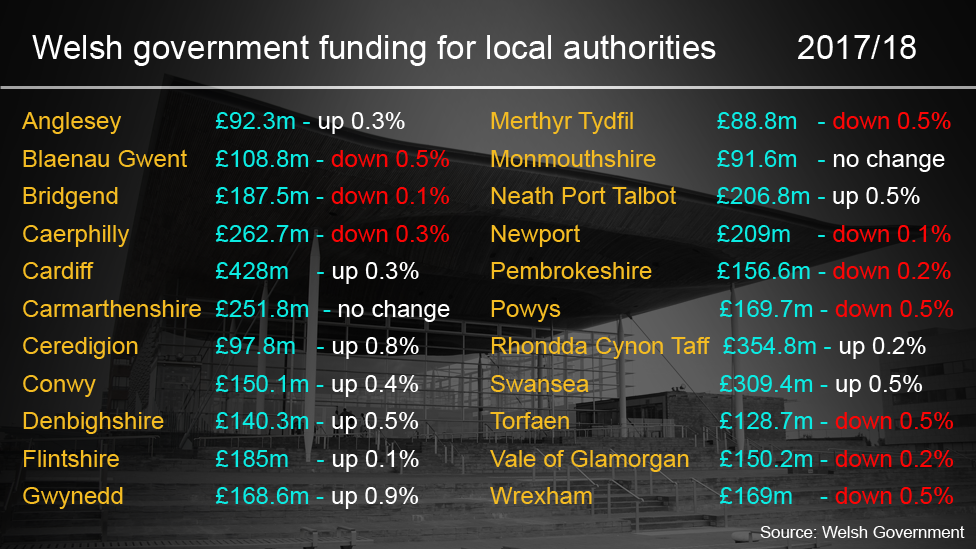

In 2017/18 a total of £4.1bn is being divided among Wales' 22 councils.

The lions share of council cash goes on schools - with social services following behind, as shown in the graph above.

Residents pay council tax based on which band their property is in, based on its worth. Band D has historically been used as the standard for comparing council tax levels between and across local authorities.

It is used to charge tax to a property that, in Wales, was worth between £91,001 to £123,000 on April 2003 values. Council tax gets lower the cheaper a property is, and higher the more expensive a property is.

Council tax figures source, external: Welsh Government

- Published23 March 2017

- Published9 April 2017