Council tax: Wales could revalue homes for first time since 2003

- Published

A stallholder said a rise in council tax would be 'disappointing'

Households in Wales could change their council tax bands as part of a proposed Welsh government shake up.

Ministers are considering the first revaluation of residential properties since 2003.

A consultation will take place next year. At the last revaluation a third of households, external saw their bills rise.

Ministers say they want to make the tax fairer, but the Conservatives said the Welsh government should protect families from higher bills.

The Welsh government said the revaluation does not necessarily mean tax bills will rise.

The move is part of the Welsh Labour government's deal with Plaid Cymru, which was signed last week.

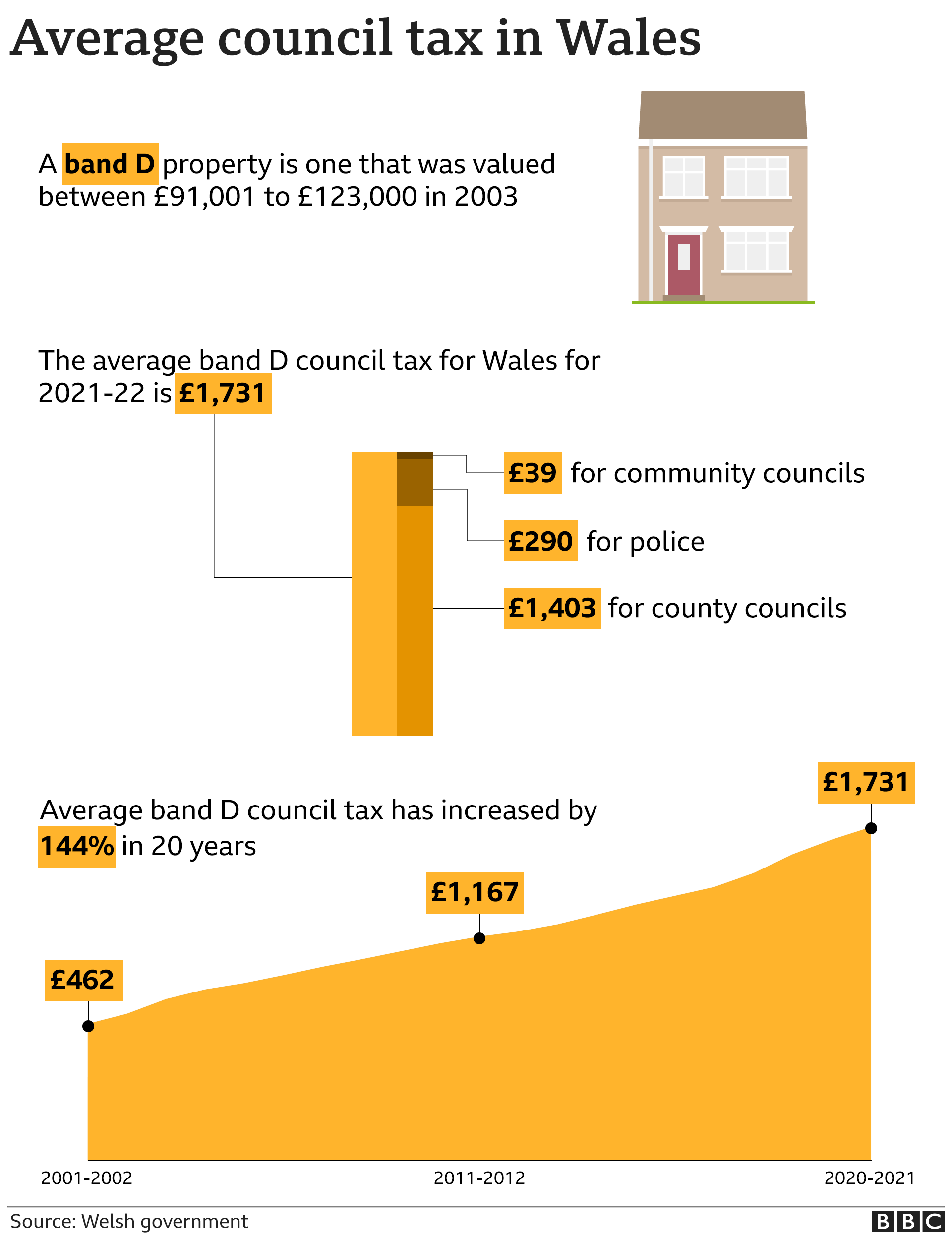

How much is council tax at the moment?

The amount of council tax you pay depends on the value of your home, however the last time Welsh homes were valued was 18 years ago.

Homes are graded into a bands from A to I, homes in band A - valued at less than £44,000 - pay the least council tax, and homes in band I - valued at more than £424,000 - pay the most.

There are more homes in band C in Wales (valued from £65,001 - £91,000) than any other band, with residents on average paying £1,538 a year in council tax.

Critics say council tax is out of date because it's based on old property values, and does not fairly tax people on lower incomes.

A think tank has called for a revaluation but says reform could go further to fix the system - the consultation holds open the option of more fundamental changes beyond the current Senedd term, which ends in 2026.

Council tax is used to partly fund local government run services, with the Welsh government also providing cash.

The revaluation exercise, officials say, could include new bands added to the top or bottom ends of the scale to better reflect household wealth and people's ability to pay.

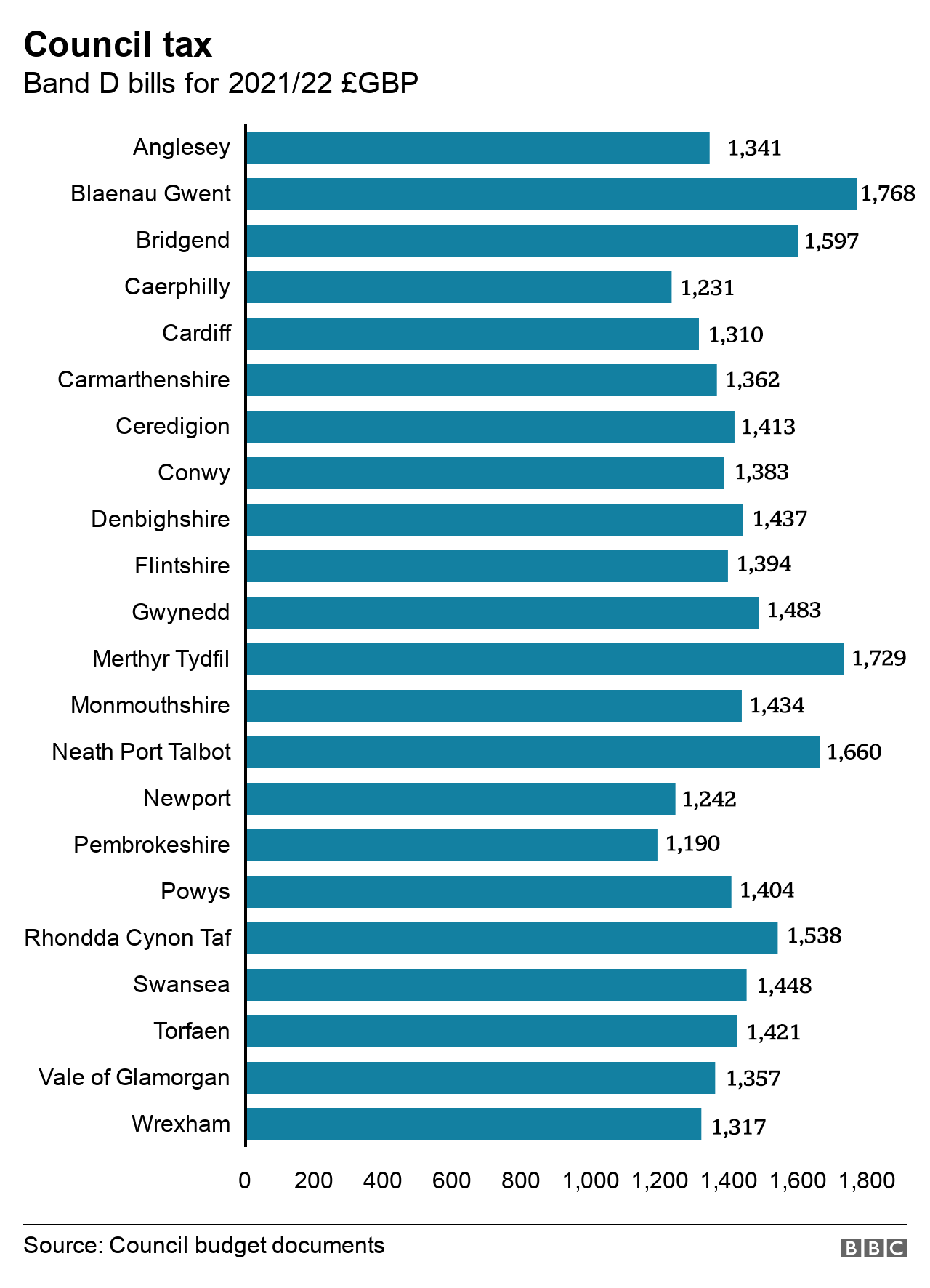

How much council tax you pay is determined by the band your house is in

Ministers want future revaluations to happen more frequently, and officials say increased house prices will not necessarily result in individuals paying more council tax.

It is one of a number of measures ministers are looking at - including a review of Wales' council tax benefit system, and a review of discounts, exemptions and premiums.

When the last revaluation took place, one in every three households in Wales saw their homes go up a council tax band - the classification that determines how much council tax a household pays - while 8% went down a band.

There has been no revaluation since, although it remains the most recent such exercise in Great Britain, with Scotland and England still using house values from 1991.

Properties in the same band pay different amounts depending on the local authority

A Welsh government-commissioned study, external by the Institute of Fiscal Studies (IFS) called council tax "out of date, regressive and distortionary", with properties in "increasingly arbitrary tax bands that may bear little relation to current reality".

It called for the tax to be both revalued and reformed, saying revaluation alone would have "little effect on the average tax bills of different household types", instead calling for a system where residents pay a tax pegged to the estimated value of a property, rather than a band.

The study said that could see 21% of households in the bottom fifth of incomes see their tax bill fall by £200 a year, while 3% would see it increase by more than £200.

David Phillips, of the IFS, said the revaluation was "good news" and it was welcome that there was more wide ranging reform planned in the long run.

"People may worry the big increases in property prices over the last two decades mean revaluation would lead to a big rise in average council tax bills," he said. "But it wouldn't."

"Average bills across Wales could easily be capped, like when business properties are revalued."

Mark Drakeford and Adam Price signed their co-operation deal last week

In an interview with BBC Politics Wales, First Minister Mark Drakeford said he was attracted to land value taxation "as a fairer and better way of dealing with the way in which we pay for local services".

Such a system would see people pay council tax according to the value of the land they own, rather than the property built on it.

He said it could take a decade to move to such a system, but added Plaid and Labour ministers had "jointly committed to not allowing the unfairness of the current system to continue".

Rebecca Evans, Minister for Finance and Local Government, said: "We want to modernise the council tax system and make it fairer. We want to make council tax more progressive in its design and delivery."

Sian Gwenllian, Plaid Cymru's lead designated member working with the Welsh government, added: "We have long argued that the current system disproportionately impacts poorer areas and change is long overdue.

"We look forward to developing a fairer and more progressive system as we put our co-operation agreement with the Welsh government into action."

'Scope' for fairer system

But the Welsh Conservatives' local government spokesman Sam Rowlands said: "The last time a revaluation took place in Wales one in three families were hammered by higher bills - and as we recover from the challenges of the pandemic that simply can't happen again.

"Labour and their coalition buddies in Plaid should use some of the extra billions in funding from the UK government to properly fund local authorities and ensure families are not unjustifiably hit by higher council tax bills in the years to come."

However his party colleague, Monmouth MS Peter Fox, told the Senedd that the current system is "not a particularly good tax" and there was "scope" for a fairer system, citing the scale of council tax debt.

"I think we have to take a very cautious approach when we reform council tax in Wales that we don't actually disadvantage a whole swathe of people," he said.

Welsh Local Government Association finance spokesman Anthony Hunt said: "The announcement by the Welsh government today is welcomed and we support these initial steps being made to reform council tax and make it fairer.

"Council tax forms a large proportion of funding for local services, and funds large services like education and social care right down to smaller, but vital, services like environmental health and trading standards."

WHAT'S THE BIG IDEA?: Food for the mind, and inspiration for the soul

THE ASIAN WELSH: How immigration from the Indian subcontinent transformed Welsh health, culture and the economy

Related topics

- Published7 December 2021

- Published11 March 2021

- Published27 April 2021

- Published19 September 2021