Land transaction tax: Threshold for Welsh version of stamp duty to rise

- Published

People buying houses worth up to £225,000 will not have to pay any tax, the Welsh government has announced.

Finance Minister Rebecca Evans raised the threshold on the Welsh version of stamp duty following last week's UK mini budget.

But the Welsh government said there will be a "small increase" in the rate of Land Transaction Tax (LTT) for homes that cost more than £345,000.

Stamp duty changes in England triggered extra Welsh funding of £70m last week.

The Tories called for more help for first time buyers, while Plaid Cymru said the Welsh government should keep the base rate of income tax at 20% in Wales, when it is due to fall to 19% next April.

Ms Evans said: "This is a change tailored to the unique needs of the housing market in Wales and contributes to our wider vision of a fairer tax system.

"61% of homebuyers will not pay tax on their purchase."

She added: "These changes will get support to people who need it and help with the impact of rising interest rates."

The new rate comes into effect from 10 October, and follows changes in England in the mini-budget that saw stamp duty thresholds rise from £125,000 to £250,000.

Unlike England, Wales has no special threshold for first-time buyers. Ms Evans did not introduce one in her statement on Tuesday.

The average price of a house in July in Wales was £240,6351, according to the Principality Building Society - a rise of 11.5% in the second quarter of 2022.

What are the new rates?

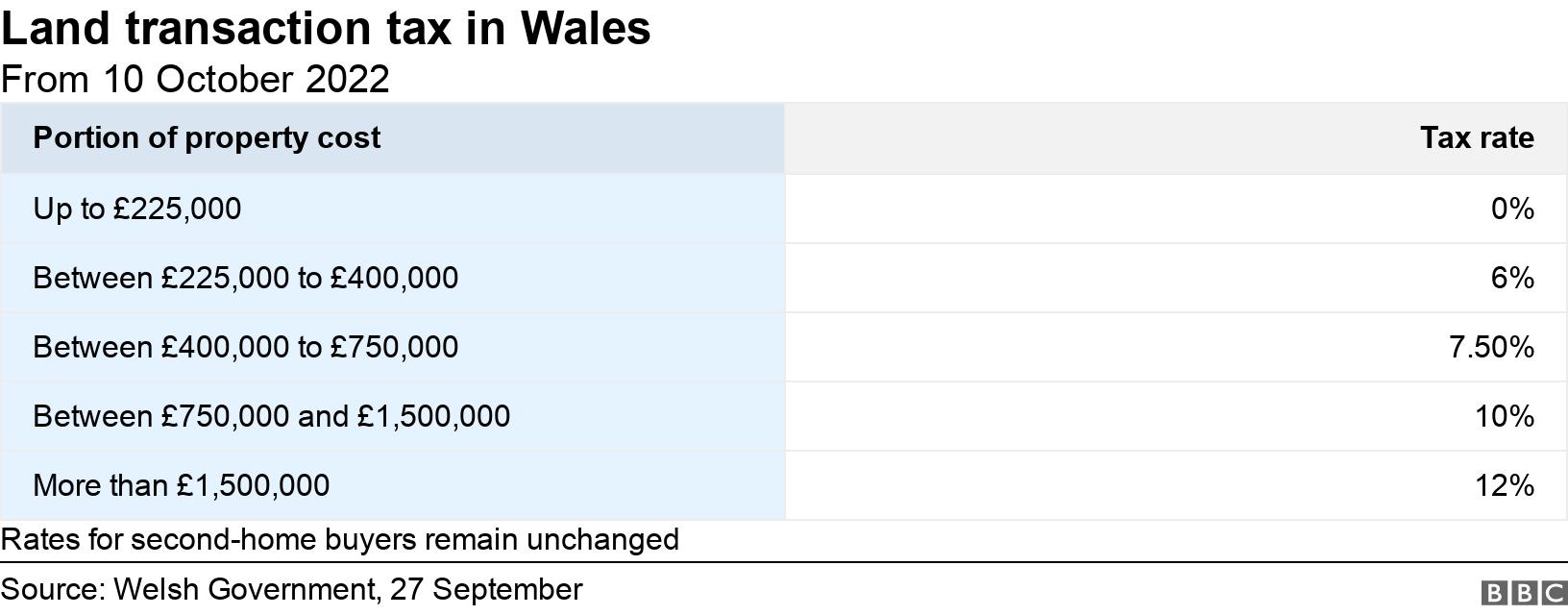

Under the new rates, house buyers will pay six per cent tax between £225,000 and £400,000.

Previously the rate was 3.5% between £180,000 and £250,000, and 5% between £250,000 and £400,000.

Despite the rise in the rate the Welsh government said the change in the threshold meant that anyone buying a home costing less than £345,000 will see a reduction in the tax they pay, up to a maximum of £1,575.

People buying homes worth more than £345,000 will see an increase - up to £550. Ministers said these represent around 15% of property transactions in Wales.

LTT is paid on a portion of the house purchase that falls within the bands, rather than the entire cost.

Other rates remain unchanged. Between £400,000 and £750,000 the rate is 7.5%, while between £750,000 and £1,500,000 it is 10%.

Purchases over £1,500,000 will pay 12%.

Why has the Welsh government done it?

Ms Evans made the announcement in a statement in the Senedd where she criticised last week's mini-budget.

She said the budget was "divisive" and failed to provide "meaningful support to the vulnerable households impacted by the cost of living crisis".

The fall in the value of the pound show the markets do not believe the UK government can deliver on economic growth, she said, adding comments by the chancellor on further tax cuts and reducing debt as a share of GDP "implies that we will likely see huge spending cuts".

Ms Evans said she was already considering changes to LTT and wanted to announce them but was "concerned that the level of expectation of changes will lead to considerable uncertainty in our housing market".

WALES' HOME OF THE YEAR: Which home will Owain, Mandy and Glen judge worthy?

SEARCHING FOR MY OTHER MAM: Gerallt searches for the father and mother he never knew

What is the political reaction?

Conservative finance spokesman Peter Fox said the mini-budget was "about boosting the supply side performance our economy by reducing the tax burden on businesses".

He welcomed the announcement on land transaction tax, but said the Welsh government should have gone further to help families "aspiring to buy their first home".

One of the decisions in the mini-budget was to bring forward a planned cut to the base rate of income tax to 19% to April.

Plaid Cymru's Llyr Gruffydd called for the Welsh government to use its income tax powers and keep the base rate at 20%.

"Doing this would offer an additional £200m a year to the Welsh Government's budget which can be used directly to help ease the pressure of the cost-of-living crisis, protect public services and shield the vulnerable from Tory cruelty," he said.

A Welsh government spokesman said in response to the Plaid comment: "We are carefully analysing the impact of the UK government's financial statement on our budget.

"Decisions about Welsh rates of income tax will be taken as part of the normal annual Welsh budget process."

Raising the Land Transaction Tax threshold and taking most house sales out of that bracket will help those on low incomes and first time buyers. In fact, it will assist anyone buying a home that costs less than £225,000.

But according to mortgage brokers what is particularly worrying homeowners is the rate at which interest rates are rising.

They have been inundated by questions from people concerned about what their mortgage may cost them over the next few months.

The Welsh government cannot do anything to impact interest rates, which are predicted to rise to almost 6% by April, but with this they do put some money into tight household budgets.

Related topics

- Published27 September 2022

- Published30 June 2021

- Published23 September 2022

- Published2 April