African migration: Is the CFA franc forcing people to leave?

- Published

Luigi Di Maio, Italian deputy prime minister and leader of the populist Five Star Movement, has blamed France for impoverishing Africa and encouraging migration to Europe.

He accused the French government of manipulating the economies of mainly former French colonies in Africa, which use a form of the pre-independence currency known as a CFA franc.

"France is one of those countries that by printing money for 14 African states prevents their economic development and contributes to the fact that the refugees leave and then die in the sea or arrive on our coasts," said Mr Di Maio.

So what is the CFA franc and does it harm African countries?

Where is the CFA used?

The CFA is in fact split into two separate currency zones dating back to 1945.

Eight countries make up the West African Economic and Monetary Union and a further six are in the Central African Economic and Monetary Community.

Since 1999, the CFA franc (in both zones) has been pegged to the euro, with the financial backing of the French treasury.

The money itself, as Mr Di Maio correctly says, is printed by France - but the quantity is decided by the central banks of the two zones.

A French official sits on the boards of both central banks, which suggests France retains at least some influence over the decision making process.

Participation in the currency is voluntary.

But critics of the CFA point to preferential French access to African resources, granted as part of the setting up of the currency arrangement.

"France agreed to grant independence to its sub-Saharan Africa colonies," says Senegalese economist Ndongo Samba Sylla, "provided they accept to use the CFA franc and [France retained] a monopoly on their raw materials."

And French companies today still have a strong presence in the CFA currency zones.

Is it driving migration?

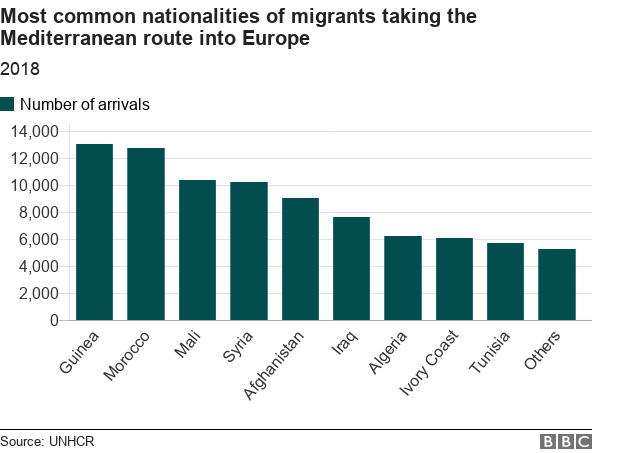

Most Mediterranean migration doesn't come from the 14 countries that use the CFA franc, 12 of which are former French colonies.

In 2018, Guinea was the largest country of origin, followed by Morocco - both former French colonies that don't use the CFA franc.

The Ivory Coast and Mali are the only countries of origin using the CFA franc that have contributed significantly to migration across the Mediterranean, accounting for 14.4% of the total last year.

Both these countries have experienced political unrest in recent years.

What does France do with African money?

The use of the CFA franc is highly controversial, with some saying it comes with a "French colonial tax".

But France doesn't tax African countries for using the currency.

It does, however, require countries to store 50% of all foreign exchange reserves with the French treasury, in the Bank of France, in something called an "operational account".

African countries can access the money in the French treasury when they like.

Activists in Africa have called for the CFA franc to be abandoned

Mr Di Maio said France was using this system to finance French public debt.

But a French treasury official told BBC News the deposits of the central banks of West Africa and Central Africa were not being used to buy or pay off French debt.

African countries receive interest on their reserves of 0.75%.

But when inflation in the eurozone is higher than this, this is a poor return.

The reasons for keeping CFA reserves in France relate in part to relationships between African nations when the CFA was established.

"The problem was that there was a lot of mistrust among the African countries," says Jean-Paul Fitoussi, an economist at the French Economic Observatory, "so they decided to put [the reserves] into the Bank of France," for safekeeping.

In December 2017, the central banks of West Africa and Central Africa had €5bn (£4.3bn) and €3.9bn in the French treasury, respectively.

This is a small amount compared with total French public debt, which stood at about €2.2trillion in 2017.

Does it keep CFA countries poor?

Many of the concerns about the CFA franc relate to how it limits the economic levers African countries can use - that they can't set their own interest rates, for instance.

The system is designed to make it easier to obtain international currencies needed for trade.

And the reserves are also guaranteed by the French central bank - although this facility is rarely called upon.

But it's difficult to say whether the arrangement between the 14 countries and France has had a detrimental impact on their respective economies.

It's clear though that the CFA franc divides opinion and there is a movement of people who would agree with the claims of the Italian politician.

Critics point to the fact that the CFA franc countries are poor, call the currency a relic of French colonialism and say it fails "to stimulate trade integration between user nations", writes, external the Senegalese economist Ndongo Samba Sylla.

But there are economic benefits of a stable and easily convertible currency, says John Ashbourne, senior emerging markets analyst at Capital Economics.

"Inflation, for instance, has tended to be much milder in the CFA countries than elsewhere in Africa."

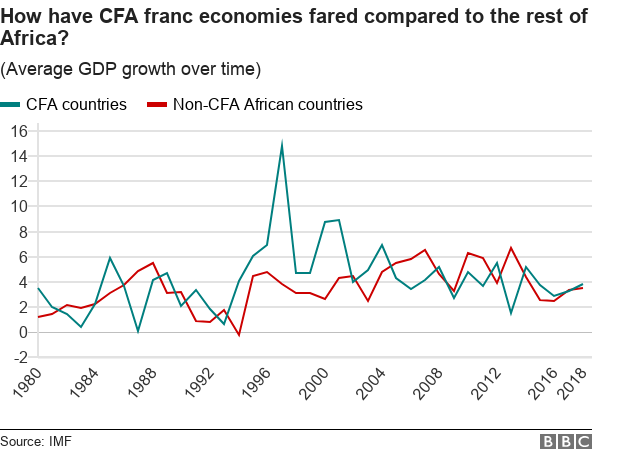

Mr Ashbourne adds that there isn't much evidence that CFA countries have underperformed compared with the rest of Africa.

Average GDP growth - the rise in the total value of goods and services produced - of CFA countries and the rest of African economies is, indeed, fairly comparable over the past few decades but that could be due to a range of factors not just the currency.