Why motorbike apps are scrambling for Africa

- Published

In our series of letters from African writers, Zimbabwean Andile Masuku looks at why venture capitalists are getting excited by motorbike taxis.

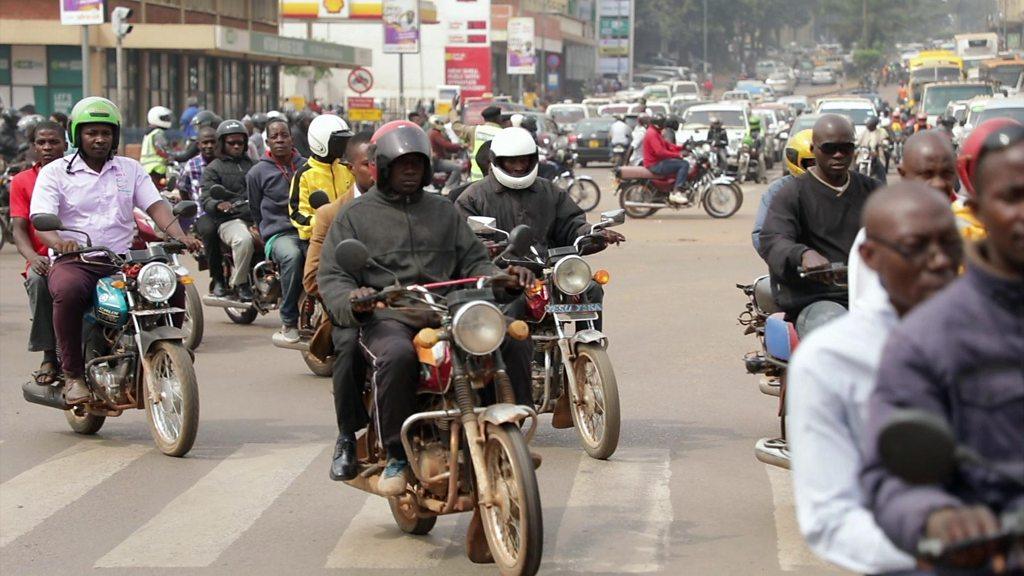

Traffic jams are the great waster of time across Africa.

Having had the pleasure of hopping on the back of a motorcycle taxi in Rwanda's capital, Kigali, I can attest to the appeal of a street-smart driver zipping me through peak-hour gridlock.

Although illegal in countries like South Africa and Zimbabwe, these taxis are popular across much of East Africa, where they are known as "boda bodas", "moto-taxis", or simply "motos", and in parts of West Africa, they are called "okadas". Young men with no jobs got the industry going - and now provide a service to millions of people.

It is hoped that the Uber-isation of the industry will make it safer

They have their fair share of detractors on the continent though, with complaints about dangerous driving.

In Ghana, a debate is raging about whether to ban them, external, yet when the Rwandan government did so a few years ago, it famously back-tracked on the decision after the streets of Kigali ground to a near halt, external.

Rwanda is now encouraging start-ups to take up the challenge of helping the government regulate an industry in which most riders are self-employed.

Making motorbike taxis in Uganda safer

As older motorcycle ridesharing brands like SafeMoto and YegoMoto intensify efforts to become household names in Rwanda, a firm called SafiRide, founded by US graduates, has launched electric motorbike taxis - promising not only to vet their drivers but also to cut down on pollution. Their e-motorbikes can be hailed by roadsides or via an app in five Rwandan cities.

Some estimates suggest sub-Saharan Africa's motorbike taxi market could be worth around $80bn (£62bn), external, and investors are keenly backing start-ups committed to advancing "Uber-isation" within the sector.

A case in point is Nigerian ride-hailing start-up MAX.ng, co-founded by Adetayo Bamiduro and Chinedu Azodoh, alumni of the MIT Sloan School of Management.

It recently raised $6m from equity investors and $1m in grants to build up its operations in Africa.

You may also be interested in:

That is not a lot of money by Silicon Valley standards, but it is significant given how, relative to start-ups based in comparatively-sized markets in other parts of the developing world, African tech ventures typically struggle to attract investors.

In June, MAX.ng, which currently operates in Lagos, also secured the participation of Yamaha, external.

The Japanese motorcycle manufacturer had already invested $150m in the Singapore-based transport company Grab last year.

The MAX.ng deal represents Yamaha's second strategic move to back a ride-hailing firm serving emerging markets.

Race to build Africa's super app

Nigerian Osarumen Osamuyi, a former venture capitalist and a frequent motorbike taxi user who lives between Nairobi and Lagos, agrees that there is great potential in Africa.

He recalls passing up the opportunity to invest in a promising motorbike taxi start-up while working for a venture capital firm a couple of years ago - it went on to raise a sizable investment sum at an attractive valuation.

It is becoming a crowded field as more motorbike taxi apps open

Mr Osamuyi, now an industry analyst, is not bitter - and is more circumspect about the long-term value of backing a business vying for prominence in a crowded field, external.

He says that what we are witnessing on the continent is a race to establish the most ubiquitous super-app, boasting the largest network of active users.

Essentially, it's another scramble for Africa as tech investors place their bets on who they think might build the continent's ultimate digital platform.

They plan to monetise their networks of users by selling them useful services like identity verification, as well as financial services"

Firms like MAX.ng, Gokada and SafeBoda are seeking to emulate the success of Grab and Go-Jek in south-east Asia, external, trying to build up a massive pan-African user network as quickly as markets will allow.

Then, once critical scale is achieved, they plan to monetise their networks of users by selling them useful services like identity verification, as well as financial services such as mobile payments, credit facilities and micro-insurance.

Beyond that, the sky is the limit should they succeed in their mission to build a large, viable network of active users.

Motorbikes are a great way of to avoid wasting hours in traffic jams

At that point, investors could reasonably expect to glean massive commercial gains as start-up teams conceive and package novel, lucrative ways of extracting commercial value via their platforms.

For now though, it's very much a case of "show me the money" as tech start-ups in the motorbike taxi space seek funds to back their bold plans to achieve mass-adoption in Africa.

More Letters from Africa

Follow us on Twitter @BBCAfrica, external, on Facebook at BBC Africa, external or on Instagram at bbcafrica, external

- Published12 March 2019