Will China reform to secure its economy?

- Published

- comments

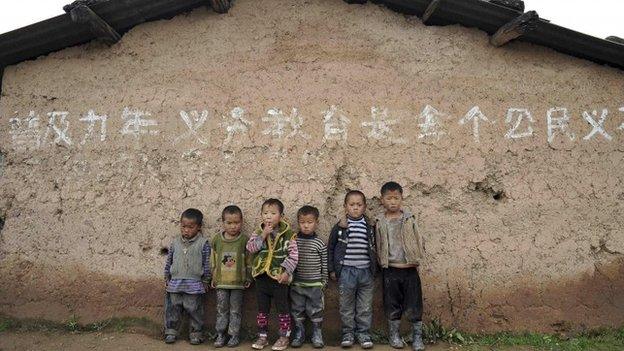

China still has a long way in spreading its wealth more evenly among citizens

As China's Communist Party meets to elevate its new generation of leaders, there's a widespread feeling in Beijing that the past decade, for all the economic success it brought, has been a missed opportunity.

The outgoing leadership has focussed its efforts on growing China's economy. The incoming leadership, many believe, must now focus on important reforms if they're to secure China's economic future.

So one of the major questions facing the next generation is how urgent they believe the need for change really is, and whether they will have the clout to push through reforms.

One view of China today is as a place of soaring superlatives, its economic achievements as impressive as the skyscrapers that now cluster in every major city.

China is now the world's second biggest economy

Thirty years ago, China was one of the poorest countries on the planet. Today it's the world's second biggest economy, its biggest manufacturer, its biggest exporter, its biggest car market, with the biggest foreign exchange reserves of any nation.

To any visitor, China certainly looks impressive - its giant cities, bisected by multi-lane freeways, jammed with expensive foreign cars, its streets lined with global brand names.

The economy is expected to expand by over 7% this year, and the government believes will continue at that pace for several more years to come. So surely China's leaders should be happy, and stick with what's been a successful formula?

But they're not. All the talk in Beijing is of how things must be reformed - urgently - if they're to be sure of another decade of impressive growth.

Idle hands

For all its success, China today is a place where average incomes are still little more than those in Jamaica. It has a long way to go, raising incomes further and spreading wealth more evenly among its people.

China's export industries, for so long a mainstay of the economy, are not contributing to growth the way they used to. Visit the vast manufacturing areas along the coast and in many of the giant factories that churn out China's exports machines stand idle. Consumers in Europe and America just aren't buying.

Wages for factory workers in China are now five times higher than in Vietnam

As one factory boss said to me last month, wages for factory workers in China are now five times higher than in Vietnam, so he's moved all his labour-intensive work out of China. Many others have done the same.

Look a little closer at some of those skyscrapers, and not much work is happening on the building sites. China's leaders have been trying to cool property prices after they spiked upwards and construction, another major part of the economy, slowed sharply recently.

Instead, the government is still pumping money into networks of motorways and high-speed railways. Many are now being built through far-off, poorer regions. At some point, China will find that building more and more infrastructure has its limits.

Visit China's huge, new shopping malls and you find quite a lot of shops are empty, collecting dust. For all the wealth that's been created, spending by China's own citizens accounts for just a third of the economy - that's half the level of Western nations.

Consumer spending is growing at over 10% a year, but needs to keep growing faster than the rest of the economy if it's to become a bigger part of China's economic mix.

That's important because it will make China less dependent on exporting to other countries, and less reliant on those giant government projects.

Free reign?

Meanwhile, all the commanding heights of the economy are controlled by the Communist Party-led state. Giant state-owned banks, telecoms companies and electricity firms and many more enjoy massive and lucrative monopolies.

Can Chinese leaders reform banking so ordinary people can invest?

They suck-up wealth and capital which would otherwise go to more dynamic, private businesses.

So will China's incoming Communist leaders break up the huge state-owned enterprises? Will they reform China's financial system so loans flow to businesses that are most likely to make money, not just those with political clout?

Will they free up the banks so ordinary people have more places where they can invest their money and can earn a decent return on their savings?

Will they expand the current low level of pensions and health insurance so people enjoy genuine security and are inclined to spend more? Will they open up to increased foreign competition?

Will they, in short, limit the role of the state?

The trouble is that the Communist Party itself, and many of its most powerful figures and their families, profit personally from the wealth and privileges that flow from controlling so much of the economy.

Relaxing the party's grip may make economic growth more sustainable, but may also be resisted by some of the party's most important vested interests.

The talk is all about how urgent reforms are. The test of the new leadership will be whether they have the clout to push reforms through, or whether they will be hobbled by the party they lead.

- Published15 November 2012

- Published8 November 2012

- Published16 October 2012