China's 'new normal' - a bit too much like the old normal

- Published

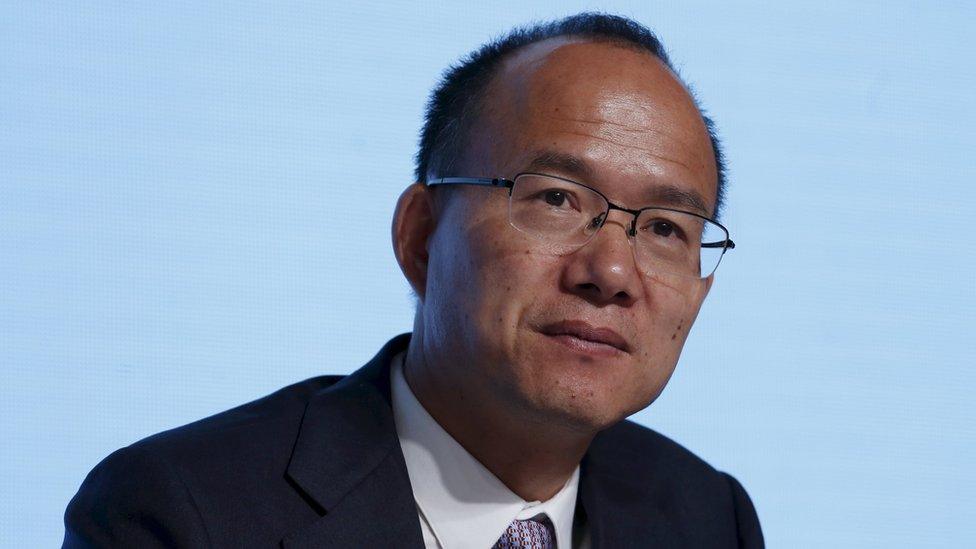

Xu Ming, seen here in 2002, was once a business ally of disgraced Chinese politician Bo Xilai

The ashes were delivered within two days of the death. No autopsy for the 44-year-old tycoon whose flamboyant career had culminated in a spectacular political scandal and corruption trial.

But Xu Ming was due for release within months and he had recently told friends he was in excellent condition. So when the man who knew so much about the murky connections between China's political and business elite suddenly died of a reported heart attack on a prison toilet, rumours swirled.

News of his death was suppressed in official media. But on social media, another billionaire commented.

"In the eyes of a government official, we are nothing but a cockroach. If he wants to kill you, he can; if he wants to keep you alive, he can."

2015 was a year in which many of China's high profile businesspeople might have agreed that they enjoyed the trappings of power and wealth only at the whim of the authorities.

"Why would the government want to target me?… I believe in the future of China. I believe in the Party's reform policy."

With even "China's Warren Buffet" caught up in investigations, there is a nervous mood among investors

So pleaded Guo Guangchang, the self styled Warren Buffet of China. But displays of loyalty and patriotism were not enough to protect the chairman of Fosun Group from disappearing for a humiliating weekend of police questioning.

As the year drew to an end, the underlying mood among the super rich was one of unease and insecurity.

It is not new for China's anti-corruption campaign to net top business people. Many fortunes have been made in ways that would not bear close scrutiny.

But in the aftermath of the summer's stock market meltdown, the hunt for villains has become intense, targeting many of the financial sector's biggest investment bankers, brokers and even regulators.

Without transparency or clear rules it is hard to see how this can amount to more than a witch hunt. The stock markets themselves have not been fixed.

And if China's economy is going to change into the much-vaunted "new normal", it desperately needs to encourage private enterprise, rather than scare off those cunning and mobile enough to export their capital abroad.

It has been a tough year all round for the new normal. The slogan is shorthand for the government's plan to shift from high speed growth, driven by exports and infrastructure investment, to slower, cleaner growth powered by domestic consumption.

Infrastructure development has underpinned much of China's growth to date

"We don't have a lot of time left and the only way forward is reform."

So said China's Finance Minister Lou Jiwei in a controversial speech in the first half of the year. A torrent of deteriorating data in the second half soon underlined his point.

It was clear that the only way China could reach its 7% growth target without resorting to old style stimulus was for consumption to surge, and it was equally clear that consumption was not surging.

Underlining the point, as the year drew to a close, Beijing's technocrats were also accused of massaging the figures to hide the shortfall.

It was not all bad news though: they had negotiated RMB inclusion in the basket of IMF Special Drawing Rights currencies, launched a regional infrastructure bank almost every key country wanted to join, and - however messy the stock market debacle - had avoided a full-scale financial crisis triggered by the underlying debt mountain.

But none of that could disguise the failure to move on essential structural reforms.

The only way is up? When the stock market slid, the authorities arrested financiers

High speed ageing and a massive debt headache are catching up with China's growth miracle. Its slowdown is real and irreversible, and the only question now is whether structural reforms can release enough growth potential to cushion the blow and help the country avoid what economists call the "middle income trap".

This fate, where a country gets to a certain income level and then stops growing, is China's current fear.

So reform is crucial, but a 2015 survey by business news group Caixin reported that only one in five of promised reforms were on target.

At the start of the year, piecemeal financial sector reforms were in prospect, but stock market meltdown, capital flight and bungled currency depreciation did not help. Nor did the sense that different agencies in government and the Communist Party were in conflict.

No economy has achieved high income status with a closed financial system and many observers argue that if China is to stop mispricing and misallocating capital, it needs to expose its financial sector to real competition. But this involves real economic risk, and that means political risk.

The government probably still has what it takes to bail out the financial sector in a property-related debt crisis. But its challenge in 2016 will be to stop debt accumulating and to tackle the underlying debt mountain. Financial risk again, political risk again.

The challenges come after decades of breakneck growth

The other huge and related challenge is the state sector.

Beijing did announce a reform plan for state-owned enterprises (SOEs) in 2015, but even charitable critics condemned it as too little, too late for a sector which has become an unaffordable drag on the economy.

From debt to jobs, there are not many of China's economic problems which can be tackled without dismantling more state-owned enterprises. It is not the private economy which is mired in debt after all.

The private sector is creating wealth - its firms now account for almost every new job created in the country. E-commerce alone shows what can be achieved when the state gets out of the way, with innovations in online payment, and mobile apps for every conceivable retail service.

But on SOEs, the government's economic and political objectives are in conflict. Yes, it wants markets because they improve economic performance, but it also wants intervention and state ownership, so that it can control certain outcomes.

The economic historians say that when countries get stuck in the middle income trap it's because obsolete policies can't be changed because they still benefit the rich and powerful. Turkeys rarely vote for Christmas and Communist Party bosses find it hard to dismantle the institutions which underpin their power.

- Published8 May 2015

- Published27 September 2015

- Published24 September 2015

- Published9 November 2015

- Published21 January 2016