India budget to boost investment

- Published

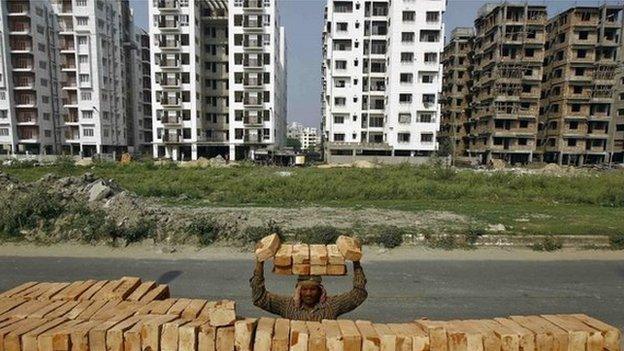

Finance Minister Arun Jaitley has increased spending on infrastructure

Indian PM Narendra Modi's government has unveiled a business-friendly budget aimed at attracting greater investment for the economy.

Finance Minister Arun Jaitley announced an unprecedented corporate tax cut, in the government's first full budget.

But he also proposed major benefits for the poor, introducing a universal social security scheme.

India will grow at a rate of more than 8% during 2015-16, a key economic report said ahead of the budget.

The growth forecast follows the country's new way of calculating GDP which has caused some confusion.

Presenting the budget in parliament Mr Jaitley said the country was growing at a strong rate, inflation was down and foreign exchange reserves were high.

Kiran Mazumder-Shaw: "I can't fault the budget but I want to see how it translates on the ground"

"We inherited a sentiment of doom and gloom. The investment community had almost written us off. We have come a long way since then," he said.

"We have turned around the economy, dramatically restoring macroeconomic stability and creating the conditions for sustainable poverty elimination, job creation, durable double digit economic growth."

Among the major announcements made by Mr Jaitley are:

Five "ultra mega" power projects of 4,000 megawatts (MW) will be built to ease the energy crisis

Spending on infrastructure will be raised by $11.3bn (£7.32bn) to boost growth

Creating a "universal social security" that would give poor Indians access to subsidised insurance and pensions

Implementation of a uniform countrywide goods and services tax (GST) by April 2016

Welfare money to be paid directly into people's bank accounts to eliminate corruption and wastage

Wealth tax to be abolished and replaced by a surcharge on the super rich

Corporate tax to be cut by 25% over next four years

Radhika Rao, an economist with DBS in Singapore told Reuters news agency that Saturday's budget was "pragmatic, wide-ranging and inclusive given the emphasis on social safety nets".

Analysts say the government's challenge will be to balance its spending with the need for fiscal restraint.

Mr Jaitley said the government would achieve its goal of cutting the fiscal deficit to 4.1% of gross domestic product (GDP) for 2014-15 from 4.5% the year before.

Budget analysis: Simon Atkinson, Editor, India Business Report

Some had billed this budget as being the most significant since 1991 - which effectively liberalised India's economy.

But Finance Minister Arun Jaitley's closing lines were basically admitting this was a budget lacking "Big Bang" reforms.

The devil will be in the detail as we plough through the small print.

A firm start date for a much-needed goods and services tax, billions of dollars for infrastructure and a "no surprises" lower corporate tax, strike me as the big business announcements.

Not using the low oil price as a chance to make more sweeping cuts to the vast subsidy bill could well prove to be a missed opportunity.

But if the proposals for a universal social security system ever reach fruition - offering a safety net for the hundreds of millions of India's poorest - history will surely judge that as the stand-out announcement of this much-hyped budget.

- Published28 February 2015

- Published27 February 2015

- Published27 February 2015

- Published26 May 2014

- Published9 February 2015

- Published29 August 2014

- Published29 August 2014

- Published18 May 2014