Meet the 'money mules' of India's cash crisis

- Published

This is one of India's many 'money mules'

The Indian government's surprise decision to ban 500 and 1,000 rupee notes in a crackdown on corruption took 86% of money out of circulation in the largely cash economy. But some enterprising Indians are seeing opportunity amid the cash crisis, reports the BBC's Vikas Pandey.

"Are you looking to make your money legal?" a young man says, approaching me as I walk to a bank in Noida, a suburban area of Delhi.

"It's very easy and we can finish our transaction right here, now are you interested?"

Mukesh Kumar, 28, is not standing in the long queue outside the doors to the bank.

He is one among many of India's "money mules" who have found ways to benefit from the cash crunch.

Prime Minister Narendra Modi's surprise announcement has left many people stuck with hoards of now illegal cash, known in India as "black money".

Many are afraid to deposit all their money into the banks, because the government has said that unaccounted for money will attract a 200% tax penalty and an investigation into the source of income.

But people like Mr Kumar are ready to help them.

"The government has said no questions will be asked if my account balance is less than 250,000 rupees (£2,947; $3,664). I can deposit your 'black money' into my account. I will charge 10% and give you back the remaining amount after a few weeks," he tells me earnestly.

Mr Kumar, a construction worker, says he doesn't mind people calling him "a money mule".

"You can call me whatever you want as long as I can make some cash."

'Hire a queue man'

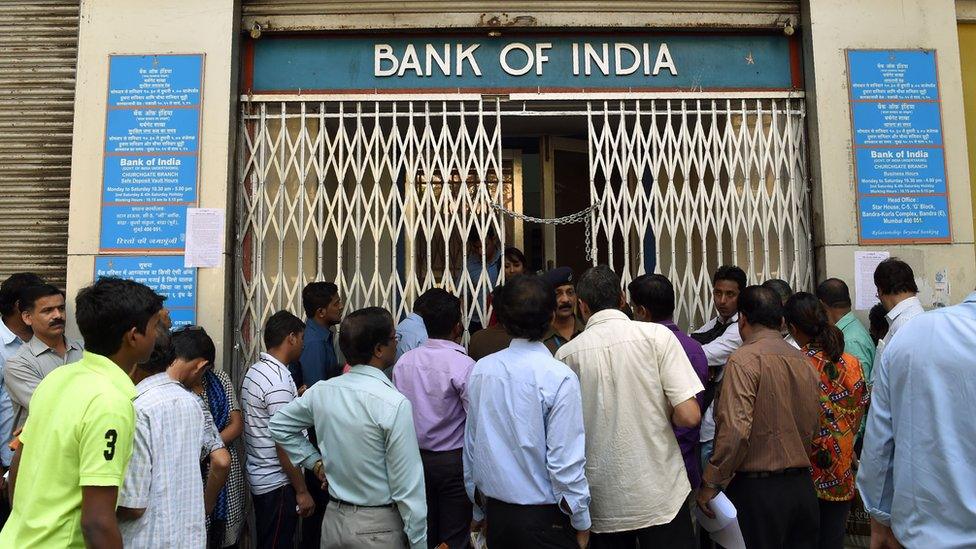

Long queues have become a familiar sight in front of ATMs and banks as people struggle to withdraw money.

Indians have been allowed to exchange a small sum of banned notes into legal tender until 24 November as long as they produce an ID. This amount was reduced from a total of 4,500 rupees to 2,000 rupees on 17 November. Anything above this needs to be credited to a bank account.

I meet more workers in Noida, which has hundreds of construction sites. And they are all looking to cash in on the situation.

Sandeep Sahu tells me he is happy to stand in queues to change banned notes for a commission of 200-300 rupees .

"It's tiring to stand in queues for six to eight hours for somebody else, but then its better than doing backbreaking construction work," he says.

People have been struggling to get cash

Mr Sahu says "rich people don't have the patience to stand in lines" and that is why "they are happy to give us a commission".

"My wife and my son are doing the same job, and together we have made a good amount," he says.

'Rent an account'

At another bank, I meet Pinku Yadav, who says that he has found a "customer to rent his bank account".

"I am going to deposit 200,000 rupees into my account for somebody else for a commission of 20%," he says.

Pointing at his bag, Mr Yadav says that he had never seen such a large amount of money in his entire life.

"I support Prime Minister [Narendra] Modi's decision. It's satisfying to see the troubled faces of rich people."

Mr Sahu's statement is quickly met with loud cheers from others standing in the queue.

I ask him if he knows that what he is doing is illegal.

"Yes, I know and I don't care," he says.

"The government is not going to go after poor people like me. I am just making a small amount, rich people are the ones who are crying because their money has become illegal."

Praveen Kumar says the government needs to improve India's taxing system

It's 12:30 [local time] in the afternoon and queues have only become longer. Some people are eating lunch from boxes they brought with them in the morning.

Praveen Singh works as a production manager in a garment factory, and he is also waiting to deposit 250,000 rupees in his bank account.

"Yes, it's not my money. I am doing this for my boss. He has always been nice to me, and has helped me financially on many occasions," he says.

"I don't see this as a fight between rich and poor people. Given a choice, everybody wants to avoid paying taxes. That's what the government needs to change and encourage people to pay taxes."

*All names have been changed

- Published17 November 2016

- Published14 November 2016

- Published11 November 2016