India budget: Will India buy Narendra Modi's story of hope again?

- Published

Mr Modi (c) has tried to woo voters with this year's budget

With India's general election just months away, the annual budget was all about Prime Minister Narendra Modi trying to resell his 2014 election pledge of hope. The question is will it work, asks economist Vivek Kaul.

Around an hour into his speech, finance minister Piyush Goyal spoke about a recent Bollywood film, Uri: The Surgical Strike. It celebrates the Indian army's strikes in 2016 against suspected militants in Pakistan-administered Kashmir.

He said while watching the film he'd been impressed with the audience's passionate reaction, reportedly inspired by the movie's overt nationalism. If there was any doubt this was an election-minded budget, it was put to rest by Mr Goyal's reference to Uri.

India's budget, the last before the next government is elected, offered something for almost everyone - from distressed farmers to its vast informal workforce to a growing middle class.

The biggest announcement was an income support scheme for farmers with cultivable land of up to two hectares (4.9 acres) - they will receive 6,000 rupees (about $84; £64) every year in their bank accounts.

At an estimated cost of $2.8bn, it will benefit nearly 120 million small and marginal farming households or 600 million people. That is a significant portion of the voting population and a little less than half of the Indian population, which will make this the world's biggest income support scheme.

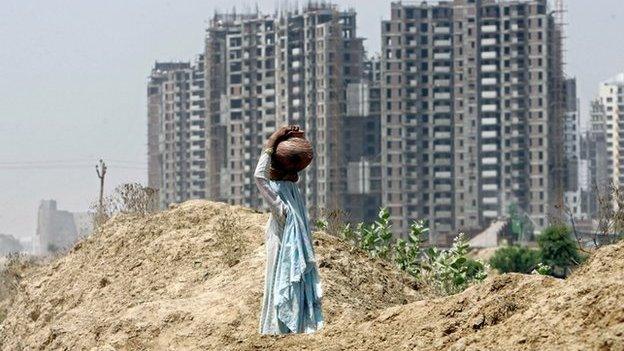

The budget includes a massive income support scheme for farmers

Although Mr Goyal did not say so, this is an attempt to tackle India's agrarian crisis. Agriculture has been blighted by a depleting water table, shrinking farms and declining productivity for decades, while farmers struggle to repay debt to banks and money lenders.

But the problem lies in determining eligibility as land records across large parts of India are not always reliable.

Rahul Gandhi, leader of the main opposition Congress party, has also proposed a similar scheme, if elected to power.

Read more by Vivek Kaul

Mr Goyal also proposed a pension scheme for India's informal workers, who he said numbered 420 million. It will only target those with a monthly income of $210 or more and is contributory - so they would have to set aside a minimum amount each month, which the government will match.

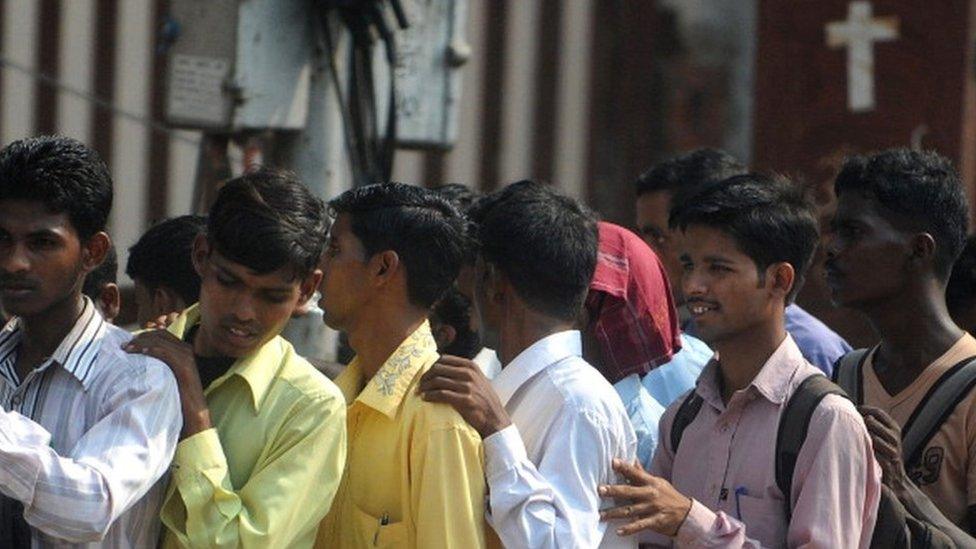

It would certainly help a workforce with almost no rights or benefits, but the trouble is that most unorganised workers are paid in cash. And their income varies as many work as contract labour on farms or construction sites. So it would be hard to decide who is eligible.

The important question is who will pay for these schemes?

India's small middle class will likely pay for the new schemes

In economics, there is no free lunch. Someone has to foot the bill and often that is in the form of higher taxes. That someone is likely to be India's middle class.

The budget offered goodies to them as well. Those earning up to $7,013 will not have to pay any income tax (the limit was $3,506 earlier).

A positive change, which will be a relief to all tax payers, is that the government is working on processing income tax returns and initiating refunds within 24 hours.

Finance minister Piyush Goyal (centre) did not make clear who will fund his plans

But this did not stop Mr Modi's Bharatiya Janata Party (BJP) from turning the budget presentation into a political performance.

In his speech, Mr Goyal made a point thanking Mr Modi many times and listed the achievements of his party. BJP members even began chanting "Modi" mid-way through the speech.

In the run-up to the 2014 elections, Mr Modi had campaigned for a better India, using the slogan "acche din aane waale hain" (happy days are about to come) and promising to create jobs.

Agrarian distress has sparked several farmers' protests

But five years later, a leaked government report shows unemployment levels have reached a 46-year high under Mr Modi.

It remains to be seen whether Indians will believe Mr Modi's story of hope again.

And it's worth remembering this is an interim budget that will remain in effect only until the election, which is expected in April or May. The newly elected government will have to ratify the schemes in its budget later this year.

Vivek Kaul is an economist and the author of the Easy Money trilogy.

- Published31 January 2019

- Published10 November 2016

- Published26 September 2017

- Published30 November 2017

- Published21 May 2015