Yes Bank: Founder Rana Kapoor held over alleged money laundering

- Published

Rana Kapoor, the founder of the troubled lender, was arrested on Sunday

India's financial crime detectives have arrested the chief of the private Yes Bank over allegations of money laundering.

Rana Kapoor was arrested days after the country's central bank seized control of the lender.

Mr Kapoor was produced in a court in the western city of Mumbai and remanded to police custody until 11 March.

The country's federal financial agency has claimed that Mr Kapoor's crime amounts to around $581m (£445m).

Mr Kapoor has denied all charges against him.

The Enforcement Directorate has alleged that the founder had refused to cooperate with the investigation.

But Mr Kapoor denied this on Sunday, as he broke down in court. "I'm willing to cooperate day and night despite the fact that I haven't slept a wink," he told the court, news agency Reuters reported.

The bank has been saddled with bad loans and has unsuccessfully tried to raise capital to meet its regulatory requirements.

The Reserve Bank of India (RBI) said Yes Bank's weakened position was "largely due to inability of the bank to raise capital to address potential loan losses and resultant downgrades".

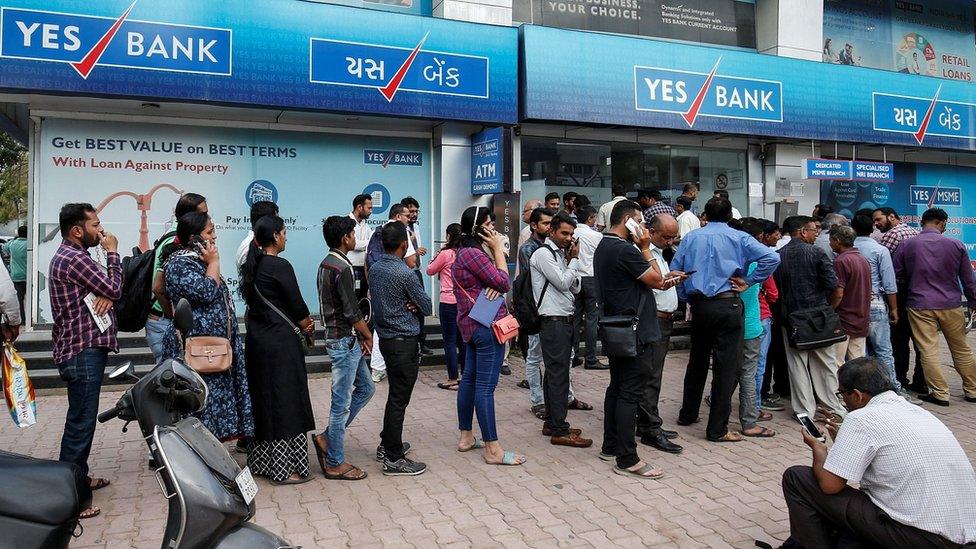

Worried customers have queued up outside Yes Bank branches to withdraw money after the RBI said it would take over the troubled lender. Depositors can now only withdraw the equivalent of about $630 (£486) during a one-month moratorium.

The RBI said it wanted to "quickly restore depositors' confidence" in the bank.

During this time, the RBI will work on a rescue plan for India's fifth biggest private bank - it has asked State Bank of India, the country's largest state-owned bank, to help with a revival plan.

Queue of people outside a branch of Yes Bank

Yes Bank has an estimated $28bn in deposits but had been seeking new capital to bolster its finances before it was seized by the central bank.

In 2016, India passed a law on recovering bad debts that placed more pressure on all banks to more quickly identify and report long-standing troubled loans and poor oversight, which have acted as a major drag on fresh lending.

"India's banking sector - as well as the wider financial sector with the shadow banks - is still under stress, and there have been no quick fixes to this issue," said TS Lombard director of India Research Shumita Sharma Deveshwar.

Private lenders such as Yes Bank were initially welcomed as bringing new technologies and fresh approaches to the state-dominated banking sector.

You may also be interested in:

'My daughter can't study because my bank took my money'

- Published6 March 2020

- Published15 November 2019