Australian budget to overhaul family benefits

- Published

New child care arrangements will leave many working families better off

The Australian government is to overhaul paid parental leave and child care in Tuesday's budget.

Almost 80,000 new mothers are set to lose some or all of their government parental leave payments.

New child care arrangements will leave many working parents better off but families with a stay-at-home parent will miss out.

The changes are among a raft of measures officially announced or leaked to the media ahead of the budget.

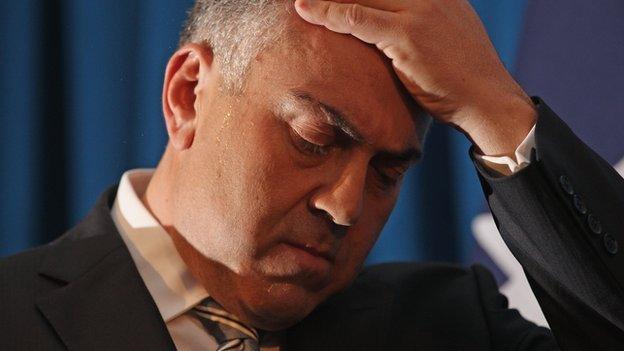

Australian Treasurer Joe Hockey will deliver the budget on Tuesday

Under the new arrangements, almost half of new mothers will lose access to the full A$11,500 ($9,091; £5,894) available under the federal government's existing scheme.

The change marks a major departure from Prime Minister Tony Abbott's previous signature policy of giving working parents six months of paid parental leave.

Mothers can currently get parental leave payments from the government and from their employer, if their workplace has a scheme.

Treasurer Joe Hockey told local media at the weekend this arrangement meant mothers could "double dip".

"We are going to stop that... You cannot get both parental leave from your employer and from taxpayers," he said.

Meanwhile, an extra A$3.5bn in government funding will make child care cheaper for working parents, with most families getting an extra A$30 a week.

Parents not in education or employment can currently access child care benefits but under the new arrangement they will have to work to get it.

Prime Minister Tony Abbott said the childcare package would "change the economics of going to work," for more than one million low and middle income families, encouraging more parents into the workforce.

Under its pledge to only increase government spending if it could save the same amount of money elsewhere, the government intends to fund the extra A$3.5bn in childcare payments by cutting an existing family tax benefits scheme.

That scheme is a per-child payment made to the primary carers of the child.

However, the Labor Opposition has vowed to vote against the package if it is tied to cuts in family tax benefits.

- Published10 May 2015

- Published15 April 2015