Merkel and Sarkozy agree to disagree

- Published

- comments

France, unlike Germany, would like the ECB to act as a lender of last resort

It is a sign of the severity of the eurozone crisis that Chancellor Merkel and President Sarkozy are now meeting almost once a week.

They meet, smile, shake hands but with each passing summit the eurozone crisis only deepens.

This is a crisis being driven by the financial markets. The two big political beasts of the eurozone react but they cannot agree on a strategy that gets ahead of the crisis.

Yesterday the crisis jolted Germany. A bond auction revealed that there were few takers even for normally rock solid German bonds. Some in Germany said this should be a wake-up call for the German Chancellor. The message was that investors are turning away from Europe.

The EU's Economics Commissioner Olli Rehn said today that the crisis has now spread to the core, including Germany. In the past few days the situation had become extremely serious, he said, and the contagion process "has now spread and touched the euro's hard core area".

A deal to agree to disagree

At an emergency meeting in Strasbourg, Chancellor Merkel said harmony had reigned and won the day. But there is a big divide between France and Germany. They disagree on the two solutions that some say might make a difference.

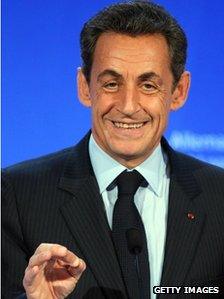

Mr Sarkozy accepts the two countries have different histories and cultures

Firstly, the role of the European Central Bank. France (and Britain and the United States) would like the ECB to act as a back-stop, as a lender of last resort that stands behind troubled eurozone countries. The Germans are against. They not only believe that such a role would contravene EU treaties but that it would lead to inflation.

Before today's meeting, French Prime Minister Francois Fillon said: "We are struck with a major difficulty, that is to convince Germany that we should arm the eurozone with an instrument of defence for our currency through a certain evolution of the role of the central bank."

Today a truce seemed to have been called, a deal to agree to disagree. President Sarkozy said that in order to ensure the independence of the European Central Bank "no positive or negative demands should be made of it". That seemed to be a temporary declaration of a ceasefire between France and Germany.

At previous summits the differences have led to raised voices and pointed fingers between the two leaders. Today the French president accepted that the two countries have different histories and cultures. It was an acceptance that Germany, with its deep-rooted fears of inflation and political pressure on banks, could not be shifted.

Eurobonds

The second proposal that has gained some traction is to issue eurobonds (for the debts of one to become the debts of all). The EU Commission was pushing that solution yesterday. Chancellor Merkel said the conditions were not right for eurobonds. There was no change from the position of yesterday, when she said the suggestion was "extraordinarily inappropriate".

The German position is not to close the door on eurobonds, but only to consider them when a tough regime is in place to discipline and sanction those countries that break the rules. Until that time, Germany would not be prepared to pay the extra borrowing costs that would come with eurobonds.

Over the next few days France and Germany will propose modifications to the treaties to improve the governance of the eurozone: more integration, more discipline and more convergence of the economies.

It remains to be seen whether these changes will be "modifications" or whether they will be more substantial, triggering referenda in countries such as the Irish Republic.

No 'big bazooka'

But none of this goes to the heart of the matter. France and Germany are divided. Investors are increasingly abandoning European assets. There is no "big bazooka" in place.

Ideas such as eurobonds or expanding the role of the ECB have been parked. Growth in the eurozone is stagnant. The debts of troubled countries are only increasing.

In countries like Greece resistance to austerity continues regardless of its new unelected prime minister. For other countries such as Italy and Spain, years of austerity lie ahead.

These are dangerous days for the eurozone. Yesterday, the Germans saw that they also were not immune. The question may not be long in coming as to whether the German taxpayer is prepared to stand behind the single currency.

The political class in Germany agrees with Angela Merkel that without the euro there is no European project. The time may be approaching when the Germans have to decide how far they will go to defend the euro.

Today the Financial Times Deutschland had the caption "the crisis speaks German now", next to a picture of a German eagle crashing into the ground.