European austerity: More pain than gain?

- Published

- comments

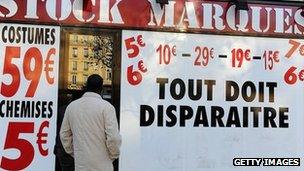

French shops are slashing prices in an effort to woo cash-strapped customers

There is no disguising that in certain European quarters the ratings agencies are feared and resented.

The EU's Economics Commissioner, Olli Rehn, was probably speaking for many when he said he found the decision to downgrade nine eurozone countries "inconsistent".

He felt that Standard and Poor's had not taken into account all the steps the EU had made to tackle the crisis, like increased discipline over budgets.

The French Prime Minister, Francois Fillon, said the downgrade was "badly timed". A French presidential adviser said the decision was "worse than pyromaniac firemen, it's seriously perverse".

As the crisis deepens in Europe the temptation to shoot the messenger grows. There are those who advocate that Europe needs its own - perhaps tamer - ratings agencies.

Perhaps the most interesting reason for the downgrade was Standard and Poor's judgement , externalthat austerity alone might be self-defeating.

Some European countries and officials might retort that they were muscled into making spending cuts and raising taxes to bring down deficits by the agencies and the bond markets.

Now they are being warned of the dangers of austerity.

Shackled with debts

The "cult of austerity" has always been controversial. The doubts are increasing. There are those who say that Greece is now trapped in a spiral of decline. The Washington Post last week asked whether austerity was "killing the Greek economy".

The fear extends to Italy, Portugal and Spain. Austerity is squeezing demand just as countries are heading into recession. Unemployment is already rising, leading to greater spending on benefits and a decline in revenue from taxation. That forces the countries to borrow more, so forcing up accumulated debt.

Recently there has been a change of emphasis. It was a focus of the meeting between French President Nicolas Sarkozy and German Chancellor Angela Merkel last Monday. It tops the agenda for the EU summit on 30 January.

Most of the talk about growth ends up underlining the importance of structural reforms, like freeing up the labour markets, making it easier to hire and fire.

In Italy the focus is on opening up closed professions like pharmacists and taxi drivers. All of these reforms may be necessary, but they take time to have an impact. In the meantime economies are declining and debt is rising.

The German chancellor remains a believer. This weekend she said that Greece could rebuild its economy despite austerity. She accepts that spending cuts alone won't work, but she believes that structural reforms have to be forcefully implemented although they take time.

Growing resentment

The Italian Prime Minister, Mario Monti, has warned of the dangers of austerity. He said the political and economic situation could unravel, sparking protests against Europe. He reminded the Germans that they were viewed as the ringleader of "EU intolerance".

The French remain very cautious about further austerity. Even after the downgrade the French Finance Minister Francois Baroin said no new cuts were necessary.

The Germans see a lesson in what happened after German reunification. It took time but their economy was forced to become more competitive.

Mrs Merkel frequently says there is no magic bullet when it comes to the eurozone crisis. The differences between the various economies that use the single currency can only be narrowed by making deep structural reforms.

But time is an issue here. When do people say - in order to save the euro - they are not prepared to continue with austerity? Some of Europe's leaders worry about this. One thing is for sure: the doctrine of austerity will be tested in the weeks and months ahead.