Pope Francis tightens Vatican bank controls

- Published

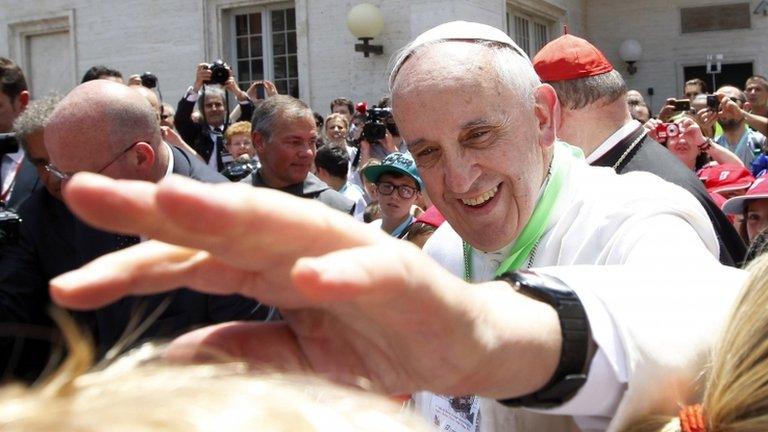

Pope Francis is set on clearing up the Vatican's finances

The Pope has stepped up the fight against corruption at the Vatican by strengthening supervision of financial transactions at its internal bank.

Pope Francis issued a decree designed to combat money-laundering and prevent any financing of terrorism.

It is the latest move to stamp out abuses at the Vatican bank, which handles funds for the Catholic Church.

The Pope recently set up a commission to investigate the bank and report back to him personally.

Last month the Vatican froze the account of a senior cleric, Monsignor Nunzio Scarano, suspected of involvement in money-laundering.

He and two others were arrested by Italian police in June on suspicion of trying to move 20m euros ($26m; £17m) illegally.

Pope Francis's number one priority this summer is to sort out the financial mess at the Vatican bank and a parent body which looks after the financial assets of the Holy See, the BBC's David Willey reports from Rome.

Bank review

The new decree, external is intended to tackle "money-laundering, the financing of terrorism and the proliferation of weapons of mass destruction", the Vatican said.

It sets up a financial security committee to coordinate the anti-corruption effort.

Church spokesman Federico Lombardi said the decree would help the Vatican resist "increasingly insidious" forms of international financial crime.

A French-based financial watchdog, Moneyval, has been carrying out a review of the Vatican bank's operations.

It found that the bank had not always exercised due diligence.

The Vatican bank, which is known officially as the Institute for Religious Works, handles the payroll for some 5,000 Vatican employees.

It also handles the funds for the central administration of the Catholic Church and holds the accounts of cardinals, bishops, priests, nuns and religious orders around the world.

It does not lend money and has assets worth $8.3bn (£5.4bn; 6.2bn euros).

- Published18 July 2013

- Published26 June 2013

- Published28 June 2013

- Published31 July 2013

- Published28 October 2022