Why Greece's early election makes the EU nervous

- Published

Pensioners are among the angriest groups after years of painful austerity

Political turbulence is back in Greece as voters face a snap election on 25 January.

The radical left Syriza bloc is ahead in opinion polls and rejects the EU's bitter austerity medicine - blamed for massive job cuts and a rise in poverty.

So there are fresh doubts about Greece's ability to reform its economy in line with EU-IMF rules, and about its very future in the eurozone.

Why is Greece in a mess?

Greece was living beyond its means before it joined the euro in 2002. Public spending soared as euro stability encouraged lending, but Greece failed to tackle widespread tax evasion and wasteful inefficiencies, especially in the bloated public sector.

The budget deficit - the difference between spending and income - spiralled out of control. The 2008 financial crisis revealed that Greek debts were far greater than had been officially reported. Greece needed an emergency credit lifeline to stay afloat.

In 2010 the EU and International Monetary Fund (IMF) granted Greece a massive €110bn (£86bn; $134bn) loan, disbursed in instalments. By 2012 it was clear that more help was needed, so a new €130bn loan was granted.

The EU-IMF bailout was conditional on the Greek government enacting tough austerity measures - drastic spending cuts in healthcare, education and other public services.

The cost for Greece has been very high: about one-third of Greeks are now at risk of poverty or social exclusion, unemployment has soared, external to more than 25% and opposition to austerity has delayed many reforms.

But wasn't Greece on the road to recovery?

Greece finally emerged this year from six years of recession, with predicted GDP growth of 0.6%. But any prolonged political uncertainty puts this fragile recovery at risk.

The snap election was triggered because Prime Minister Antonis Samaras failed to get his nominee - former EU commissioner Stavros Dimas - elected president, in three parliamentary votes.

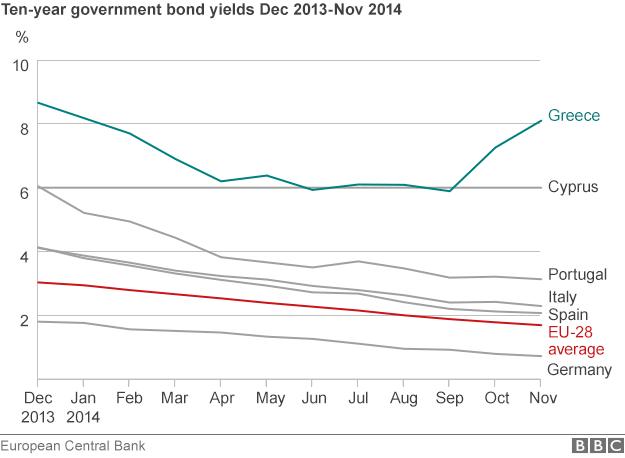

That political clash pushed up the cost of borrowing for Greece - long-term bond yields rose to 9.5% - and the Athens stock market slumped.

Prime Minister Samaras faces an election 18 months earlier than planned

Syriza is about 3% ahead of Mr Samaras's centre-right New Democracy in opinion polls. If elected, Syriza plans to renegotiate the bailout, to get at least half of the debt written off.

But EU lenders insist that Greece must stick with the agreed austerity programme.

The bailout only has another two months to run, leaving any future loans to Greece uncertain.

Is the situation as serious as the previous Greek crisis?

Probably not. In 2012 there was much talk of a possible "Grexit" - Greece leaving the euro, which could trigger "contagion", with investors shunning other struggling, highly indebted eurozone countries.

Now many analysts believe the EU has done enough to contain any new Greek upheaval.

The EU has a €500bn firewall called the European Stability Mechanism (ESM), which can disburse emergency funds if needed.

In 2012 European Central Bank President Mario Draghi famously pledged to do "whatever it takes" to save the euro. The markets interpreted that as the ECB accepting the role of lender of last resort.

In addition, some of the worst-hit eurozone economies in 2010-2012 - notably Ireland and Spain - are performing better now.

Greece itself has managed to balance its budget, though it still has colossal debts of €319bn. In 2013 it achieved a budget surplus of €1.5bn - the first since 2002.

Greece is still fragile, dependent on its international credit lifeline. It cannot borrow again in the markets until its bond yield comes down.

Much has changed since the 2010-2012 crisis - but worries about the euro persist.

Student protest in Athens: Anti-austerity rallies are a feature of Greece now

Greece - key facts

Population - 11.3m (EU total is 505m)

Ranks 13th in size of economy in EU

Unemployment rate - 25.5% (but youth unemployment is 49.5%)

Economy shrank by more than 20% during crisis

Gross government debt - 175% of GDP (EU average - 87%, 2013 data)

What can we expect after the January election?

Greek politics is very volatile, as anti-austerity parties are challenging the old establishment.

Syriza looks capable of winning, but it would still need coalition allies to form a government. That could force some compromises in its stridently anti-austerity platform.

Syriza leader Alexis Tsipras is riding a wave of anger directed at the EU

A Syriza victory would certainly send shockwaves through European politics. It would inspire other anti-austerity, populist parties elsewhere in the EU, which are already gaining ground. Those parties include not only the left-wing Die Linke in Germany and Podemos in Spain, but also the right-wing National Front in France and Italy's Five Star Movement.

The UK Independence Party (UKIP) - winner of the European election in the UK - could also argue that the EU's solution for Greece was no solution at all.

The EU's German-led efforts to enforce budget discipline EU-wide could face stronger opposition. Political instability could delay the growth that is desperately needed, as Europe remains plagued by stubbornly high unemployment and sluggish investment.

Is a 'Grexit' still possible?

Syriza says it wants Greece to stay in the euro - as do the traditional mainstream parties in Greece.

Germany's Chancellor Angela Merkel and other EU leaders have staked much credibility - and spent billions - on keeping Greece in.

But there are fears of a crisis of confidence in the Greek economy. In the worst-case scenario there could be a run on the banks, with Greeks trying to get their savings out of the country. Cyprus suffered such a crisis in 2012 and had to be bailed out.

The risk is that a Syriza-led government could refuse to repay the €17bn of debt due in 2015, external, triggering a default and exodus of investors.

The ECB might then refuse another bailout, putting impossible pressure on the Greek central bank to shore up domestic banks. In such a crisis the only solution might be for Greece to leave the euro. Many analysts agree that a disorderly exit would be catastrophic for Greece, fuelling inflation and intensifying hardship as imports would rocket in price.

In the long term a "Grexit" might make Greece more competitive, but the immediate cost would be huge and it would certainly undermine confidence in the euro.

Correction 5 January 2015: This report has been amended to clarify the position of UKIP, which is against EU policy rather than against austerity in principle.

- Published28 June 2023