Greece debt crisis: Has Grexit been avoided?

- Published

Politically, eurozone leaders appear to have made the decision to keep Greece in the euro

Greece has negotiated a eurozone deal for a possible third bailout - but that does not mean its future in the single currency is guaranteed.

Short-term financing has been arranged to help Greece get through July and emergency funding has enabled the banks to reopen for the first time since June.

But the bailout has been widely criticised and there are many voices still arguing that Greece should leave the eurozone, also known as a "Grexit".

Has the immediate threat of Grexit gone?

For now, the threat of a Grexit is diminished. But it was a genuine possibility in the hours before the 13 July bailout deal was hammered out. Since then, Greece has successfully negotiated the first hurdles put up by its eurozone partners.

The most important obstacle was in the Greek parliament, where the Syriza-led government survived a rebellion and pushed through tough reforms on VAT, pensions and early retirement which eurozone partners said were an immediate test for the government to pass.

That triggered a deal on €7.16bn in emergency funding, to enable the government to pay its arrears with the International Monetary Fund (IMF) and its July bill from the European Central Bank (ECB).

Significantly, it has also prompted the ECB to lift its limit on emergency cash assistance for Greek banks, which reopen on 20 July, three weeks after they were shut.

Will Greece return to normal?

Not for a while, and it depends on weeks of negotiations on the terms of the third bailout.

Capital controls, imposed when the ECB froze emergency liquidity assistance for the banks (ELA), are unlikely to be lifted for some time. So while the banks are open again, cash withdrawals will be limited to €420 per week.

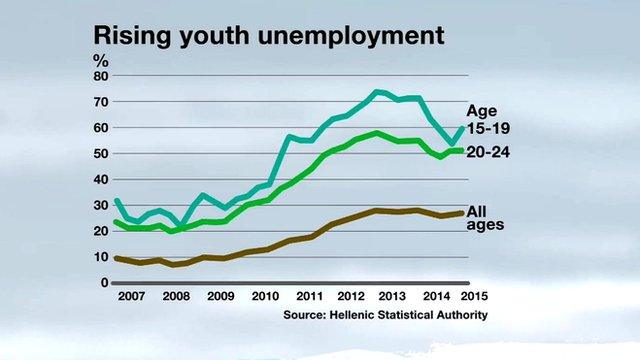

The reality is that Greece has not been normal for several years. The financial crisis hit Greece and its banks hard. The jobless rate is above 25% and youth unemployment is as high as 50%.

How big is the risk of Grexit?

If negotiations fall through, Greece could still leave the single currency.

Prime Minister Alexis Tsipras said he was unhappy with the bailout deal he negotiated with other eurozone leaders but he was faced with a clear choice: "A deal we largely disagreed with, or a chaotic default."

So there is a chance a government that does not believe in a bailout deal and that relied on opposition MPs to get it past parliament might not last to see it through.

Alexis Tsipras is popular in Greece but he lost the support of almost 40 Syriza MPs in pushing reforms through

There are plenty of politicians and economists who believe Greece should leave the euro, most notably German Finance Minister Wolfgang Schaeuble, who believes Greece needs debt relief, which is not seen as legal within the single currency.

But at a European level, politically the decision appears to have been taken to do whatever it takes to keep Greece in. And for now Mr Schaeuble's arguments have been over-ruled.

Austria's centre-left Chancellor Werner Faymann has said it would be "totally wrong" for Greece to leave, and ECB Chairman Mario Draghi has been even clearer. The ECB's mandate was, he said, "to act based on the assumption that Greece is and will be a member of the euro area".

What about a temporary Grexit?

This was an idea, external put forward by Mr Schaeuble, who called for a Greek "time-out from the euro area", enabling the Athens government to restructure its debts.

He and many others believe Greek debt is unsustainable and that a debt write-off - a "haircut" - would make more sense outside the euro as it is not allowed inside it.

A time-out was discussed by eurozone leaders, but the terms of re-entering the eurozone are so stringent that a time-out would in reality have become permanent. For France's President Hollande, there is "no such thing as temporary Grexit".

The German finance minister has recommended a Greek exit from the euro

Would Grexit make more sense than staying in?

Certainly, there is a clear attraction for many Greeks of abandoning the euro, when faced with many more years of eurozone austerity and a new debt burden of €86bn (£62bn).

But it all depends on whether or not Greece is allowed to restructure its debts.

The International Monetary Fund revealed it had warned eurozone leaders, external that Greece's debt would peak at 200% of GDP, far higher than previous estimates. Its "dramatic deterioration in debt sustainability" required debt relief "on a scale that would need to go well beyond what has been under consideration to date".

The only reference to potential debt relief in the eurozone deal, external is of "possible longer grace and payment periods". And Germany's Angela Merkel said there was a plan to consider restructuring later in the year, after the "first review" of the bailout.

The European Commission said "a very substantial debt re-profiling", external was possible if Greece kept to agreed reforms. However a debt write-off was not on the cards.

Greece's former Finance Minister Yanis Varoufakis certainly believes it will not happen, external.

What would Grexit look like?

There is no precedent for a country to leave the euro and no-one knows how it might happen.

However, Yanis Varoufakis gave an illuminating idea, external of the initial steps he had planned for Greece to take towards Grexit in preparation for when the ECB cut off emergency funding for Greek banks.

Greece would have issued euro-denominated IOUs

A "haircut" would have been made to Greek bonds issued to the ECB in 2012, reducing Greece's debt

Control of the Bank of Greece would have been seized from the ECB

His colleagues rejected the plan.

The problem for Greece is the damage already done to the banks. Tens of billions of euros have already been withdrawn from private and business accounts, and capital controls have left Greeks unable to withdraw large sums of cash.

The risk is that a messy default could cause even more harm to the Greek economy.

Greek paramedic: "We don't have enough money to help people - we don't have enough ambulances"

Greece would suffer instant devaluation and inflation. It could end up a pariah in the international markets for years, much like Argentina in 2002.

Tourism - one of Greece's main earners - would be hit hard, dealing a hammer blow to an ailing economy.

Some economists believe a return to the drachma could eventually benefit the economy, but it is difficult to see anything positive in the short term.

If Greece left the eurozone, what currency would it use?

If Greece were to fall out of the euro, one potential option for the banks would be to reopen with a parallel currency before the revival of Greece's former currency, the drachma.

Another would be to place Greece in a type of eurozone quarantine, where it would use the euro but not be a fully-fledged part of it. After all, Kosovo and Montenegro, external have adopted the euro without being inside the eurozone. This method could also be used if Greece were to leave the eurozone on a temporary basis.

Greece could also maintain two euro currencies, with the euro used for transactions and the government paying salaries and pensions in a separate Greek-style euro or even in IOUs.

Why are Greece's finances in such dire straits?

Since 2010, the Athens government has been reliant on two EU-IMF bailouts totalling €240bn

Greece's last cash injection from international creditors was back in August 2014

When the eurozone agreement ran out on 30 June, Mr Tsipras's government also failed to make a key debt repayment to the IMF of €1.5bn

Greece's debts now total more than €300bn - about 180% of its GDP

Greece in numbers

€320bn

Greece's debt mountain

€240bn

European bailout

-

177% country's debt-to-GDP ratio

-

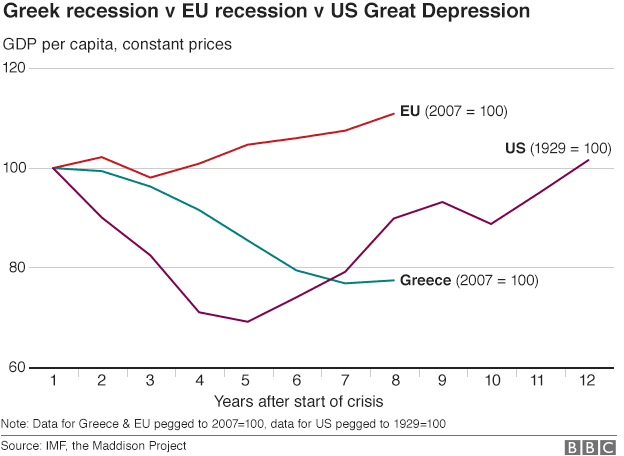

25% fall in GDP since 2010

-

26% Greek unemployment rate

- Published15 July 2015

- Published20 July 2015

- Published20 July 2015