Greece crisis: No vote would mean euro exit, leaders warn

- Published

Ros Atkins reports as thousands of Greeks take to the streets in a show of support for their government

EU leaders have warned Greeks that rejecting creditors' proposals in a snap referendum called for Sunday would mean leaving the euro.

German Vice Chancellor Sigmar Gabriel said the vote would be "yes or no to the eurozone".

Greek Prime Minister Alexis Tsipras has urged a no vote but insists he wants Greece to stay in the euro.

Talks between Greece and its creditors broke down last week, leading to Greek banks having to shut this week.

Global stock markets fell sharply on Monday.

As well as Mr Gabriel, the leaders of the eurozone's other two largest economies said Greek voters would effectively be deciding next Sunday whether or not they wanted to stay in the eurozone.

Prime Minister Alexis Tsipras says creditors want to get rid of him

Italian Prime Minister Matteo Renzi said, external the choice would be between the euro and the drachma, while French President Francois Hollande said "what's at stake is... knowing whether the Greeks want to stay within the eurozone".

Speaking to Greek television on Monday evening, Mr Tsipras urged as many Greeks to vote "no" as possible on Sunday to give his government a stronger position to restart negotiations.

He said his government had a mandate "to be within the European framework but with more justice".

"They will not kick us out of the eurozone because the cost is immense," he said.

Mr Tsipras hinted strongly that he would resign if the result of the referendum was a "yes" vote

"If the Greek people want to proceed with austerity plans in perpetuity, which will leave us unable to lift our head... we will respect it, but we will not be the ones to carry it out," he said.

The UK's Chancellor of the Exchequer, George Osborne, said a Greek exit would be "traumatic" and Britain should not underestimate the knock-on effects, even though it was outside the single currency.

He said UK retirees who live in Greece would continue to receive their pensions, but advised British holidaymakers to take more euros than usual.

Days of turmoil

Queues were forming in front of some ATMs in Athens - but customers will only be allowed to take out €60 per day

Friday evening: Greek prime minister calls referendum on terms of new bailout deal, asks for extension of existing bailout

Saturday afternoon: Eurozone finance ministers refuse to extend existing bailout beyond Tuesday

Saturday evening: Greek parliament backs referendum for 5 July

Sunday afternoon: ECB says it is not increasing emergency assistance to Greece

Sunday evening: Greek government says banks to be closed for the week and cash withdrawals restricted to €60

Earlier, European Commission President Jean-Claude Juncker said he felt "betrayed" by the "egotism" shown by Greece in the failed talks on giving heavily indebted Greece the last payment of its international bailout.

He said Greek proposals were "delayed" or "deliberately altered" but added the door was still open to talks.

Despite the public war of words, a Greek official said Mr Tsipras had spoken to Mr Juncker on Friday and asked him to extend Greece's bailout until the referendum.

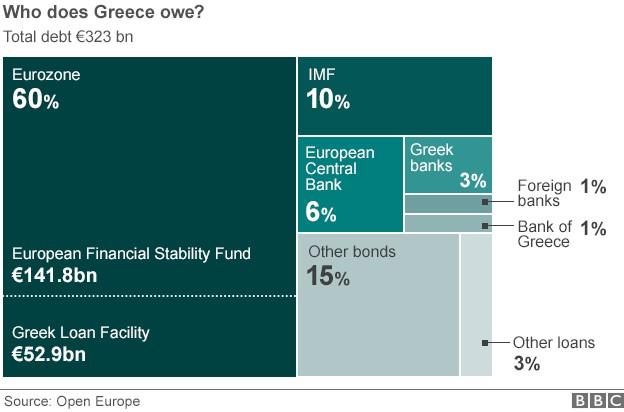

A critical deadline looms on Tuesday, when Greece is due to pay back €1.6bn to the International Monetary Fund - the same day its current bailout expires.

Mr Juncker said that he still believed a Greek exit from the euro was not an option and insisted that the creditors' latest proposal, external meant more social fairness.

Referendum question

The question which will be put to voters on Sunday will not be as simple as whether they want to stay in the euro or not - instead it asks Greeks to approve or reject the specific terms laid out by Greece's creditors:

"Should the agreement plan submitted by the European Commission, European Central Bank and the International Monetary Fund to the June 25 eurogroup and consisting of two parts, which form their single proposal, be accepted? The first document is titled 'Reforms for the completion of the Current Program and Beyond' and the second 'Preliminary Debt Sustainability Analysis'.

"Not approved/NO

"Approved/YES"

On Saturday, the European Central Bank (ECB) decided not to extend emergency finance to the Greek banks after talks broke down.

The current ceiling for the ECB's emergency funding - Emergency Liquidity Assistance (ELA) - is €89bn (£63bn). It is thought that virtually all that money has been disbursed.

Following the ECB announcement, Greece said its banks would remain shut until 6 July.

Public transport will be free in the Athens area for a week while the banks are closed, the government says.

On Monday evening the ratings agency Fitch said it had downgraded its rating of four Greek banks, National Bank of Greece, Piraeus Bank, Eurobank Ergasias and Alpha Bank, to "restricted default".

The agency said, external the downgrade "reflects Fitch's view that these banks have failed and would have defaulted had capital controls not been imposed, given the high rates of ongoing deposit withdrawal and the ECB's decision".

The euro lost 2% of its value against the US dollar in market trading on Monday before recovering some ground. Government borrowing costs in Italy and Spain, two of the eurozone's weaker economies, have also risen.

The Athens stock exchange is closed as part of the emergency measures.

'Resorting to barter system'

Greeks in Athens gave the BBC their views on bank closures and the government

Athens resident Ilia Iatrou says the situation is "unbearable".

"My mother-in-law queued up for over an hour at the cash point just to be able to withdraw a small amount of money.

"I haven't tried to go to the cash machine myself, as we don't have much money left.

"My neighbours and I have now resorted to a sort of barter system among ourselves because we have no money left.

"We can't take any more of this, so we have to keep saying no to the EU masters.

"The EU can't afford to let us fail so we should continue to say no and they will blink and give us a better deal."