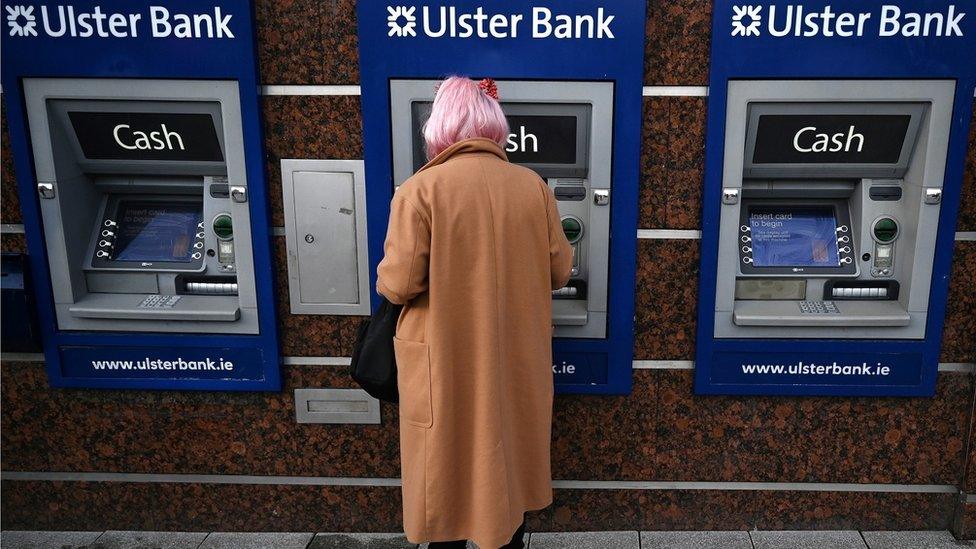

ROI: Ulster Bank fined €38m for 'serious failings'

- Published

The fine relates to the treatment of customers with tracker mortgages

NatWest's business in the Republic of Ireland has been fined Ulster Bank fined €38m for regulatory breaches in its handling of some mortgage customers.

The fine on Ulster Bank is the largest ever imposed by Ireland's Central Bank.

The Central Bank uncovered what it described as "serious failings" in the treatment of 5,940 customers over 16 years.

Earlier this year NatWest announced it was closing the Ulster Bank business in the Republic.

The investigation concerned customers who had tracker mortgages.

These were very popular in the Republic of Ireland during the economic boom years - the interest rate was fixed at a certain level above the European Central Bank (ECB) base rate, often for the lifetime of the mortgage.

Homeowners taking these mortgages were effectively betting that the ECB would keep rates low.

At one point 65% of Ulster Bank's total mortgage book in Ireland consisted of lifetime tracker mortgages.

That is a gamble that has paid off for consumers but was a disaster for banks.

Trackers were mostly loss-making as the interest charged was less than the banks' cost of funding.

At one point 65% of the Ulster Bank's total mortgage book in the Republic consisted of lifetime trackers.

The Central Bank found that Ulster Bank sought to implement a campaign to encourage some customers to convert their tracker rates to fixed rates during 2008, without telling them that they would not be entitled to return to their original rate if they moved.

'Serious harm'

Although no customers moved as a result of that campaign the investigation found a range of other failings.

These included a deliberate strategy not to provide certain customers with their correct tracker mortgage entitlement unless they complained.

The Central Bank said some customers suffered serious harm: 'At the most serious end 43 properties were lost, 29 of which were family homes, as a direct consequence of Ulster Bank's actions.'

In a statement, Ulster Bank's chief executive Jane Howard said she was deeply sorry for the impact the bank's handling of the tracker mortgage issue had on customers and their families.

Related topics

- Published19 February 2021

- Published19 February 2021