Irish budget: Finance minister unveils tax 'giveaways'

- Published

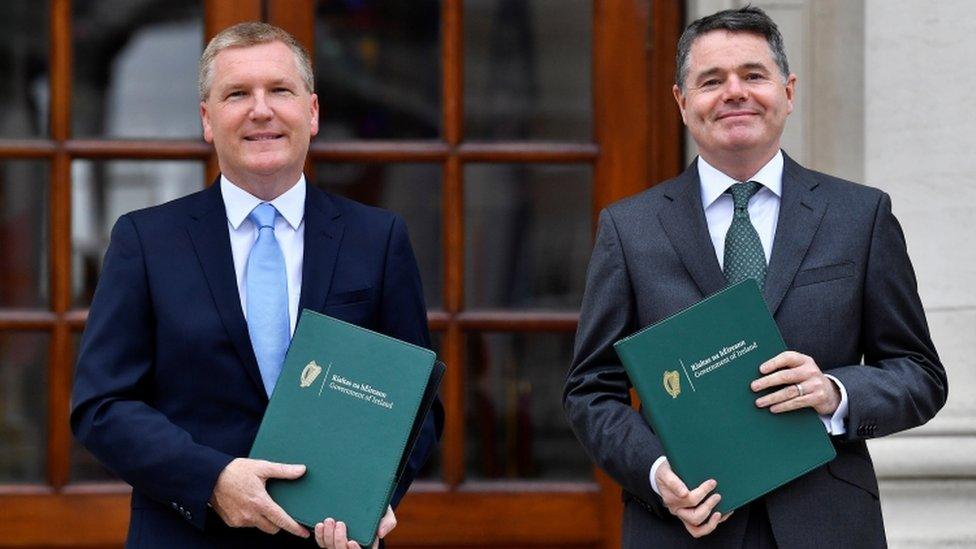

Paschal Donohoe says the Republic of Ireland has a large budget surplus

The Irish finance minister has unveiled one of the biggest giveaway budgets in the country's history.

Paschal Donohoe told the Dáil (Irish parliament) that he was in a position to do so because the country had a large budget surplus.

Most of that comes from a huge increased tax-take from corporations, particularly a small number of American tech companies.

Some of that income is to go towards a "rainy day" national reserve fund.

Mr Donohoe announced an income tax package to the value of more than €1.1bn (£963m).

Unlike the UK, Ireland is not borrowing to fund tax cuts.

People will now start paying the higher 40% rate of tax on income over €40,000

The minister said his budget was focused on helping families and businesses facing the cost-of-living crisis arising from the after effects of the Covid-19 pandemic and the Russian invasion of Ukraine.

"As one of the most open economies in the world, we benefit when things are going well internationally, but when they reverse, we are also one of the most exposed," he said.

Mr Donohoe also said that headline inflation in Ireland is now running at "highs not seen in many decades", adding that the Department of Finance has updated its forecasts to headline inflation of 8.5% for 2022, and just over 7% for 2023.

People will now start paying the higher 40% rate of tax on income over €40,000 (£35,731).

Tax credits will be given to home owners for fuel, and tax on petrol and diesel at the pump will remain unchanged.

Other announcements include:

Electricity credits for all households totalling €600 (£536) will be paid in three instalments of €200 (£179)

An additional payment of €500 (£447) to those in receipt of the Working Family Payment will be paid in November

There will be €12 (£11) a week increase for those in receipt of social welfare

A packet of 20 cigarettes will go up by 50 cents (45p)

VAT on newspapers will be reduced from 9% to 0%

A reduction of up to 25% in weekly childcare fees

Free GP care will be extended to 400,000 people, including all children aged six and seven

Funding will be provided for free primary school books for all children from autumn 2023

Third level tuition fees will be cut by €1000 (£896) in a one-off reduction

A temporary business support scheme will cover 40% of energy costs up to €10,000 (£8,965)

Mr Donohoe said there were many risks to the country's finances but he concluded: "We can and should be confident about our future."

Related topics

- Published10 February 2022

- Published12 October 2021