Guernsey minister calls for change to Zero-10 tax regime

- Published

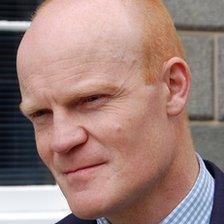

Deputy St Pier said the changes could cost Guernsey £3-4m

The European Union would leave Guernsey alone if the island changed its corporate tax regime, said the States' Treasury and Resources minister.

A motion to repeal parts of Guernsey's Zero-10 tax regime will be put to States members in June.

Deputy Gavin St Pier said: "If the States pass this measure, we will repeal the regime from 1 January 2013."

The Zero-10 system was introduced in 2008, but was deemed harmful by an EU review in April 2012.

The system allows some corporations in Guernsey to pay no tax, while others - such as banks - pay 10% tax.

Deputy St Pier said the EU Code of Conduct Group had given its formal assessment of Zero-10 to the States earlier in the week.

He said the main change made to the system would be to the "deemed distribution" of business profits.

Deputy St Pier said this element treated profits as belonging to businesses' shareholders, despite not actually being distributed.

He acknowledged that there may be a financial cost to the island of changing the Zero-10 system, and said: "Our best estimates at the moment are around £3-4m per year."

Jersey and the Isle of Man have similar corporate tax systems, and were also required to make changes to bring them in line with EU guidelines.

- Published20 April 2012

- Published21 December 2011

- Published1 November 2011

- Published29 October 2011