Guernsey placed on EU tax haven blacklist

- Published

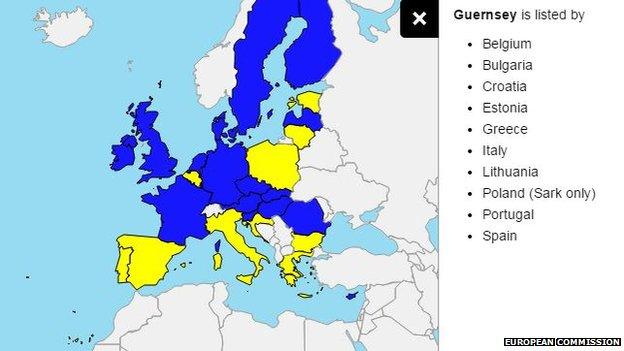

Guernsey was nominated by a number of EU countries as being non-compliant

Guernsey's Chief Minister has called for the island to be removed from a new European tax blacklist.

The European Commission list features 30 non-EU jurisdictions it has branded "non co-operative".

Each country on the list, including six British overseas territories, was nominated by 10 members of the European Union.

Deputy Jonathan Le Tocq said he believed that the list used outdated and arbitrary criteria.

Chief Executive Officer of the States of Guernsey, Paul Whitfield, said: "The fact is, it is technically inaccurate, it is not factually correct and we need to address it quickly.

"It is well known Guernsey meets every international standard on tax-transparency and co-operating including the European Commission's own standards.

"I think this is just a lack of understanding about our constitution."

The European Commission asked each member state to nominate non-compliant nations

Non-compliant countries

Andorra, Anguilla, Antigua and Barbuda, Bahamas, Barbados, Belize, Bermuda, British Virgin Islands, Brunei, Cayman Islands, Cook Islands, Grenada, Guernsey, Hong Kong, Liberia, Liechtenstein, Maldives, Marshall Islands, Mauritius, Monaco, Montserrat, Nauru, Panama, Saint Kitts and Nevis, Saint Vincent and the Grenadines, Seychelles, Turks and Caicos Islands, US Virgin Islands, Vanuatu

Guernsey is the only crown dependency to be included on the list. The United Kingdom and Ireland did not nominate any countries for inclusion on the list.

The island was listed as non-compliant by Belgium, Bulgaria, Croatia, Estonia, Greece, Italy, Lithuania, Portugal and Spain. Poland listed Guernsey but only because of Sark.

Andrew Whittaker, a spokesman for the Guernsey International Business Association, said: "Blacklists are very difficult to talk to investors about and when you've been on one you have to make a song and dance about getting off it."

Vanessa Mock, European Commission spokesperson for Taxation and Customs said the list is based on data from European nations and will be updated annually.

- Published18 March 2015

- Published6 March 2015