Guernsey States approve 'realistic budget' for 2016

- Published

Deputy Gavin St Pier said if islanders wanted more services then higher taxes, GST or higher duties would be needed

Approving extra money for Guernsey health services, raising corporate tax and ending some benefits leaves a "realistic budget" for 2016, according to the treasury and resources minister.

The budget, with a number of changes, was voted through by the States.

Gavin St Pier said the public needed "realistic expectations" of services.

He said: "[It] is a fair budget. It is a responsible budget. It is a balanced budget that has us living within our means."

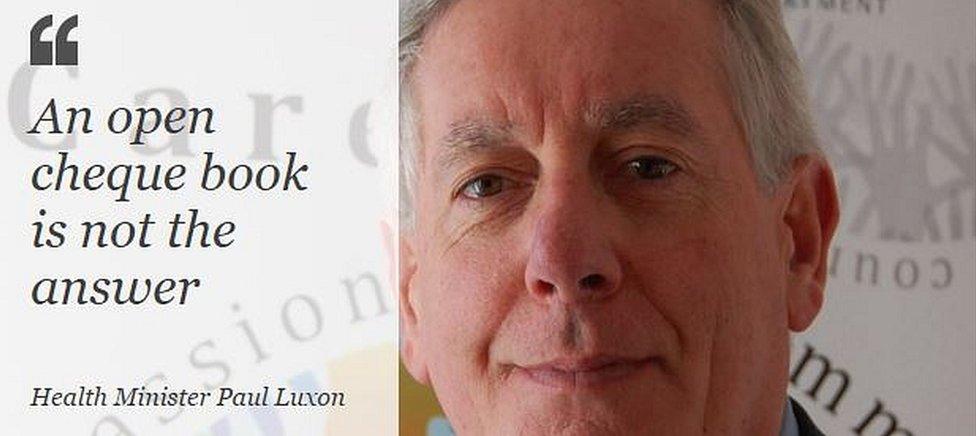

An open cheque book is not the answer

Health Minister Paul Luxon said: "Services cannot continue to be delivered within the existing model here in Guernsey unless we are prepared to see continual budget bid increases and overspends year on year, as healthcare costs and demands continue to grow.

"Transformation and reform can be the only way forward for a sustainable model of delivery. It will be no easy task, but this States, and the next, and the one after that, along with the HSS [Health and Social Services] department staff, must tackle this conundrum."

Guernsey's 2016 Budget

Additional £8.2m for the health department budget

£382,600,000 budgeted across all States departments and committees

Duty introduced on production or importation of biodiesel

Rises in property tax

Introduce a £50,000 tax cap for Alderney residents for 10 years from 2016

Alcohol duty to be based on volume among changes to excise duty, external on tobacco and fuel

Removal of tax relief on let properties to be investigated

Rises in company income tax rates to 10% for custody services and 20% for income from the importation of the supply of hydrocarbon oil or gas

Retail companies with a taxable annual profit of £500,000 to be taxed at a higher rate of 20%

The cap on the amount paid out in mortgage tax relief for a main residence to fall until 2025 when it will end

Increase the standard charge, an alternative to paying Guernsey income tax on worldwide income for residents who mainly live somewhere else, from £27,500 to £30,000

No capital projects to be put forward until the 2017-2020 capital priorities have been decided, except the Alderney runway rehabilitation project

A review of the island's local housing market

The creation of a sports strategy by July 2017

- Published27 October 2015

- Published29 September 2015

- Published27 March 2015

- Published8 October 2014