How are Venezuelans coping with tumbling oil prices?

- Published

The Venezuelan government will have to do some blue sky thinking to get the economy back on track

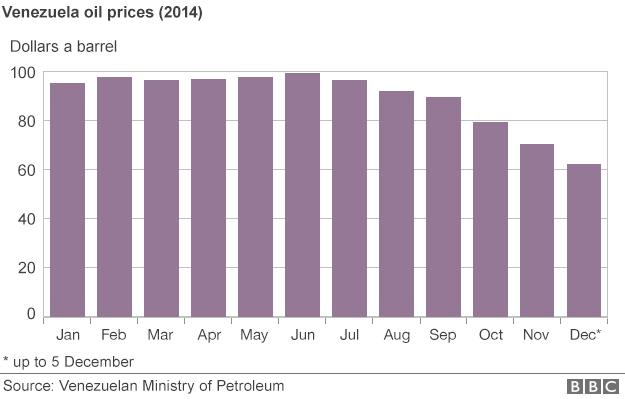

Falling global oil prices have been a headache for many oil-producing countries, with exports now failing to bring in cash they used to just six months ago.

On Thursday, the price of Brent crude was just below $63 a barrel, while US crude was near $58.

The price of Venezuelan oil, which is very heavy by international standards, was even lower - at $57.53 a barrel for the week ending 13 December.

The dramatic downward slide started in June.

Six months of falling prices have hit Venezuela particularly hard - the country is heavily dependent on oil money, with 96% of export revenues coming from oil, according to reports, external.

BBC News has been speaking to a selection of Venezuelans on the streets of Caracas to find out how they have been personally affected by the fall in oil prices.

Oil down, goods up

Alex Hernandez, a businessman in Caracas, says the problem is exacerbated by a lack of foreign currency.

Businessman Alex Hernandez says the fall in oil prices means there is not enough foreign currency to import goods

In 2003, the Venezuelan government set a fixed rate for foreign currency exchange.

The move was designed to keep government control over prices and to make certain basic items, such as bread and rice, more affordable to the poor.

Under the currency controls, people and businesses can receive US dollars at the official rate only by applying to a government currency agency, and then only for the purpose of importing goods or to pay for foreign travel.

Mr Hernandez believes the fall in oil prices has made it even harder for businessmen like himself to get hold of the foreign currency needed to buy the imported goods he sells.

A falling oil price means fewer dollars flowing into Venezuela's government coffers, and less to spend on paying for imports.

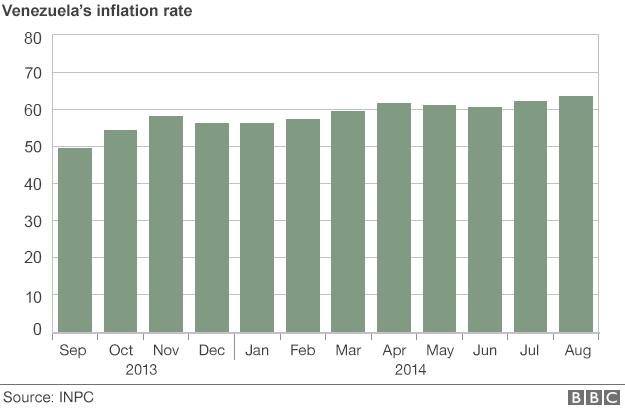

As Mr Hernandez mentioned, prices for goods in Venezuela have been rising

The most recent official figures put the inflation rate at 63.4%.

The figures were the first Venezuela's central bank had released since May, which led critics to accuse the government of withholding data for political reasons.

Neither did the central bank publish its scarcity index, a measure of goods that are missing from store shelves, but it is clear the difficulty of getting hold of basic products is a source of discontent for many.

Daily hunt

Housewife Eugenia Martinez says she sometimes has to queue all day to get what she needs for her family. She says the queues have got longer and longer as the price of oil has tumbled.

Eugenia Martinez queues all day to get the products she needs for her family

Mechanic Enrique Moreno says his business is also hit by the scarcity of replacement parts. But in his view, the situation cannot just be blamed on the falling oil prices.

Mr Moreno believes that given Venezuela's riches the country should be a lot better off than it is, even if the current price per barrel is low.

Mechanic Enrique Moreno thinks mismanagement rather than low oil prices are the problem

Mr Moreno says he can feel a general mood of unhappiness in the streets of Caracas.

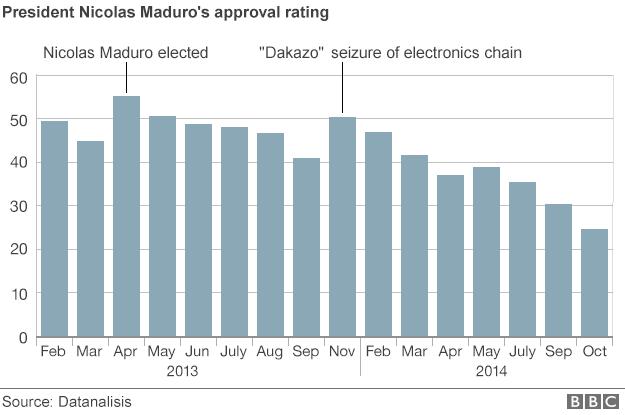

That mood is reflected by opinion polls which suggest the approval rating for President Nicolas Maduro has been falling along with falling oil prices.

Venezuela's generous social programmes are largely financed through oil revenue.

The government is reluctant to cut them back - both out of an ideological commitment to the legacy of its late socialist leader, Hugo Chavez, and out of the knowledge that a drastic cut could erode the support of those Venezuelans who voted the government into power.

With Venezuela's credit rating lowered on Thursday by three notches to CCC, the country is getting closer to default.

And with no sign of oil prices rising, the headache for its government of how to counter the drop in revenue looks set to get worse.

- Published18 December 2014

- Published19 January 2015

- Published10 September 2014