Venezuela opposition condemns Goldman Sachs debt deal

- Published

Protesters vented their anger outside the Goldman Sachs offices in New York

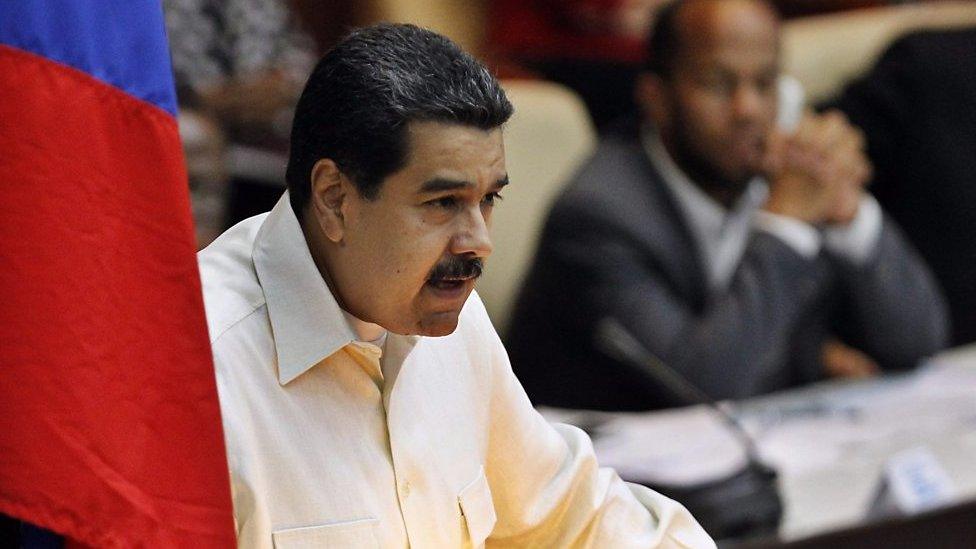

Opposition leaders in Venezuela have strongly criticised the investment bank Goldman Sachs for buying $2.8bn (£2.1bn) of government bonds.

Opponents of embattled President Nicolas Maduro say the move has given his government a financial lifeline.

The New York-based investment bank is reported to have bought the bonds at a heavily discounted rate.

Goldman Sachs said it bought the debt on the secondary market and did not deal directly with the government.

But the opposition has threatened that a future government would refuse to repay the debts to the bank.

The opposition-controlled Congress also voted on Tuesday to ask its US counterpart to investigate the deal.

"Goldman Sachs' financial lifeline to the regime will serve to strengthen the brutal repression unleashed against the hundreds of thousands of Venezuelans peacefully protesting for political change in the country," said Julio Borges, head of Venezuela's Congress, in a letter to Goldman Sachs president Lloyd Blankfein.

"Given the unconstitutional nature of Nicolas Maduro's administration, its unwillingness to hold democratic elections and its systematic violation of human rights, I am dismayed that Goldman Sachs decided to enter this transaction."

He said he intended to recommend to "any future democratic government of Venezuela not to recognise or pay on these bonds".

The Venezuelan capital Caracas is the scene of regular anti-government protests

BBC economics correspondent Andrew Walker says it is likely that the price was deeply discounted and, if the debts are paid on time, it would make the bonds a very lucrative investment.

However, the economic crisis in Venezuela means that a default is a real possibility, he adds.

A small group of protesters gathered outside the Goldman Sachs offices in New York on Tuesday, holding placards accusing the company of supporting President Maduro.

The bonds were issued by Venezuela's nationalised oil company, PDVSA.

In a statement, Goldman Sachs said it made the purchase in the expectation that the political situation in Venezuela would improve.

"We are invested in PDVSA bonds because, like many in the asset management industry, we believe the situation in the country must improve over time," it said.

"We recognise that the situation is complex and evolving and that Venezuela is in crisis. We agree that life there has to get better, and we made the investment in part because we believe it will."

Venezuela is grappling with regular anti-government demonstrations and dozens of people have died in protest-related violence since April.

- Published12 August 2021

- Published18 April 2017

- Published12 April 2017

- Published13 April 2017