Military spending: Balance tipping towards China

- Published

China now spends more than neighbouring Japan, South Korea, Taiwan and Vietnam combined

It is tempting to see statistics for overall defence spending as providing an image of sorts of the ranking of the major military players around the world.

So this year's edition of the annual reference book - The Military Balance - published by the International Institute for Strategic Studies (IISS) will be eagerly scrutinised to see who is up and who is down, and what this might mean for the global balance of power.

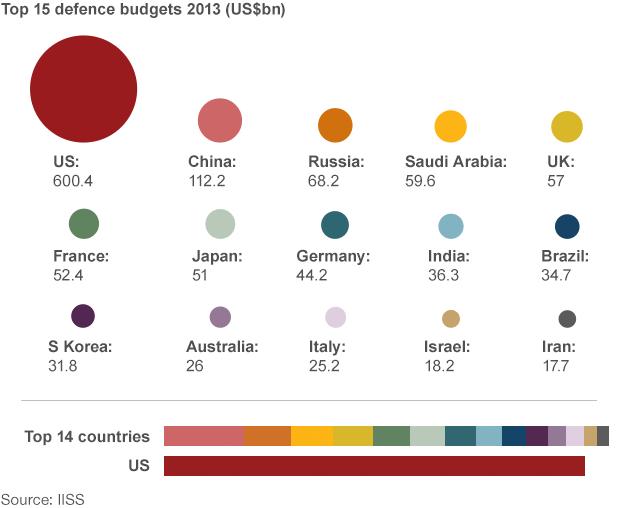

The United States remains by far the world's largest military player spending $600bn (£370bn; 440bn euros) on defence in 2013.

China, the next most highly ranked player, spent some $112bn in the same period, though there are complex debates about how far Beijing's figures encompass all of its defence-related spending.

One striking fact is that Britain has fallen from third place to fifth, behind Russia and Saudi Arabia. This is a reflection of both the Russians' and Saudis' efforts to modernise their military machines while British defence expenditure is falling.

Broad trends

But caution is needed here. The IISS itself accepts that factors like exchange rates can muddy the picture.

It says that while it is true that the UK has been cutting its defence spending levels, this fall to fifth place is partly due to exchange rate effects: if sterling-dollar exchange rates from last week were applied to UK defence spending levels instead, these would rise from $57bn to $61.1bn in US dollar terms, above Saudi Arabia and into fourth place.

Even without the exchange-rate effect, IISS analyst Giri Rajendran notes, the fall in the UK's ranking is not nearly as significant as it might first appear.

When the UK was third, in 2012, it was only spending about 1.5% more than Russia in US dollar terms, meaning that a relatively minor currency depreciation or decline in spending levels would produce a fall in its ranking.

Only last month, British Prime Minister David Cameron was championing Britain's defence budget as still the fourth largest in the world, so maybe he was right after all.

But spending alone is a crude indicator of military capability.

What does money actually buy you? How much funding, for example, goes on salaries and the housing of large conscript armies? What about a country's willingness to use force?

All of these factors cannot readily be encompassed in the stark numbers of a military balance.

Broad trends, though, can be identified and this year's Military Balance shows the continuing growth of China's military machine.

And China's rise is driving defence expenditure elsewhere in the region. Defence spending in Asia is up by 23% since 2010.

China has ambitions to become a major maritime power. China now spends about three times as much as India on defence and more than neighbouring Japan, South Korea, Taiwan and Vietnam combined.

Japan announced last year it was increasing its defence spending, investing in a new marine unit

In the Middle East, defence spending is also going up significantly, with Libya trying to reconstruct its security forces, Iraq re-equipping and some significant expenditure by Saudi Arabia and other Gulf States.

They are alarmed particularly by Iran's potential nuclear programme and especially by its missile forces.

Missile defence is a key priority for Gulf states. Qatar, Saudi Arabia and the United Arab Emirates have all bought or are buying Western missile- and air-defence and strike systems , including stand-off air-launched munitions.

The IISS notes that one of the key factors facing the Gulf States is how to improve defence co-ordination between them.

Ambitions

Overall, though, the Military Balance shows the continuing shift in global military power away from the West - especially from Europe where real defence spending fell in 2013 in 57% of countries - towards Asia.

Asian countries are increasingly buying capabilities that were previously owned only by Russia and Nato countries.

But spending alone is not everything. Britain and France remain, for example, the only players with real expeditionary capabilities after the United States. European capabilities are, though, declining in real terms and much will depend upon the economic future if this trend is to be halted.

Much of the discussion at the IISS press conference focused on when China might rival the US in defence expenditure.

The mid- to late-2030s was one suggested answer. But this obscures a more fundamental reality.

The US is a superpower with global ambitions. On present evidence, China's ambitions are more limited.

It wants to be the major player in its own strategic backyard, and to contain US forces there might potentially only require a more limited outlay.

And China's military build-up - its goal of denying access to areas it sees as its strategic approaches - is tailored specifically to do this.

- Published17 December 2013

- Published16 January 2014

- Published23 February 2013