Iran executes 'Sultan of Coins' amid currency crisis

- Published

Vahid Mazloumin (R) was said to have amassed two tonnes of gold coins

Iran has executed a currency trader known as the "Sultan of Coins" for amassing some two tonnes of gold coins.

Vahid Mazloumin and another member of his currency trading network received the death penalty for "spreading corruption on earth".

According to the Iranian Students' News Agency, Mr Mazloumin and associates had hoarded the coins to manipulate prices.

Rights group Amnesty International described the executions as "horrific" and a violation of international law.

"Use of the death penalty is appalling under any circumstances," Amnesty said in a statement on Wednesday, adding that under international law "the death penalty is absolutely forbidden for non-lethal crimes, such as financial corruption".

Amnesty went on to say that the manner in which the trials were "fast-tracked" displayed a "brazen disregard" for due process.

How did these executions come about?

Mr Mazloumin was arrested in July for operating as a speculator and accused of hoarding gold coins with the aim of later manipulating prices on the local market.

In August, Iran's Supreme Leader Ayatollah Ali Khamenei approved a judicial request to set up special courts to deal with those suspected of financial crimes.

Since then, these courts have sentenced several people to death in trials often broadcast live on state television.

The second man executed, who was also convicted of "spreading corruption", was linked to Mr Mazloumin's network and was reportedly involved in the sale of gold coins, according to Mizan, the official website of Iran's judiciary.

Both men were executed by hanging.

Why are gold coins in high demand in Iran?

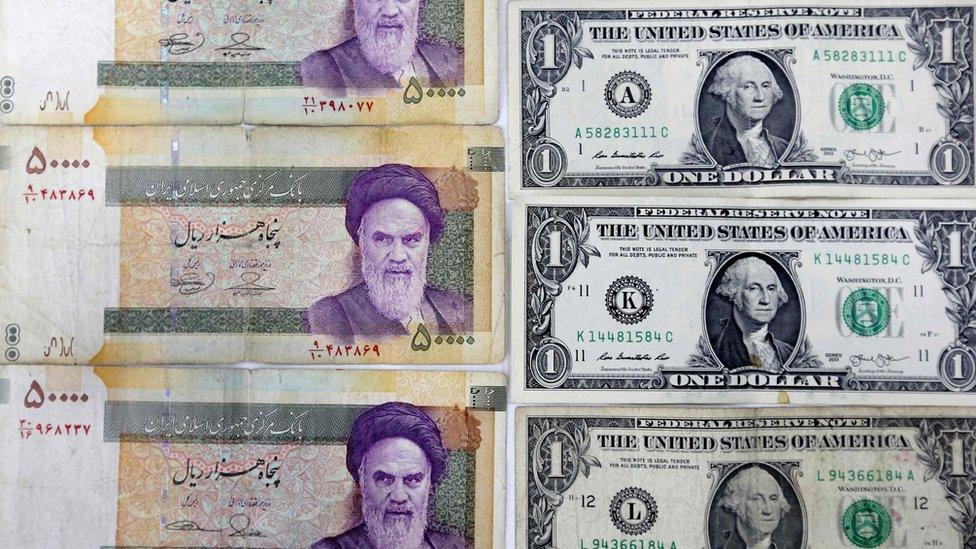

Demand for gold coins and US dollars in Iran has soared as the country's currency has declined in value.

In the wake of the latest round of US sanctions on Iran, the rial has fallen about 70% against the US dollar, while gold coins have grown more expensive.

Gold coins have increased in value as Iran's currency, the rial, has fallen

As a result, a cost of living crisis has seen demonstrators take to the streets against perceived corruption.

The tough US sanctions on Iran target the country's oil and finance sectors. Iran is heavily dependent on its exports of oil, and the renewed sanctions, if effective, would cause yet further damage to the economy.

Tehran has been battling instability in its financial markets since April, when the government attempted to stabilise currency prices by introducing a single official dollar exchange rate.

- Published4 July 2018

- Published10 May 2018